North Carolina Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

If you need to extensive, obtain, or create authentic document templates, utilize US Legal Forms, the largest selection of authentic forms, accessible online.

Employ the site’s straightforward and user-friendly search to find the documents you require. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the North Carolina Stock Option and Award Plan in just a few clicks.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finish the transaction.

Step 6. Choose the format of the authentic form and download it to your device. Step 7. Fill out, modify, and print or sign the North Carolina Stock Option and Award Plan. Each authentic document template you purchase is yours indefinitely. You can access every form you downloaded within your account. Select the My documents section and choose a form to print or download again. Stay competitive and acquire, and print the North Carolina Stock Option and Award Plan with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the North Carolina Stock Option and Award Plan.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the instructions below.

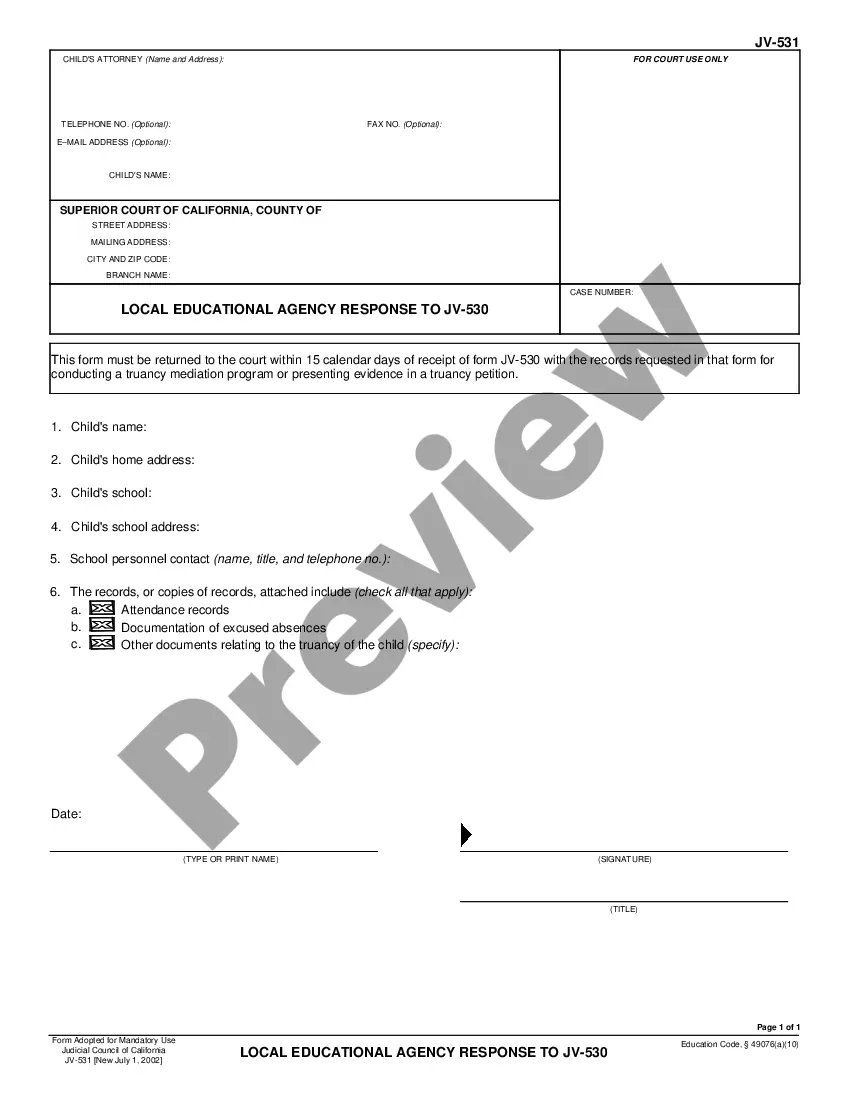

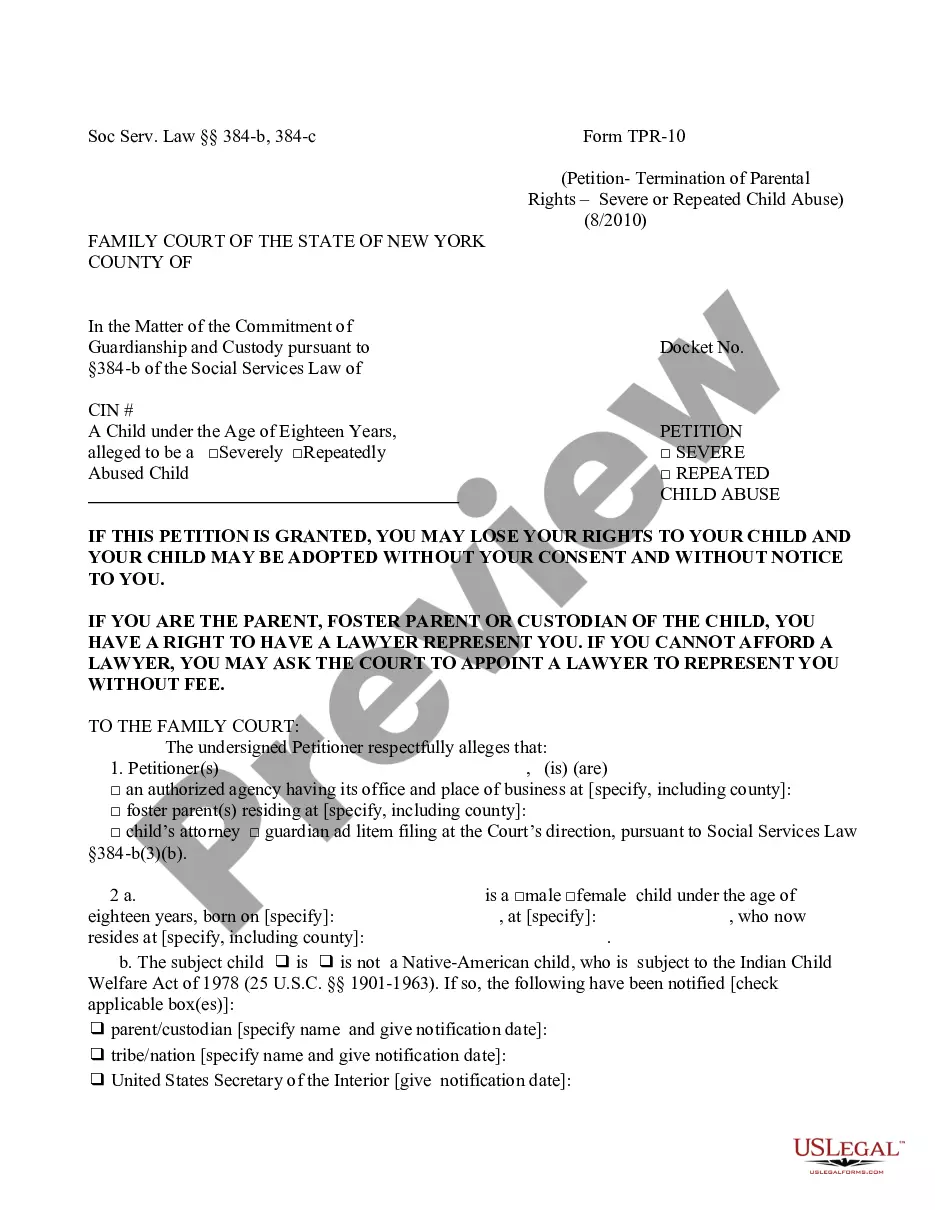

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other variations of the authentic form template.

- Step 4. After you find the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

Stock Awards means any rights granted by the Company to Executive with respect to the common stock of the Company, including, without limitation, stock options, stock appreciation rights, restricted stock, stock bonuses and restricted stock units.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

An award that gives you the ability to purchase shares of company stock at a specified price for a fixed period of time.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

A Restricted Stock Award Share is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period.

In a divorce, your spouse will have a 50% claim in the value of the company or any stock options you hold (assuming that the business was started during marriage and all of the stock was vested).