North Carolina Authorization to purchase 6 percent convertible debentures

Description

How to fill out Authorization To Purchase 6 Percent Convertible Debentures?

Are you currently in the placement in which you need papers for sometimes business or person uses virtually every working day? There are plenty of legal file layouts available on the Internet, but finding ones you can depend on is not simple. US Legal Forms delivers a huge number of type layouts, such as the North Carolina Authorization to purchase 6 percent convertible debentures, which can be published to meet federal and state requirements.

In case you are presently familiar with US Legal Forms site and get a merchant account, just log in. Afterward, you can down load the North Carolina Authorization to purchase 6 percent convertible debentures format.

If you do not provide an account and would like to start using US Legal Forms, adopt these measures:

- Find the type you require and ensure it is for your right town/county.

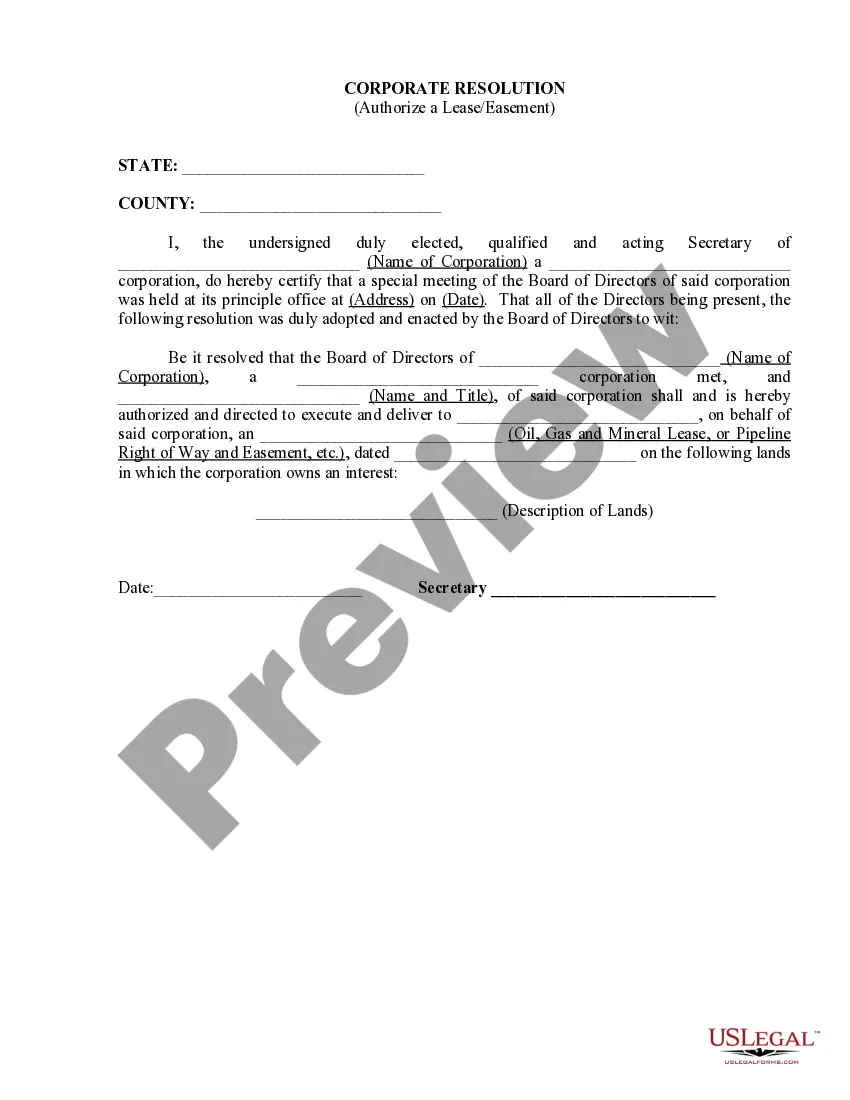

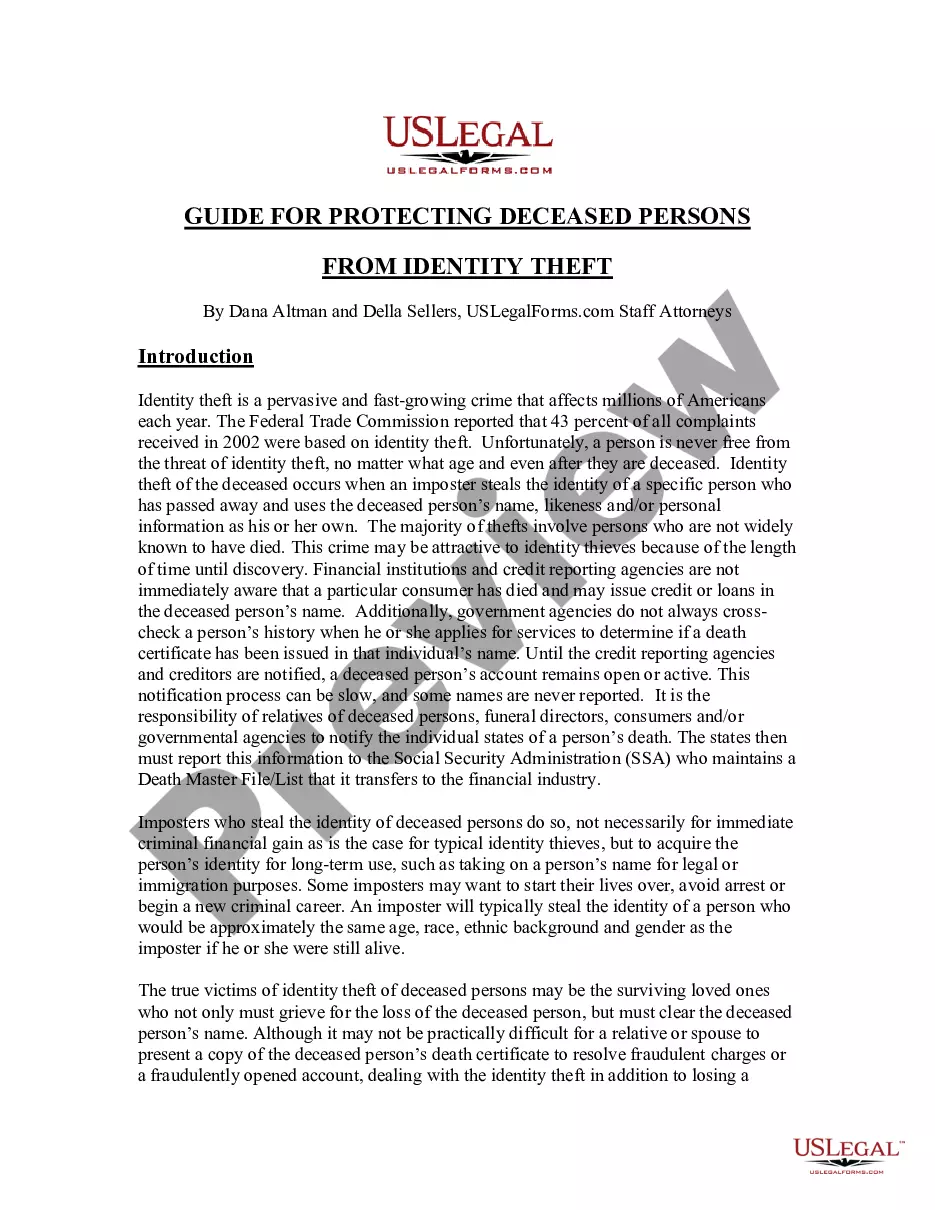

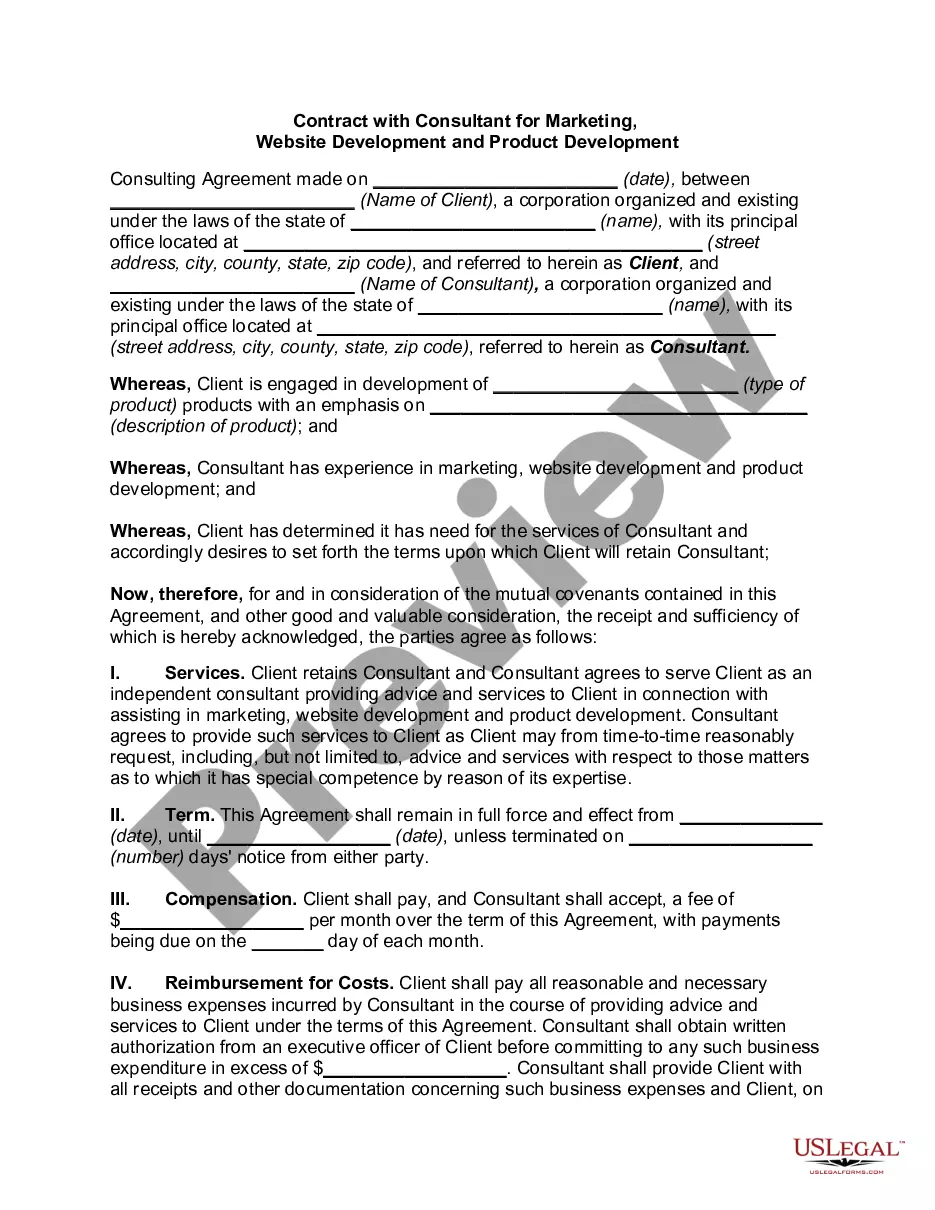

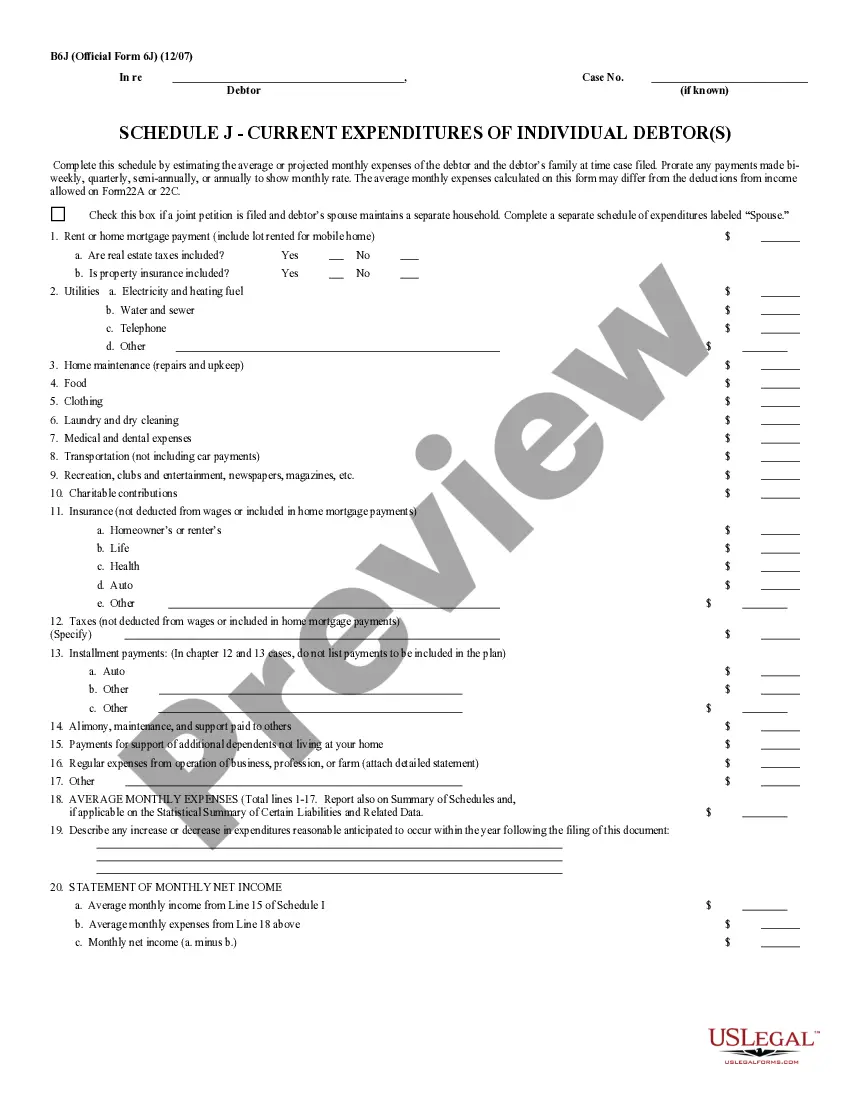

- Take advantage of the Review key to review the shape.

- Browse the outline to actually have chosen the proper type.

- When the type is not what you are trying to find, take advantage of the Search field to find the type that meets your needs and requirements.

- When you discover the right type, simply click Buy now.

- Opt for the costs strategy you want, complete the required information and facts to produce your bank account, and buy an order using your PayPal or Visa or Mastercard.

- Choose a practical file file format and down load your duplicate.

Find all of the file layouts you might have purchased in the My Forms food list. You can obtain a further duplicate of North Carolina Authorization to purchase 6 percent convertible debentures any time, if necessary. Just click the necessary type to down load or produce the file format.

Use US Legal Forms, probably the most considerable variety of legal kinds, in order to save time as well as stay away from mistakes. The services delivers professionally made legal file layouts that can be used for a range of uses. Make a merchant account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

The capital investment requirement differs with every NCD issue and is set by the company. However, the minimum required amount is Rs 10,000.

Buying an NCD Directly from the Issuer: You may directly visit the issuer's website and can apply from there by making an online payment. Buying NCD through a Broker: If you already have a Demat account with any brokerage firm, you can buy the NCD when it starts trading in the secondary market.

NCD issue process is similar to the IPO process Investors apply for NCD shares through a broker. Based on the subscription, they receive the number of NCD shares. The NCD's are credited to the demat account and the money gets deducted from the trading/bank account.

Investors can hold on to their convertible debentures and continue to receive fixed interest payments at the rate of 2% per year until the debt matures and the company returns their principal.

Section 71(1) permits companies to issue debentures with an option to convert such debenture into shares, either wholly or partly at the time of redemption, provided that it shall be approved by a special resolution passed at a general meeting.

A company can issue any type of debenture based on its requirement. A convertible debenture is one among them, which is a hybrid debt instrument that strikes a balance between equity and debt. This debt instrument is where the company can convert into equity shares fully or partially.

Advantages of investing in NCDs. NCDs offer higher interest rates as compared to traditional investment options like bank FDs, government bonds or securities, etc. Generally, the NBFC NCD rate of interest is higher by up to 150-175 basis points than bank FDs. NCDs are tradable in the share market, hence highly liquid.

Later, the company issues the NCDs through a public issue that remains open for a specific period, similar to IPOs. The process of how to buy non-convertible debentures requires the investors to login into their online stock broking account and place a buy order to buy NCD online.