North Carolina Co-Debtors - Schedule H - Form 6H - Post 2005

Description

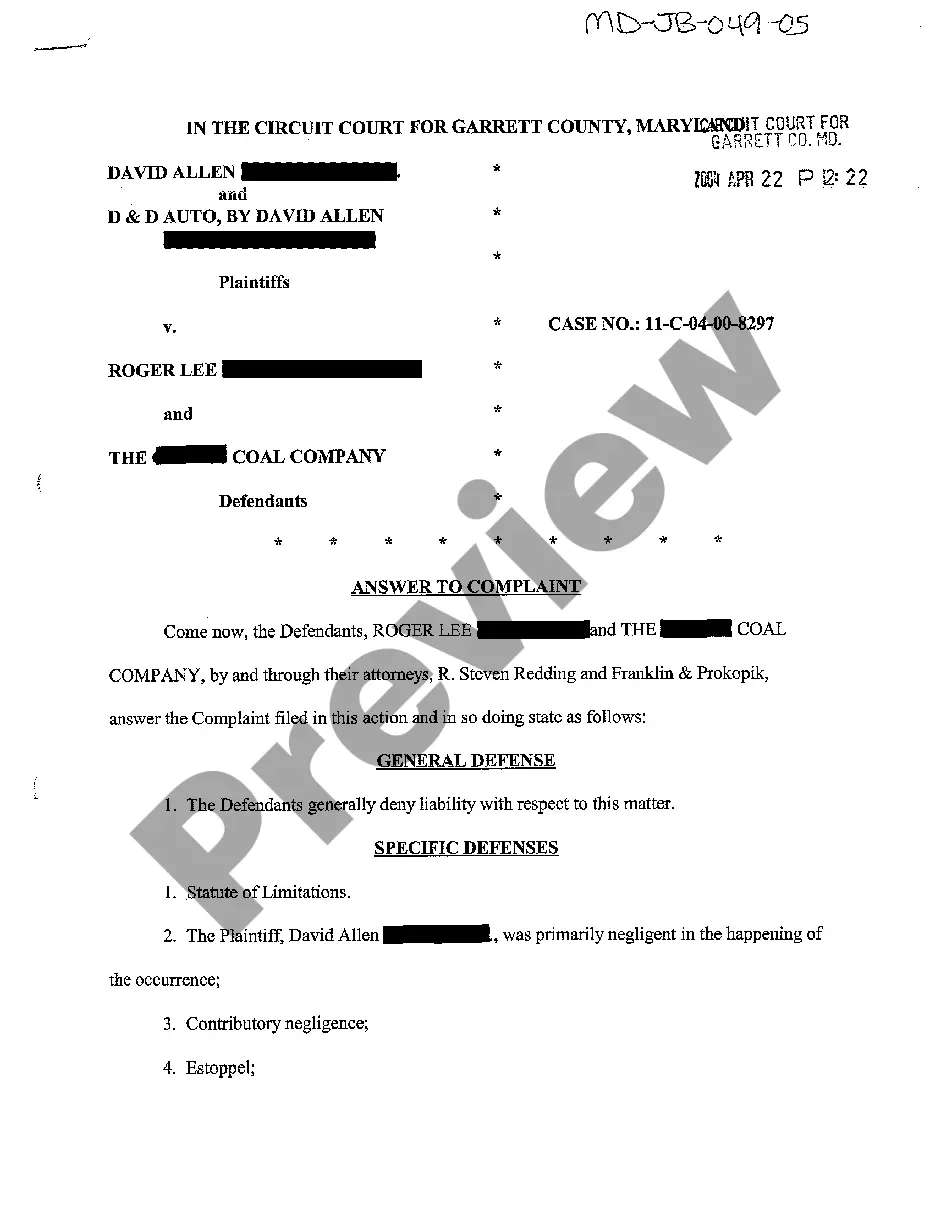

How to fill out Co-Debtors - Schedule H - Form 6H - Post 2005?

If you want to full, download, or printing authorized papers layouts, use US Legal Forms, the biggest collection of authorized varieties, that can be found on-line. Utilize the site`s basic and practical research to obtain the documents you will need. Numerous layouts for company and individual purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to obtain the North Carolina Co-Debtors - Schedule H - Form 6H - Post 2005 within a couple of clicks.

In case you are presently a US Legal Forms customer, log in for your bank account and click the Download switch to find the North Carolina Co-Debtors - Schedule H - Form 6H - Post 2005. Also you can access varieties you earlier acquired within the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for the correct city/country.

- Step 2. Use the Review method to look over the form`s content material. Do not overlook to read through the description.

- Step 3. In case you are not satisfied together with the form, make use of the Lookup industry towards the top of the screen to discover other models in the authorized form template.

- Step 4. After you have located the shape you will need, click on the Buy now switch. Select the prices plan you like and add your references to register for an bank account.

- Step 5. Approach the purchase. You can use your credit card or PayPal bank account to complete the purchase.

- Step 6. Choose the file format in the authorized form and download it on your own system.

- Step 7. Full, edit and printing or signal the North Carolina Co-Debtors - Schedule H - Form 6H - Post 2005.

Every authorized papers template you get is your own eternally. You possess acces to every form you acquired inside your acccount. Go through the My Forms portion and decide on a form to printing or download again.

Compete and download, and printing the North Carolina Co-Debtors - Schedule H - Form 6H - Post 2005 with US Legal Forms. There are thousands of professional and state-certain varieties you may use for the company or individual needs.

Form popularity

FAQ

debtor is a person or entity who assumes joint liability for a debt alongside the principal debtor. The codebtor is responsible for repaying the debt if the principal defaults or is unable to fulfill their obligations.

A codebtor is someone who must pay off a debt owed by the debtor (the person who files for bankruptcy) if the debtor fails to do so.

debtor is someone who took out a loan with you. In doing so, they agreed to be equally responsible for repaying the loan or debt. If you have debts with codebtors and you don't reaffirm the debt in a Chapter 7 case, your codebtor will be solely responsible for repaying the debt if you get a bankruptcy discharge.

Usually, when you file bankruptcy, an automatic stay for co-debtors goes into effect under 11 USC 1301 (C). The automatic stay keeps creditors from collecting from the debtor or their property.

As a guarantor payer, you are responsible for obligations due under a loan as the main debtor. As a co-debtor, you are responsible to the credit institution for all due obligations and the lien debtor is responsible to the credit institution with all voluntarily liened assets.