North Carolina Loan Term Sheet

Description

How to fill out Loan Term Sheet?

If you wish to total, obtain, or printing lawful papers templates, use US Legal Forms, the greatest assortment of lawful varieties, which can be found online. Use the site`s easy and hassle-free lookup to discover the papers you need. A variety of templates for enterprise and individual functions are sorted by groups and claims, or search phrases. Use US Legal Forms to discover the North Carolina Loan Term Sheet in a few click throughs.

When you are presently a US Legal Forms client, log in for your bank account and click the Down load button to have the North Carolina Loan Term Sheet. Also you can access varieties you earlier downloaded inside the My Forms tab of the bank account.

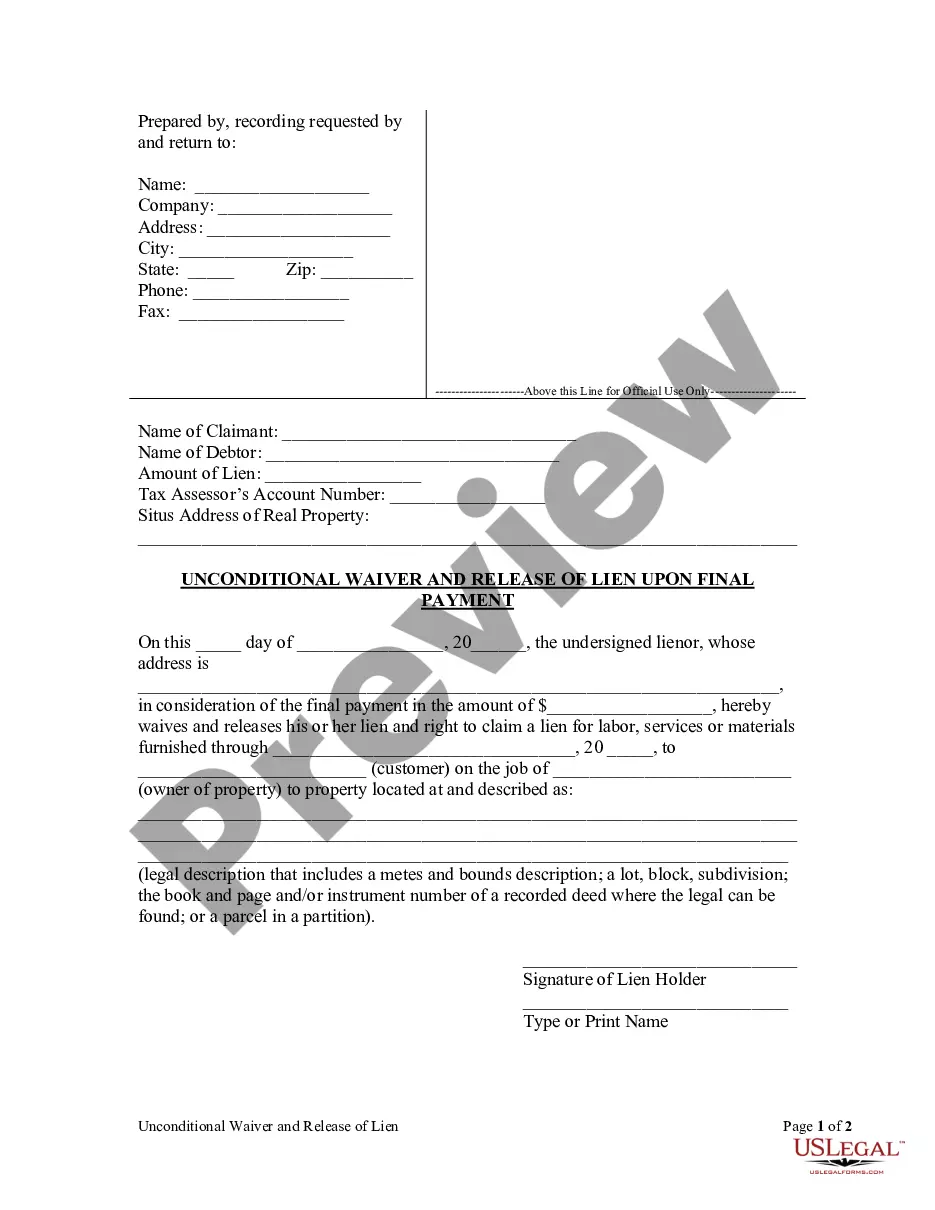

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the shape to the proper town/region.

- Step 2. Make use of the Preview option to check out the form`s information. Never forget to read the information.

- Step 3. When you are unhappy together with the develop, utilize the Look for field at the top of the monitor to locate other variations in the lawful develop web template.

- Step 4. Once you have identified the shape you need, select the Buy now button. Select the pricing program you prefer and include your qualifications to register for an bank account.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal bank account to complete the transaction.

- Step 6. Select the structure in the lawful develop and obtain it on the product.

- Step 7. Comprehensive, revise and printing or indicator the North Carolina Loan Term Sheet.

Every lawful papers web template you buy is the one you have for a long time. You have acces to each develop you downloaded within your acccount. Select the My Forms portion and select a develop to printing or obtain yet again.

Contend and obtain, and printing the North Carolina Loan Term Sheet with US Legal Forms. There are many expert and express-distinct varieties you may use to your enterprise or individual requirements.

Form popularity

FAQ

Regarding debt agreements, commonly included details are: Economic details. This includes the term, loan size, interest rate, and other financial matters common to debt. Risk mitigation preferences. ... Extension rights. ... Due diligence at closing.

Once you're certain the investors offering you a term sheet are a good match, go beyond the obvious. Investment dollars and valuation are critical, of course, but don't overlook important details like option pools, liquidation preferences and the composition of your board.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

This includes the term, loan size, interest rate, and other financial matters common to debt. Risk mitigation preferences. The lender will often require specific conditions be met or specific information be provided on a recurring, timely manner.

The term sheet will lay out what the lender will provide in the way of financing and also outlines your obligations, but it is non-binding. The commitment letter is the next step where the lender says you met all their pre-conditions and are ready to close.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.