North Carolina Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

You are able to spend hrs online looking for the authorized papers web template that fits the state and federal requirements you want. US Legal Forms supplies a large number of authorized types which can be analyzed by specialists. It is possible to download or print out the North Carolina Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 from the assistance.

If you already have a US Legal Forms accounts, you may log in and click on the Download button. Next, you may comprehensive, modify, print out, or indication the North Carolina Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005. Each and every authorized papers web template you purchase is your own eternally. To obtain another duplicate for any acquired kind, visit the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms site the very first time, stick to the simple recommendations below:

- Very first, make certain you have selected the right papers web template for your region/city of your choosing. Browse the kind explanation to make sure you have selected the proper kind. If readily available, use the Preview button to search from the papers web template also.

- In order to get another version of the kind, use the Look for field to find the web template that suits you and requirements.

- Once you have found the web template you would like, click Acquire now to proceed.

- Find the rates strategy you would like, type your references, and register for a free account on US Legal Forms.

- Complete the purchase. You should use your charge card or PayPal accounts to purchase the authorized kind.

- Find the structure of the papers and download it in your device.

- Make alterations in your papers if required. You are able to comprehensive, modify and indication and print out North Carolina Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

Download and print out a large number of papers templates using the US Legal Forms site, which provides the biggest collection of authorized types. Use specialist and express-specific templates to take on your company or personal requirements.

Form popularity

FAQ

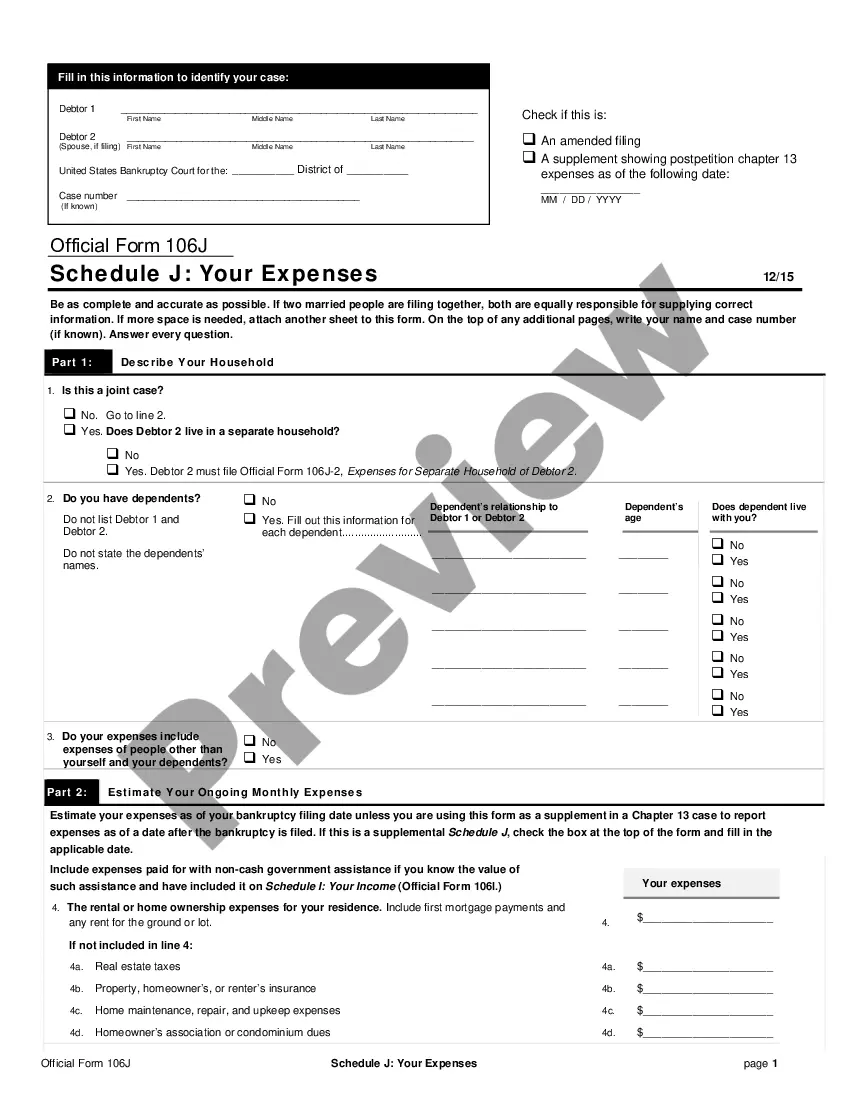

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Schedule J and its instructions guide you through calculation of tax on your current year elected farm income as well as the three base years to calculate your averaged income.

Some of the monthly expenses that are listed on your Schedule J include your rent or mortgage payments, upkeep expenses on your home, utilities, food, gas, telephone, water, car maintenance, childcare, clothing, laundry, and vehicle maintenance. Basically, the money you spend just to live each month is listed here.

Schedule J-2: Expenses for Separate Household of Debtor 2 (individuals)

Schedule J helps the bankruptcy trustee determine your disposable income, which is the amount of money you have left over each month after paying your necessary expenses.

Schedule J: Your Expenses (Official Form 106J) provides an estimate of the monthly expenses, as of the date you file for bankruptcy, for you, your dependents, and the other people in your household whose income is included on Schedule I: Your Income (Official Form 106I).