North Carolina Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank

Description

How to fill out Escrow Agreement Public Offering Between Lorelei Corporation And Chase Manhattan Bank?

If you need to comprehensive, down load, or produce lawful record layouts, use US Legal Forms, the biggest variety of lawful kinds, that can be found on-line. Use the site`s easy and hassle-free lookup to obtain the papers you require. Numerous layouts for organization and person purposes are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the North Carolina Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank in just a handful of clicks.

If you are already a US Legal Forms buyer, log in to the bank account and click on the Download option to get the North Carolina Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank. Also you can gain access to kinds you earlier acquired from the My Forms tab of your own bank account.

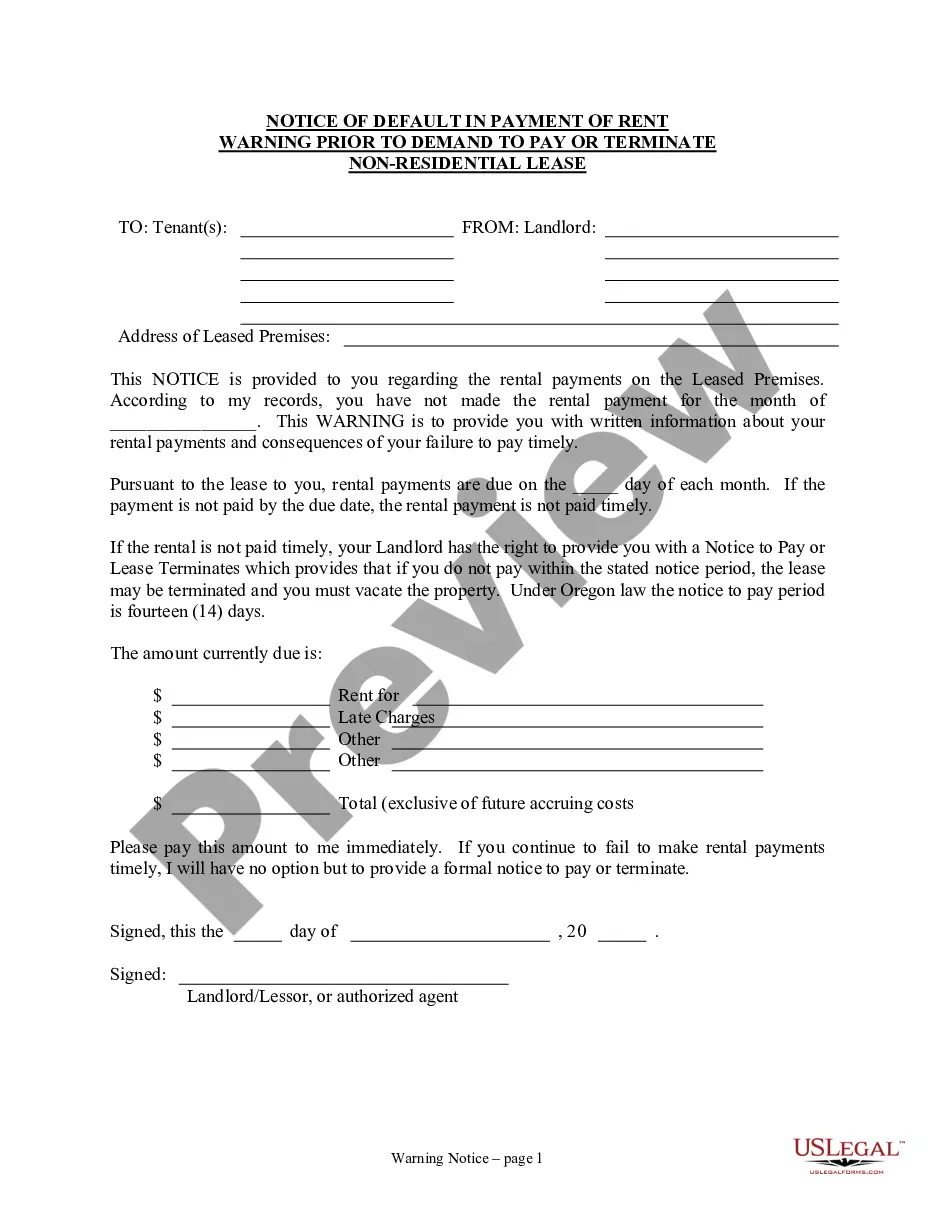

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the right town/nation.

- Step 2. Use the Preview option to check out the form`s content. Do not overlook to read through the information.

- Step 3. If you are not happy with the kind, make use of the Research industry near the top of the monitor to locate other versions from the lawful kind template.

- Step 4. Upon having discovered the shape you require, click the Buy now option. Select the pricing prepare you like and add your credentials to register for an bank account.

- Step 5. Process the transaction. You should use your charge card or PayPal bank account to accomplish the transaction.

- Step 6. Pick the file format from the lawful kind and down load it on your own device.

- Step 7. Total, revise and produce or indicator the North Carolina Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank.

Every single lawful record template you purchase is yours for a long time. You may have acces to each kind you acquired with your acccount. Click on the My Forms area and choose a kind to produce or down load yet again.

Remain competitive and down load, and produce the North Carolina Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank with US Legal Forms. There are millions of professional and status-specific kinds you can use for your personal organization or person requires.