North Carolina Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

If you wish to complete, obtain, or print out authorized record themes, use US Legal Forms, the most important assortment of authorized types, which can be found on the web. Use the site`s easy and practical lookup to get the papers you require. A variety of themes for organization and specific purposes are sorted by classes and says, or search phrases. Use US Legal Forms to get the North Carolina Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation within a number of click throughs.

If you are currently a US Legal Forms buyer, log in in your account and then click the Download option to obtain the North Carolina Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. You can even gain access to types you formerly acquired inside the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct town/land.

- Step 2. Take advantage of the Preview method to check out the form`s articles. Don`t forget about to see the explanation.

- Step 3. If you are unsatisfied with all the kind, utilize the Search area near the top of the monitor to get other types of the authorized kind format.

- Step 4. Once you have located the form you require, click the Acquire now option. Opt for the costs strategy you like and add your accreditations to register to have an account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Find the formatting of the authorized kind and obtain it on the gadget.

- Step 7. Total, revise and print out or signal the North Carolina Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

Each authorized record format you buy is your own property forever. You have acces to every single kind you acquired inside your acccount. Click the My Forms portion and select a kind to print out or obtain again.

Contend and obtain, and print out the North Carolina Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation with US Legal Forms. There are thousands of expert and state-particular types you can utilize for your personal organization or specific needs.

Form popularity

FAQ

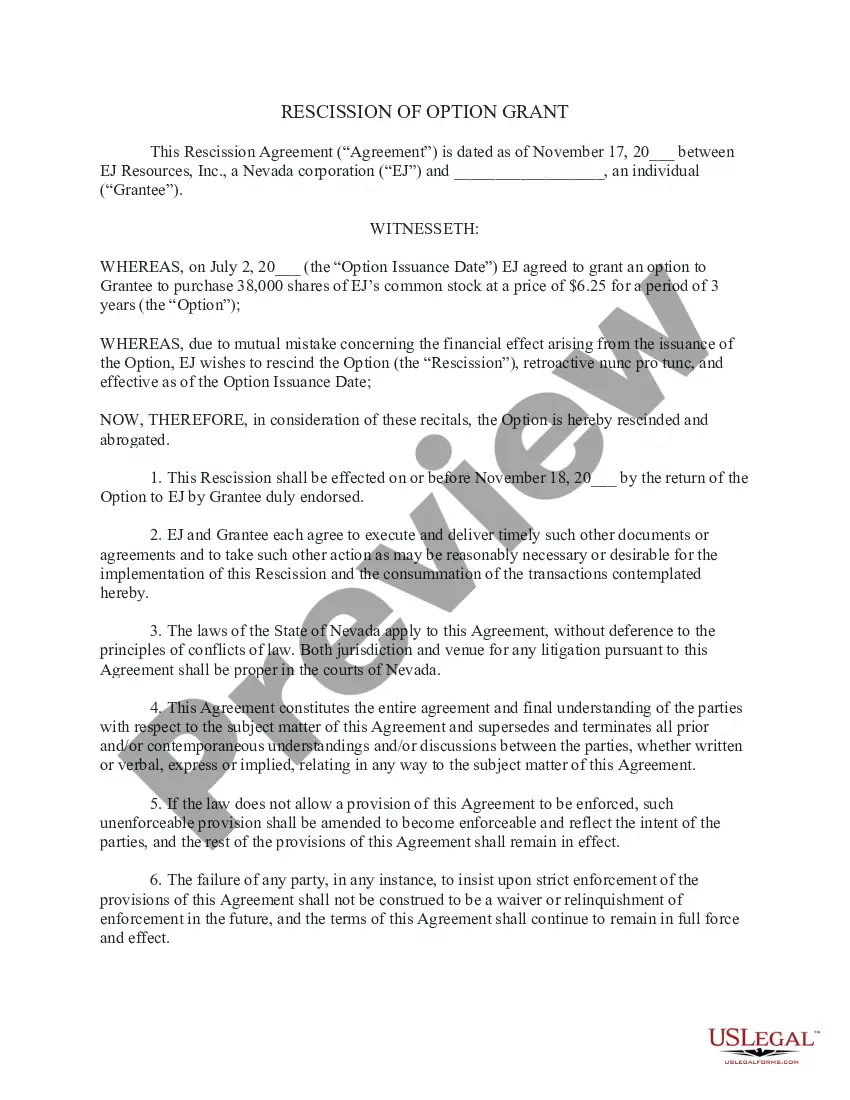

Unvested Options ? Depending on the structure of the deal, there are three possibilities for unvested options. The holdings could be canceled, they might be converted to cash and paid out over time, or they could be converted to the acquiring company stock and subject to a new vesting schedule.

The new company could assume your current unvested stock options or RSUs or substitute them. The same goes for vested options. You'd likely still have to wait to buy shares or receive cash, but could at least retain your unvested shares.

There are two typical outcomes if you have employee stock options and an M&A occurs, the acquiring company can cash you out or give you company shares. If the acquiring company cashes you out, your outcome is simple: you receive cash and pay taxes on the gains.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.