This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

North Carolina Outline of Considerations for Transactions Involving Foreign Investors

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

If you need to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the premier selection of legal forms, that are available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now option. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the North Carolina Outline of Considerations for Transactions Involving Foreign Investors with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download option to find the North Carolina Outline of Considerations for Transactions Involving Foreign Investors.

- You can also access forms you previously acquired from the My documents tab of your account.

- If using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/region.

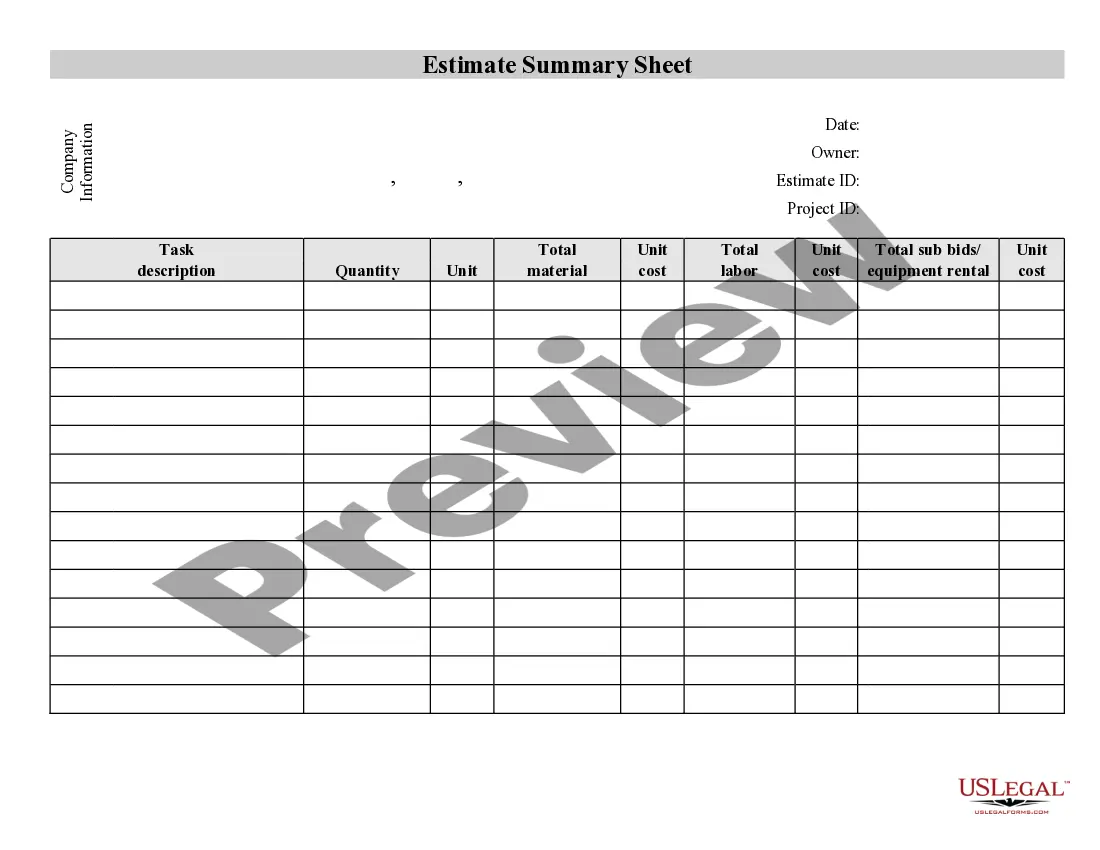

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, North Carolina does accept federal extensions for tax filings. This means that if you file for an extension with the IRS, you generally receive the same extension period for your state taxes. For foreign investors unfamiliar with these processes, it is crucial to comply with both federal and state requirements. For a deeper understanding, consult the North Carolina Outline of Considerations for Transactions Involving Foreign Investors.

Yes, interest income is generally taxable in North Carolina. This applies to interest earned from various sources, including savings accounts, bonds, and other investments. For foreign investors, understanding how interest income is taxed can inform better investment decisions. The North Carolina Outline of Considerations for Transactions Involving Foreign Investors thoroughly outlines these tax implications.

North Carolina does not allow the foreign earned income exclusion, unlike federal guidelines. This means that any income earned abroad may still be subject to state taxation. Foreign investors should plan accordingly to ensure compliance with state tax laws. The North Carolina Outline of Considerations for Transactions Involving Foreign Investors provides clarity on these essential aspects.

The 183-day rule determines whether an individual is considered a resident for tax purposes in North Carolina. If you spend 183 days or more in the state during a tax year, you may be subject to state taxes on your income. Foreign investors should be aware of this rule to avoid unexpected tax liabilities. For comprehensive information, refer to the North Carolina Outline of Considerations for Transactions Involving Foreign Investors.

North Carolina does conform to Internal Revenue Code Section 163J, which relates to the limitation on business interest expense deductions. This means that businesses, including those with foreign investments, must adhere to these guidelines while preparing their tax documents. It's vital for international investors to navigate these regulations effectively, as highlighted in the North Carolina Outline of Considerations for Transactions Involving Foreign Investors.

Yes, an LLC operating in North Carolina is required to file an annual tax return. Regardless of whether the LLC has income, it must report its activities to the North Carolina Department of Revenue. Understanding these filing obligations is critical for foreign investors looking to establish an LLC. The North Carolina Outline of Considerations for Transactions Involving Foreign Investors offers additional insights into compliance.

In North Carolina, business owners must establish a nexus to be subject to state taxes. Generally, this means having a physical presence, such as an office or employees within the state. For foreign investors, understanding the nexus requirements is crucial when considering investment opportunities. The North Carolina Outline of Considerations for Transactions Involving Foreign Investors provides essential guidance on this topic.