North Carolina Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

Are you presently in a role that requires documents for potential business or specific purposes almost daily.

There are numerous legal document templates available online, but locating reliable ones isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the North Carolina Fireplace Contractor Agreement - Self-Employed, designed to fulfill state and federal requirements.

Once you find the appropriate form, click Buy now.

Choose the payment plan you want, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Fireplace Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

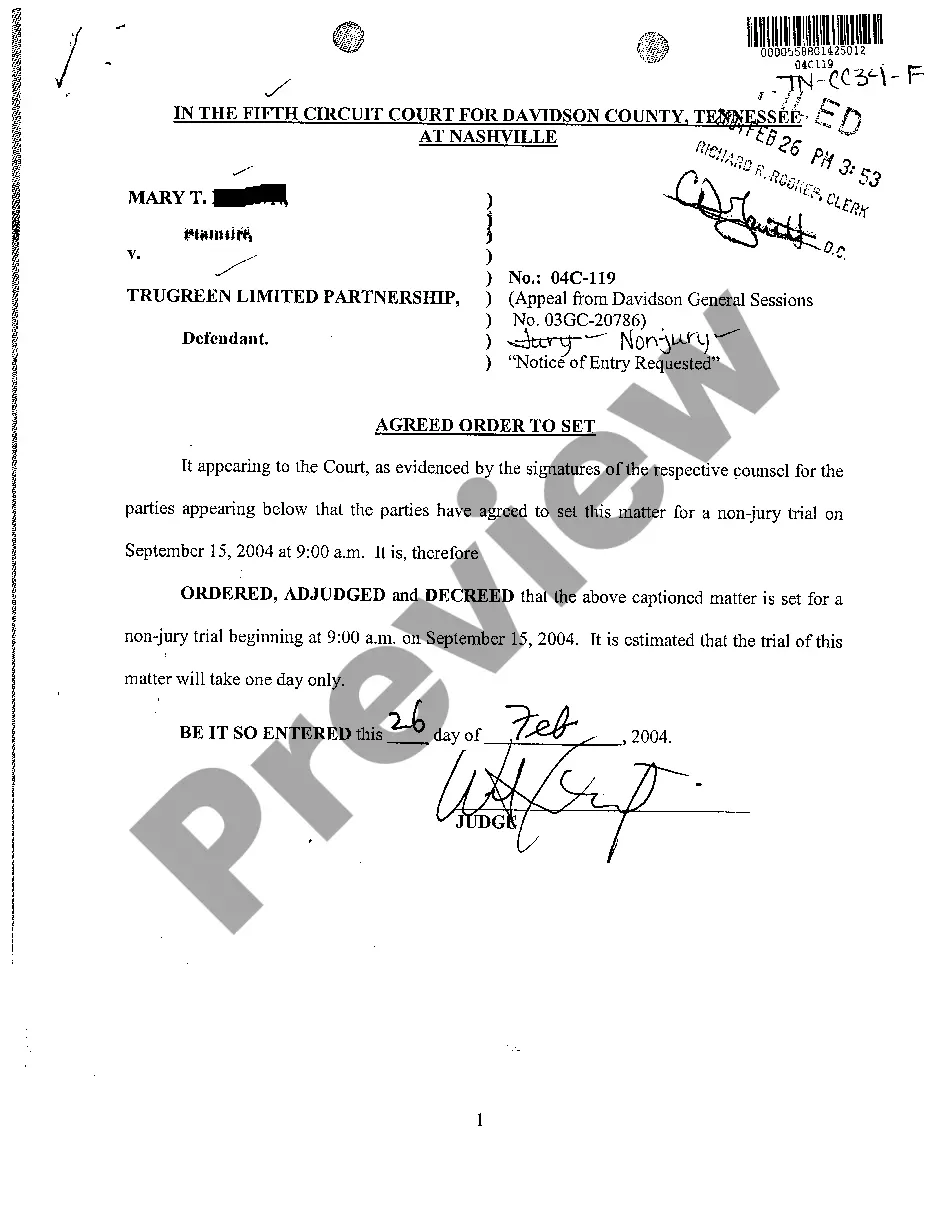

- Use the Preview button to examine the form.

- Read the description to ensure you have selected the right document.

- If the form isn’t what you are looking for, utilize the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

Writing a self-employed contract involves outlining the specific terms of your working relationship, such as project scope, payment terms, and deadlines. A well-structured North Carolina Fireplace Contractor Agreement - Self-Employed should clearly define both parties' responsibilities to avoid misunderstandings. Be sure to include legal considerations, such as dispute resolution methods and confidentiality clauses. U.S. Legal Forms offers templates that can simplify this process, ensuring you cover all necessary aspects.

As an independent contractor in North Carolina, you typically need to complete several important documents. These may include the North Carolina Fireplace Contractor Agreement - Self-Employed, tax forms such as the W-9, and any necessary business licenses. Proper documentation helps clarify your working relationship with clients and ensures compliance with state laws. For more comprehensive resources, consider exploring the tools available at U.S. Legal Forms.

Writing an independent contractor agreement involves several key elements. Start by including the scope of work, payment terms, and deadlines. It’s essential to specify the relationship between the parties to avoid any legal issues. For those drafting a North Carolina Fireplace Contractor Agreement - Self-Employed, uslegalforms can provide templates and guidance to help you create a compliant and effective agreement.

The new federal rule clarifies the classification of independent contractors versus employees, emphasizing the need to assess factors like control and independence. This change aims to prevent misclassification and ensure workers receive the correct benefits. For independent contractors, including those involved in a North Carolina Fireplace Contractor Agreement - Self-Employed, understanding these classifications helps protect your rights and align with legal standards.

In North Carolina, independent contractors are not typically required to carry workers' compensation insurance. However, if you hire subcontractors, you may need to ensure they have proper coverage. This requirement protects both you and your contractors during job-related injuries. If you are considering a North Carolina Fireplace Contractor Agreement - Self-Employed, it’s wise to address insurance needs in the agreement.

While North Carolina does not mandate an operating agreement for LLCs, having one is highly advisable. An operating agreement outlines the management structure and operating procedures for your business. It becomes especially useful in resolving disputes among members. For a North Carolina Fireplace Contractor Agreement - Self-Employed, this document can clarify the terms of business operations.

Writing an independent contractor agreement involves several key steps. Begin by outlining the parties involved, then describe the specific services and deliverables expected. Make sure to incorporate payment information and any relevant terms from the North Carolina Fireplace Contractor Agreement - Self-Employed. Finally, include signatures and dates to make the agreement binding, ensuring clarity and professionalism.

To fill out an independent contractor agreement, start by clearly stating the names and addresses of both parties involved. Define the services to be provided and the compensation details, ensuring it aligns with the North Carolina Fireplace Contractor Agreement - Self-Employed guidelines. Additionally, include terms regarding confidentiality and termination to protect both parties. Once completed, both parties should sign the document.

Filling out an independent contractor form is straightforward. Begin by providing your personal information, such as your name, address, and contact details. Next, include specifics regarding the work relationship, like project scope and payment terms, which are essential for the North Carolina Fireplace Contractor Agreement - Self-Employed. Finally, review the form for accuracy and completeness before submitting it.

Firing an independent contractor without a contract can be tricky, but it's manageable. Start by reviewing any verbal agreements or documented communications to ensure fair treatment. Next, communicate openly with the contractor about your decision, providing reasons if possible. In such situations, having a North Carolina Fireplace Contractor Agreement - Self-Employed can help clarify the termination process and protect your interests.