North Carolina Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

Are you in a situation where you require documents for either business or personal purposes daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the North Carolina Disability Services Contract - Self-Employed, which can be customized to meet federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and complete your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Carolina Disability Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/region.

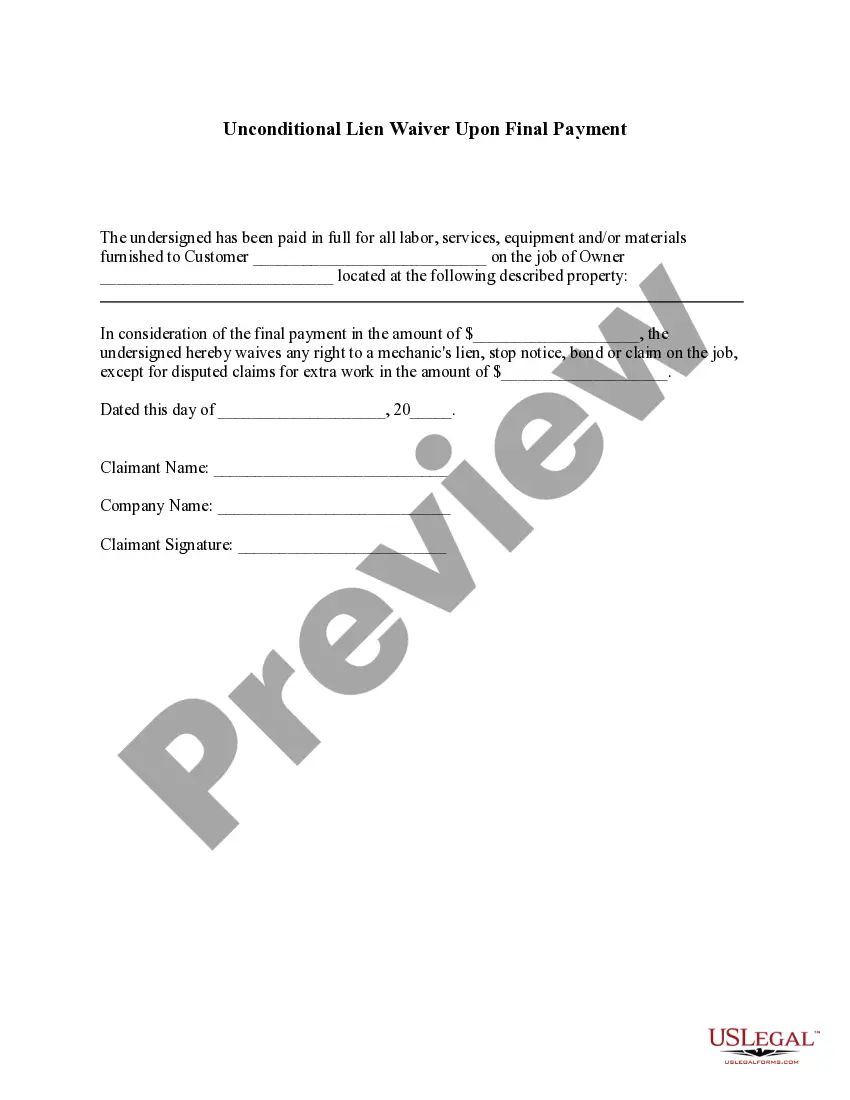

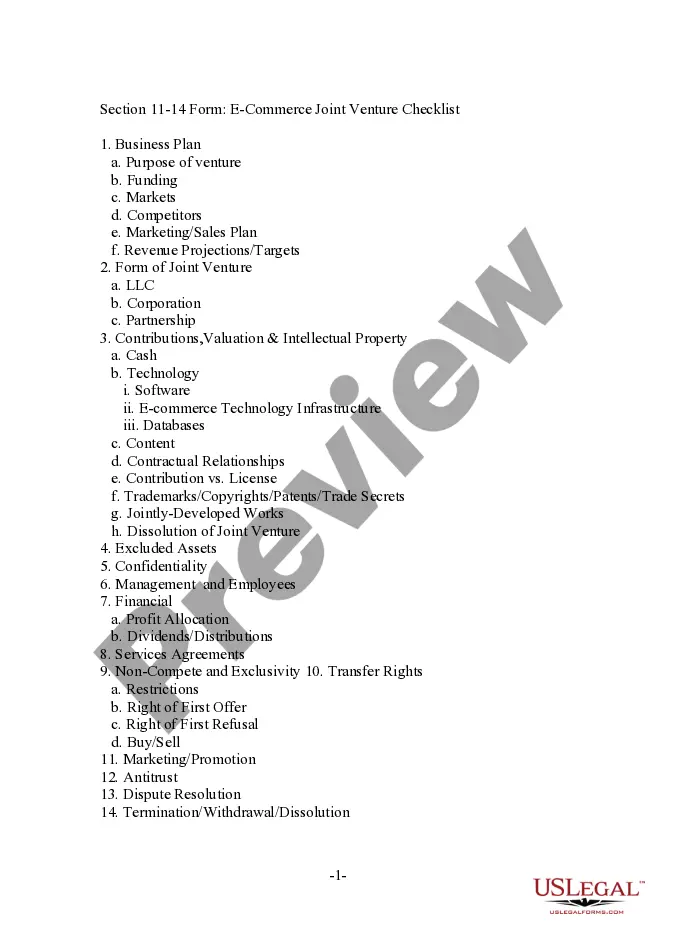

- Use the Preview button to examine the form.

- Check the description to confirm you have chosen the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Yes, a 1099 employee can collect disability benefits, but it depends on several factors. In North Carolina, individuals under a Disability Services Contract - Self-Employed may qualify if they meet the necessary eligibility criteria set by the state. It is important to ensure that you have contributed to Social Security or have the appropriate insurance coverage to be eligible for these benefits. Consider exploring the options available through US Legal Forms to help you navigate the application process and understand your rights.

Receiving a 1099 form indicates you are self-employed, but you can still apply for disability benefits. To qualify, you must show that your disability impacts your work ability. The North Carolina Disability Services Contract - Self-Employed can aid in navigating this process. Always keep thorough records of your earnings and medical conditions to support your application.

Yes, independent contractors can qualify for disability benefits if they meet the criteria set by Social Security. You need to provide evidence of your disability and how it impacts your ability to work. Utilizing the North Carolina Disability Services Contract - Self-Employed can offer additional resources to assist you in this process. It's essential to understand the documentation required to make a successful claim.

If you're self-employed and seek disability benefits, you must first demonstrate how your condition affects your ability to work. Gather medical evidence and financial records that support your claim. You can apply for Social Security Disability Insurance (SSDI) and, if eligible, utilize the North Carolina Disability Services Contract - Self-Employed for additional support. Consulting with an expert can streamline this process.

The self-employment assistance program in North Carolina supports individuals seeking to start their own businesses. This program provides training and financial aid to help you become self-sufficient. If you qualify, you can receive benefits while developing your business under the North Carolina Disability Services Contract - Self-Employed. This program encourages entrepreneurship and helps individuals create sustainable careers.

While this question focuses on Arizona, it's important to note that qualifying for disability generally involves demonstrating a significant impairment that limits your ability to work. In North Carolina, similar criteria apply under the North Carolina Disability Services Contract - Self-Employed. Applicants must provide medical documentation and meet financial eligibility requirements. Always consult with a professional for the most relevant guidance.

To become an independent contractor in North Carolina, you need to register your business with the state. First, select a business structure such as a sole proprietorship or LLC. Next, obtain any necessary licenses or permits. Finally, ensure you understand how to manage your taxes and responsibilities under the North Carolina Disability Services Contract - Self-Employed.

Yes, you can apply for disability while self-employed under the North Carolina Disability Services Contract - Self-Employed. It's important to demonstrate that your work limits your ability to perform daily activities due to a medical condition. When applying, you will need to provide detailed documentation of your income and the nature of your disability. Using the US Legal Forms platform can help you navigate the application process effectively, ensuring you complete all necessary forms accurately.

employed person can obtain disability coverage by researching and comparing various insurance providers. It is essential to evaluate policies that cater to the selfemployed, such as a North Carolina Disability Services Contract SelfEmployed. This contract can be obtained through insurance brokers or directly from companies that offer selfemployed disability plans. By understanding the details of each option, you can select the best coverage for your circumstances.

For self-employed individuals, disability insurance can be a wise investment. It provides a safety net in case an injury or illness prevents you from working, ensuring that you can maintain your income. Specifically, a North Carolina Disability Services Contract - Self-Employed can offer tailored coverage to fit your unique needs. Ultimately, having this insurance gives you peace of mind and financial security.