North Carolina Generator Installation And Repair Services Contract - Self-Employed

Description

How to fill out Generator Installation And Repair Services Contract - Self-Employed?

If you wish to total, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Make use of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you desire, click the Get now option. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the North Carolina Generator Installation And Repair Services Contract - Self-Employed within a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download option to receive the North Carolina Generator Installation And Repair Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate area/region.

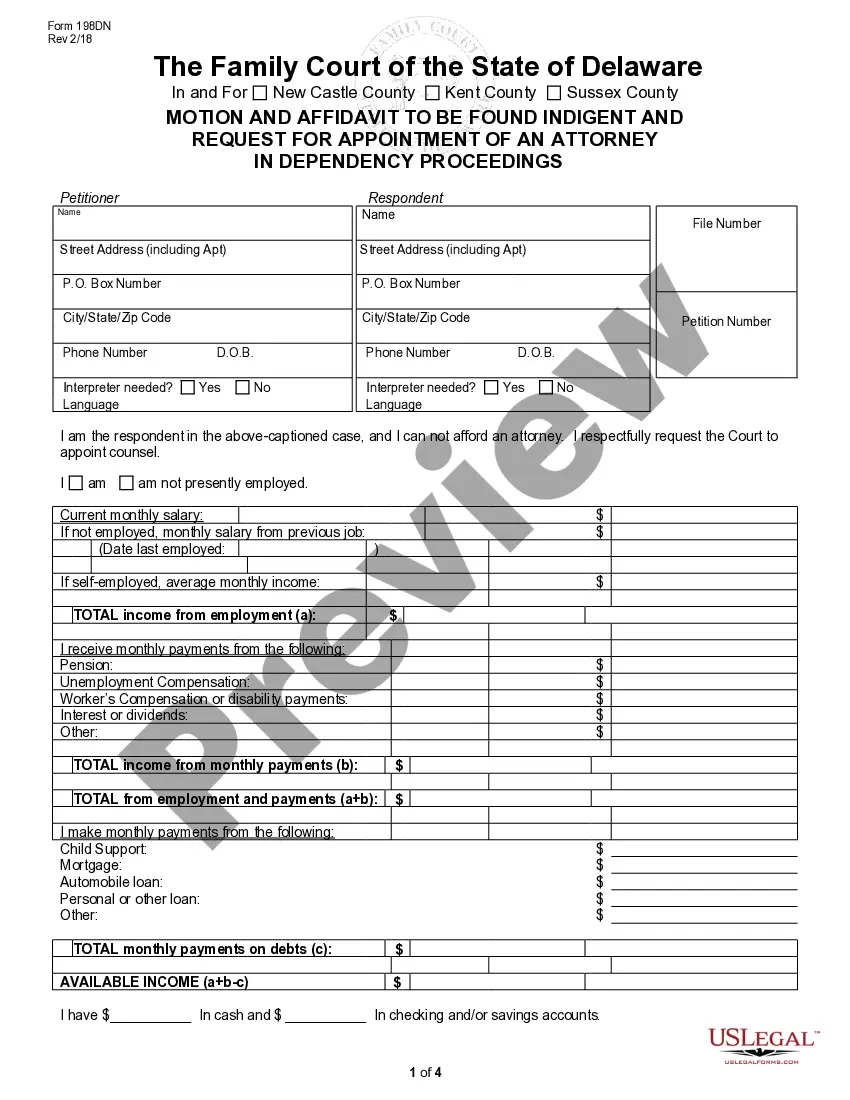

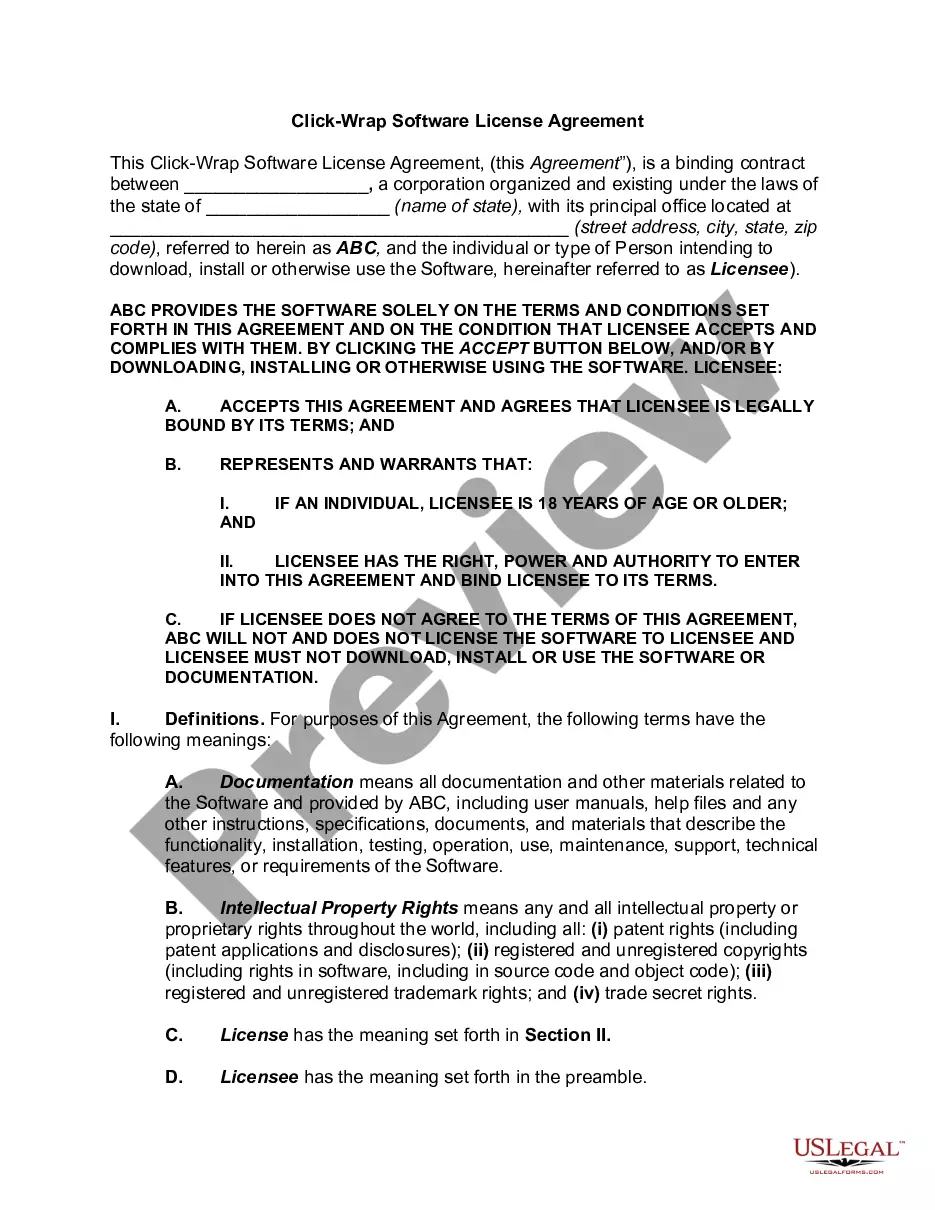

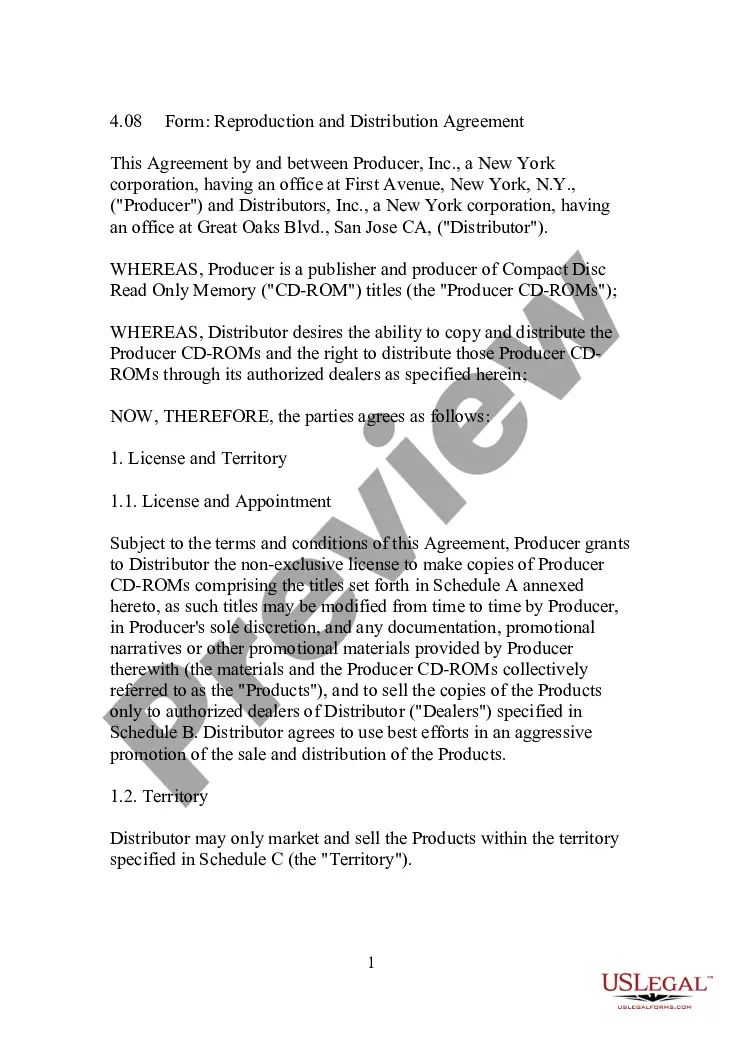

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other forms in the legal form catalog.

Form popularity

FAQ

A generator maintenance contract often proves valuable, ensuring your equipment runs smoothly and efficiently. With a North Carolina Generator Installation and Repair Services Contract - Self-Employed, regular maintenance can help prolong the lifespan of your generator. It can also prevent costly breakdowns and repairs down the line. Therefore, consider investing in a maintenance agreement if you rely heavily on your generator.

Yes, independent contractors in the construction and installation fields, including generator services, often need a license in North Carolina. If you are planning to operate under a North Carolina Generator Installation and Repair Services Contract - Self-Employed, make sure to check the licensing requirements for your specific trade. Licensing ensures that you meet safety and quality standards. So, verify what’s necessary before you begin your work.

In North Carolina, labor associated with tangible personal property, like generators, typically needs to be taxed. This requirement holds true when you sign a North Carolina Generator Installation and Repair Services Contract - Self-Employed. Taxation helps your business comply with state revenue laws. Always keep these financial factors in mind when planning your installation projects.

Yes, installation labor is generally subject to sales tax in North Carolina. When you enter into a North Carolina Generator Installation and Repair Services Contract - Self-Employed, it is important to account for tax obligations. The tax applies to both labor and materials involved in the installation. You may want to consult a tax professional for specifics related to your situation.

To become an independent contractor in North Carolina, you should start by defining your niche, particularly within the North Carolina Generator Installation And Repair Services Contract - Self-Employed. Register your business legally, either by forming an LLC or other structure that fits your goals. Additionally, exploring platforms like USLegalForms can help streamline your contract process and provide guidance on legal requirements.

In North Carolina, independent contractors are generally not required to carry workers' compensation insurance. However, if you hire employees or subcontractors, you’ll need to have this coverage. It's important to understand your liability and ensure you're adequately protected while providing services related to generator installation and repair.

To be classified as an independent contractor, you should have a business setup and the necessary skills for your trade. For North Carolina Generator Installation And Repair Services Contract - Self-Employed, obtaining the right certifications may also be beneficial. Additionally, maintain accurate records of income and expenses to ensure compliance with tax obligations.

Becoming an independent contractor in North Carolina involves a few steps. Start by selecting a business structure, such as a sole proprietorship or LLC. Register your business with the state, and consider getting liability insurance to protect yourself while working on generator installation and repair services. Lastly, familiarize yourself with contracts and establish clear agreements with your clients to avoid misunderstandings.

To establish yourself as an independent contractor, first decide what services you want to provide under the North Carolina Generator Installation And Repair Services Contract - Self-Employed. Next, register your business name with the state and obtain any necessary permits or licenses. Building a solid portfolio and networking with potential clients can significantly boost your visibility and credibility in the market.

Starting a generator repair business involves several key steps. First, acquire relevant skills and certification in generator repair. Next, develop a business plan that includes your target market and service offerings, focusing on the North Carolina Generator Installation And Repair Services Contract - Self-Employed for your local community. Finally, consider using platforms like uslegalforms to draft contracts and manage your legal documents effectively.