North Carolina Boiler And Radiator Services Contract - Self-Employed

Description

How to fill out Boiler And Radiator Services Contract - Self-Employed?

Are you in a situation where you constantly require documents for either business or personal purposes? There are numerous legal document templates accessible online, but obtaining reliable versions can be challenging. US Legal Forms offers thousands of template options, including the North Carolina Boiler And Radiator Services Contract - Self-Employed, that are designed to meet federal and state requirements.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Following that, you can download the North Carolina Boiler And Radiator Services Contract - Self-Employed template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Discover the template you need and verify that it is for the correct city/region. Utilize the Preview button to examine the form. Review the details to confirm that you have selected the appropriate template. If the template isn’t what you’re looking for, take advantage of the Search field to find the document that suits your needs and requirements. Once you find the correct template, simply click Buy now. Choose the pricing plan you desire, complete the necessary information to create your account, and purchase an order using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents list. You can obtain another copy of the North Carolina Boiler And Radiator Services Contract - Self-Employed at any time, if necessary. Just click the desired template to download or print the document format.

Utilize US Legal Forms to enhance efficiency and minimize errors with professionally developed legal documents that cater to multiple needs.

Start your journey towards a more organized life by registering on US Legal Forms today.

- Use US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes.

- The service provides expertly crafted legal document templates that can be utilized for a variety of purposes.

- Create an account on US Legal Forms and begin simplifying your life.

- Ensure the template fits your requirements before downloading.

- Check the pricing plans available to choose the best option for you.

- Keep track of your purchased documents in the My documents section.

- Easily download or print any document template as needed.

Form popularity

FAQ

Yes, if you operate as an LLC in North Carolina, you must file an annual report with the Secretary of State. This requirement also applies to those with a North Carolina Boiler And Radiator Services Contract - Self-Employed. Filing helps maintain your LLC's good standing and is essential for ongoing business operations.

Service contracts in North Carolina are typically subject to sales tax. This applies to any agreements made under a North Carolina Boiler And Radiator Services Contract - Self-Employed. Understanding tax implications is crucial for financial planning and to ensure you're meeting local regulations.

Yes, maintenance contracts in North Carolina are generally taxable. This includes contracts related to a North Carolina Boiler And Radiator Services Contract - Self-Employed. As a service provider, you typically need to include sales tax when invoicing customers for these essential services.

North Carolina does not tax certain services, such as professional services provided by doctors or lawyers. However, activities related to a North Carolina Boiler And Radiator Services Contract - Self-Employed typically fall under taxable services. Always consult with a tax professional to navigate specific exemptions and ensure compliance.

In North Carolina, personal service contracts are generally considered taxable services. This includes work done under a North Carolina Boiler And Radiator Services Contract - Self-Employed. It is essential to understand your tax obligations, as providing services may require you to collect sales tax from your clients.

In North Carolina, self-employed individuals can perform up to $30,000 worth of work without needing a contractor license. However, this limit applies to all services, including those under a North Carolina Boiler And Radiator Services Contract - Self-Employed. Beyond this threshold, you must obtain the appropriate licenses to legally continue operating.

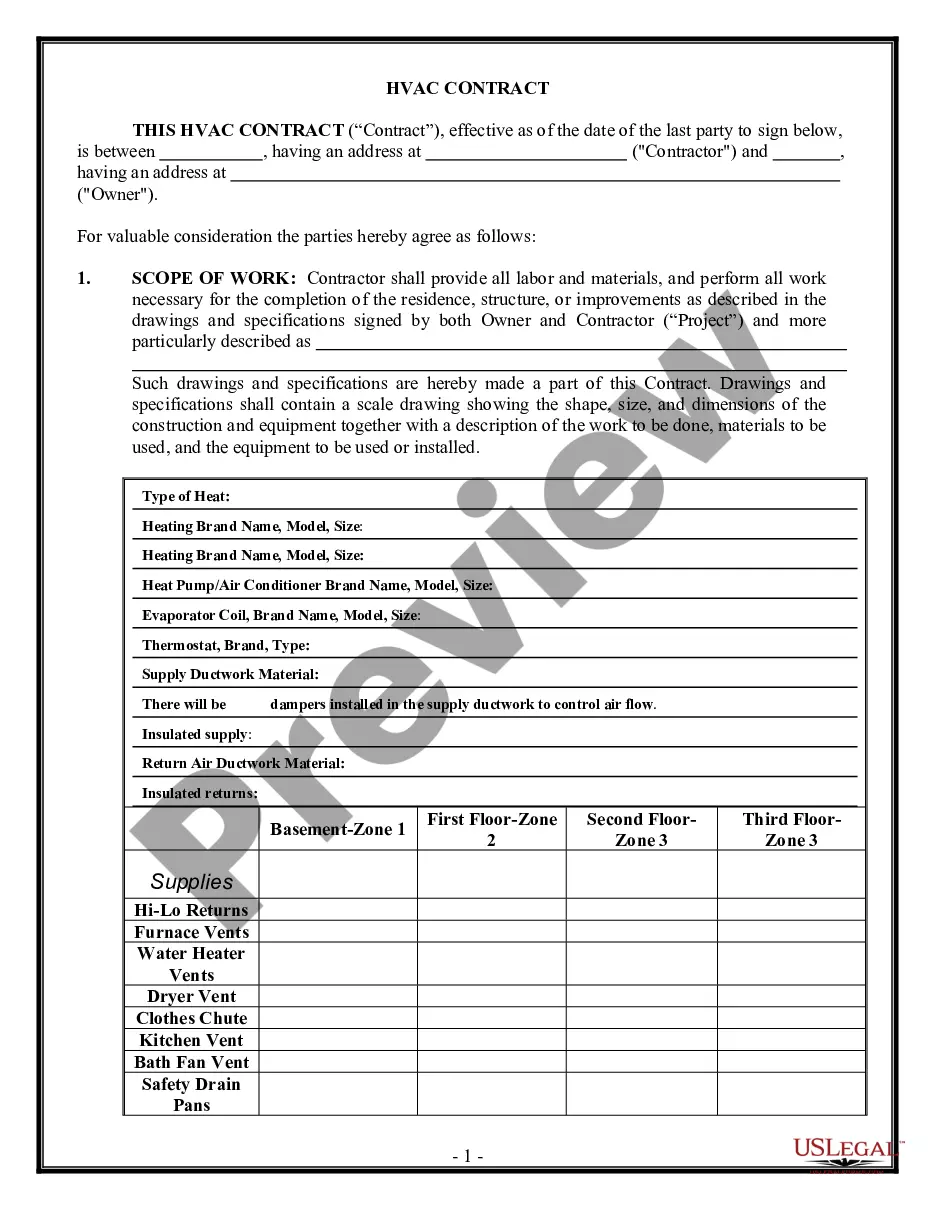

In North Carolina, a service contract is an agreement providing services for maintenance, repair, or installation. For those offering North Carolina Boiler And Radiator Services Contract - Self-Employed, it outlines the specific work to be performed and the terms of service. This contract ensures that both the client and service provider understand their responsibilities, leading to better customer satisfaction.

In North Carolina, installing or repairing a toilet generally requires a licensed plumber, especially for tasks that are complex or involve water supply lines. While minor adjustments might be performed by homeowners, larger installations should be handled by qualified professionals. If you are self-employed in boiler and radiator services, ensuring that all plumbing work complies with state regulations is crucial for your business’s credibility. Consider utilizing USLegalForms to guide you in these matters.

Yes, you can act as your own general contractor (GC) in North Carolina for your projects. This flexibility allows you to manage the scope of work, including boiler and radiator services, as long as you follow local regulations. However, remember that certain permits and licenses may still be necessary, depending on the work involved. USLegalForms can assist you in drafting contracts to ensure compliance and protect your business interests.

In North Carolina, several factors can void a contract, such as lack of mutual consent, illegal subject matter, or fraud. If a party fails to fulfill their obligations or if the contract was formed under duress, these can also invalidate the agreement. For self-employed individuals offering boiler and radiator services, understanding these nuances can protect your business. Use USLegalForms to create solid contracts that clearly outline expectations and responsibilities.