Iowa Sample Letter for Cancellation of Subject Deed of Trust

Description

How to fill out Sample Letter For Cancellation Of Subject Deed Of Trust?

Are you within a position the place you need to have documents for sometimes organization or personal purposes just about every day time? There are plenty of legitimate papers web templates available online, but discovering kinds you can depend on is not straightforward. US Legal Forms gives 1000s of develop web templates, just like the Iowa Sample Letter for Cancellation of Subject Deed of Trust, which can be published to meet federal and state requirements.

Should you be already familiar with US Legal Forms website and also have a merchant account, just log in. After that, you are able to acquire the Iowa Sample Letter for Cancellation of Subject Deed of Trust format.

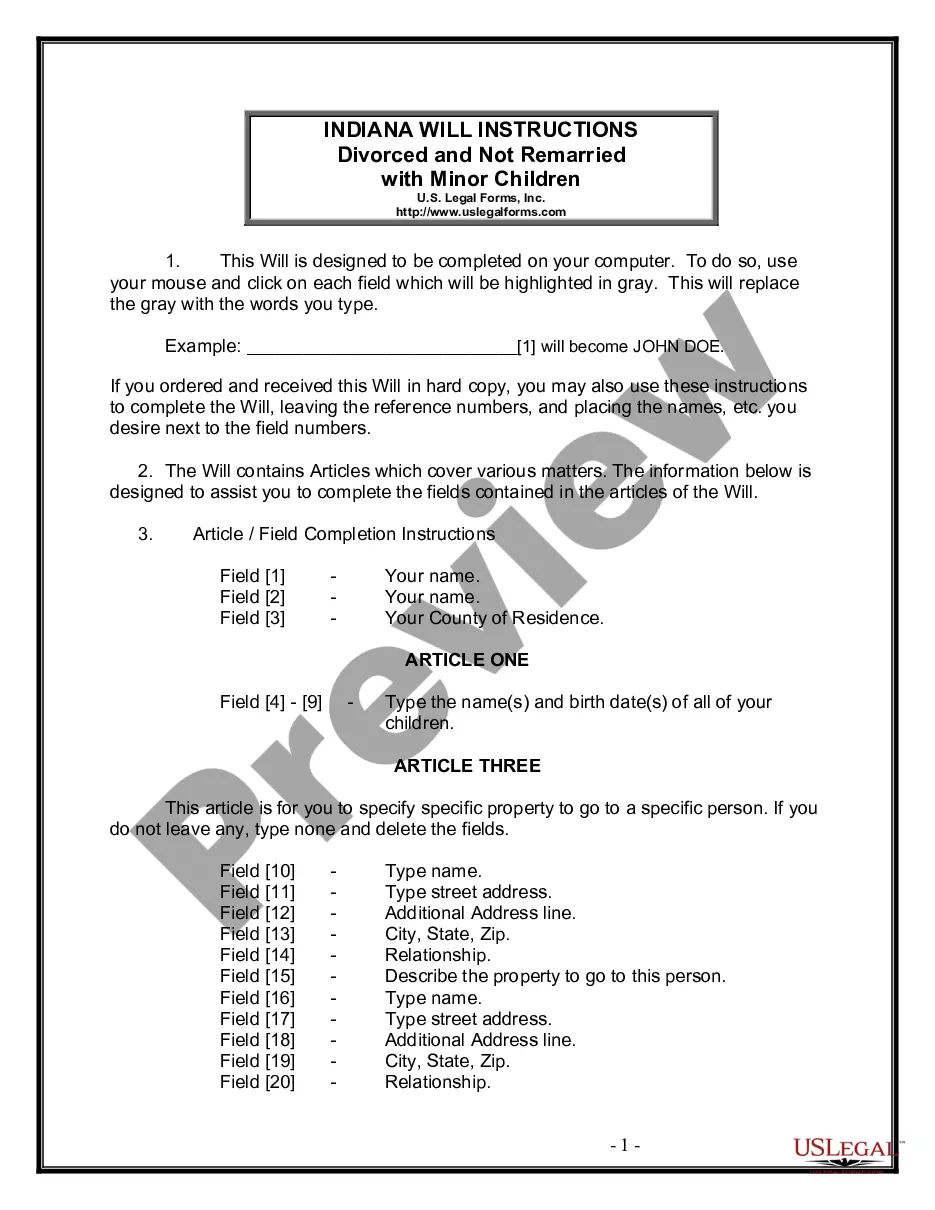

Should you not come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is for your proper city/county.

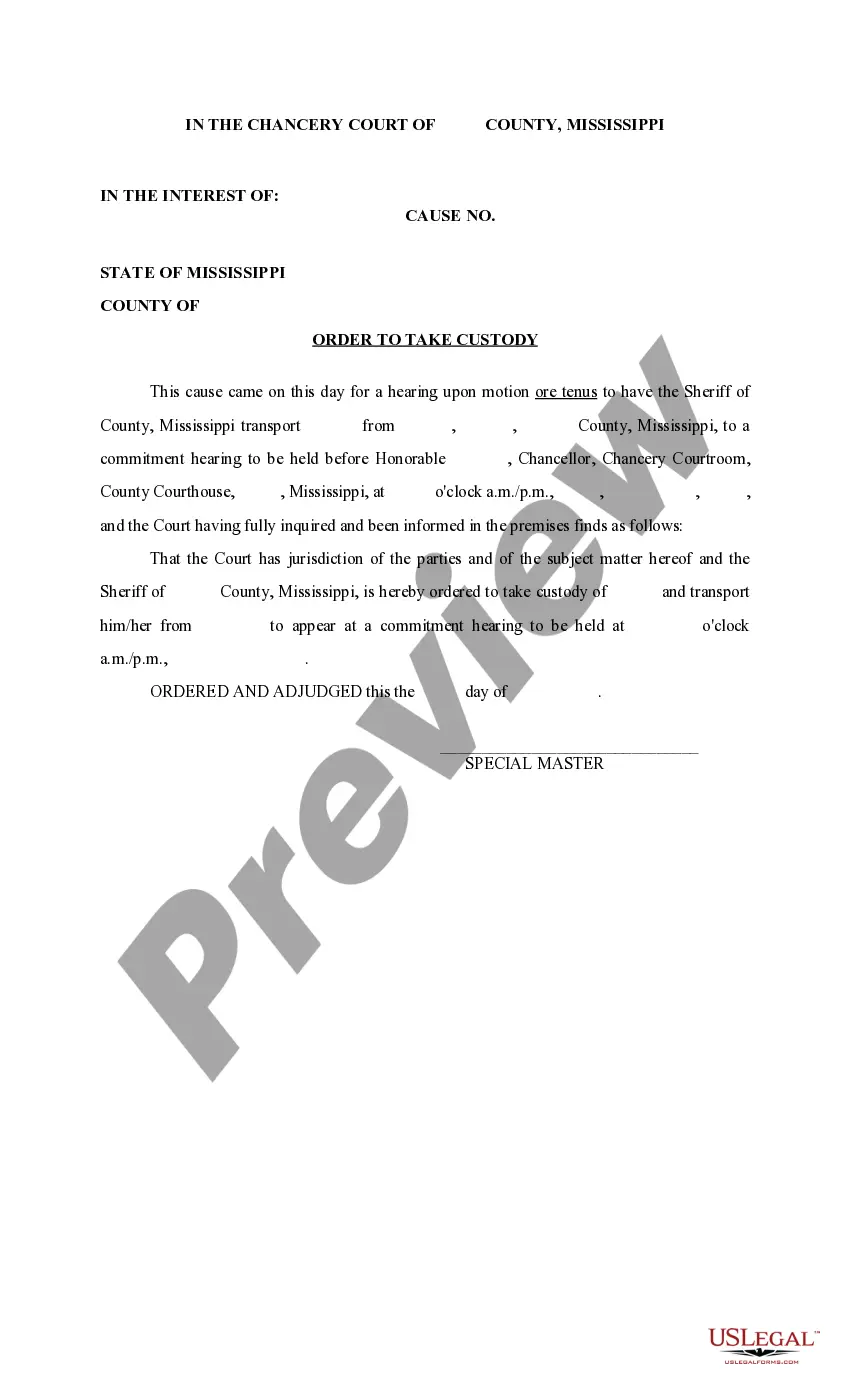

- Utilize the Review key to review the shape.

- Look at the description to actually have chosen the appropriate develop.

- In case the develop is not what you are looking for, take advantage of the Research field to get the develop that meets your needs and requirements.

- Whenever you get the proper develop, click on Get now.

- Select the costs prepare you need, fill in the specified information to make your account, and pay money for the order with your PayPal or charge card.

- Pick a handy document structure and acquire your duplicate.

Get all the papers web templates you might have bought in the My Forms menu. You can get a more duplicate of Iowa Sample Letter for Cancellation of Subject Deed of Trust any time, if necessary. Just go through the essential develop to acquire or print out the papers format.

Use US Legal Forms, the most extensive selection of legitimate forms, to conserve time as well as stay away from mistakes. The support gives appropriately created legitimate papers web templates that you can use for a range of purposes. Create a merchant account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A trust deed is a legal agreement between you and your creditors to pay back part of what you owe over a set period. This is usually four years, but may vary.

An Iowa deed of trust is a document that appoints a trustee who will hold a property title until a borrower (the property owner) has repaid a loan to a lender. The borrower retains the use and enjoyment of the property, while the trustee is given legal ownership (title).

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.