North Carolina Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

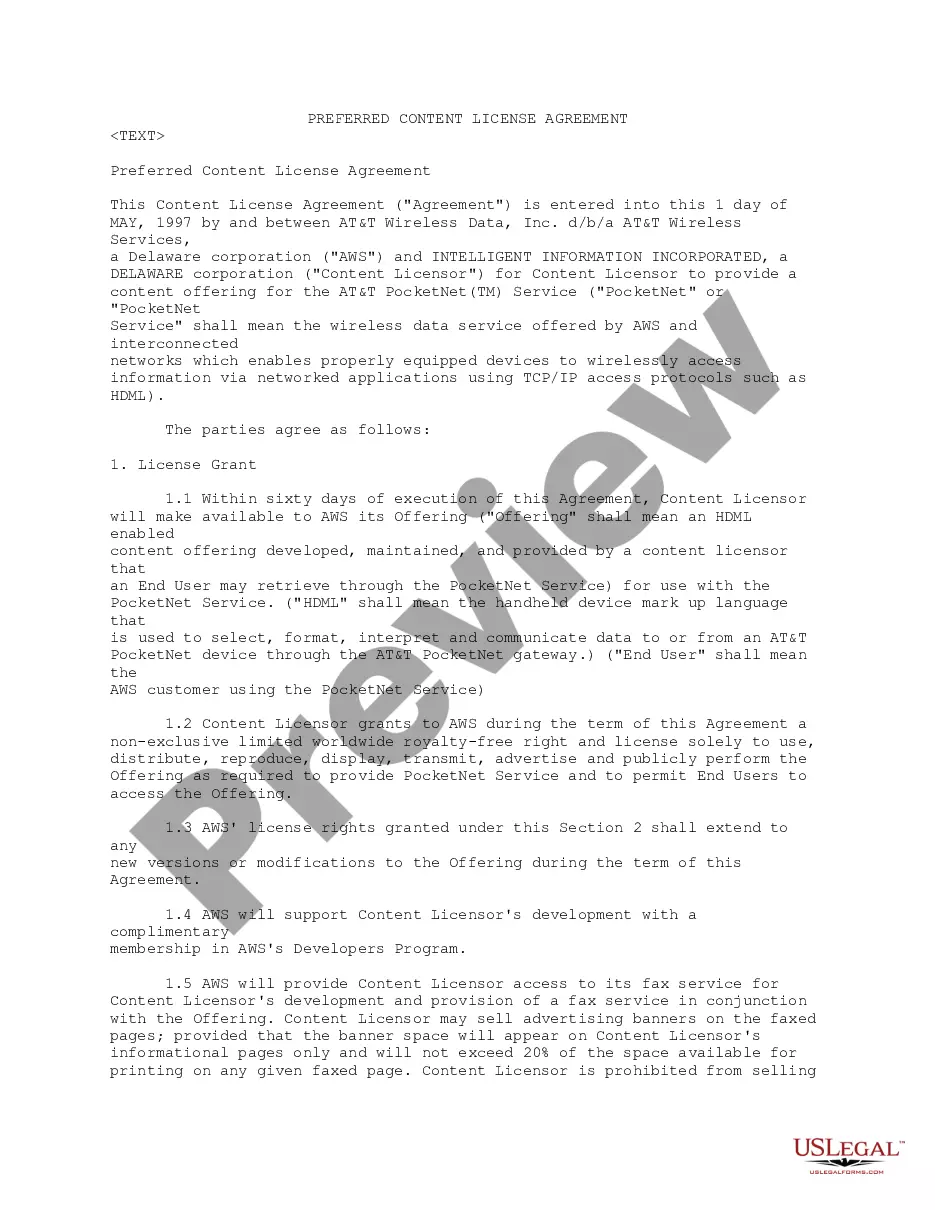

Discovering the right lawful papers design can be quite a have a problem. Obviously, there are a lot of templates available online, but how can you get the lawful form you require? Utilize the US Legal Forms web site. The service delivers 1000s of templates, for example the North Carolina Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, that can be used for company and personal requires. Each of the kinds are checked out by pros and meet up with federal and state demands.

If you are already signed up, log in in your accounts and then click the Obtain switch to get the North Carolina Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Utilize your accounts to appear from the lawful kinds you possess ordered formerly. Visit the My Forms tab of your own accounts and get an additional version in the papers you require.

If you are a fresh customer of US Legal Forms, here are basic instructions for you to stick to:

- Initially, ensure you have chosen the right form to your metropolis/area. You may look through the form using the Preview switch and read the form information to guarantee it is the best for you.

- When the form is not going to meet up with your requirements, use the Seach discipline to get the right form.

- When you are sure that the form would work, click the Buy now switch to get the form.

- Choose the pricing prepare you desire and enter the necessary information. Design your accounts and buy your order with your PayPal accounts or Visa or Mastercard.

- Pick the file structure and down load the lawful papers design in your gadget.

- Total, modify and print out and indicator the received North Carolina Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

US Legal Forms is definitely the greatest library of lawful kinds where you will find different papers templates. Utilize the company to down load professionally-created paperwork that stick to condition demands.

Form popularity

FAQ

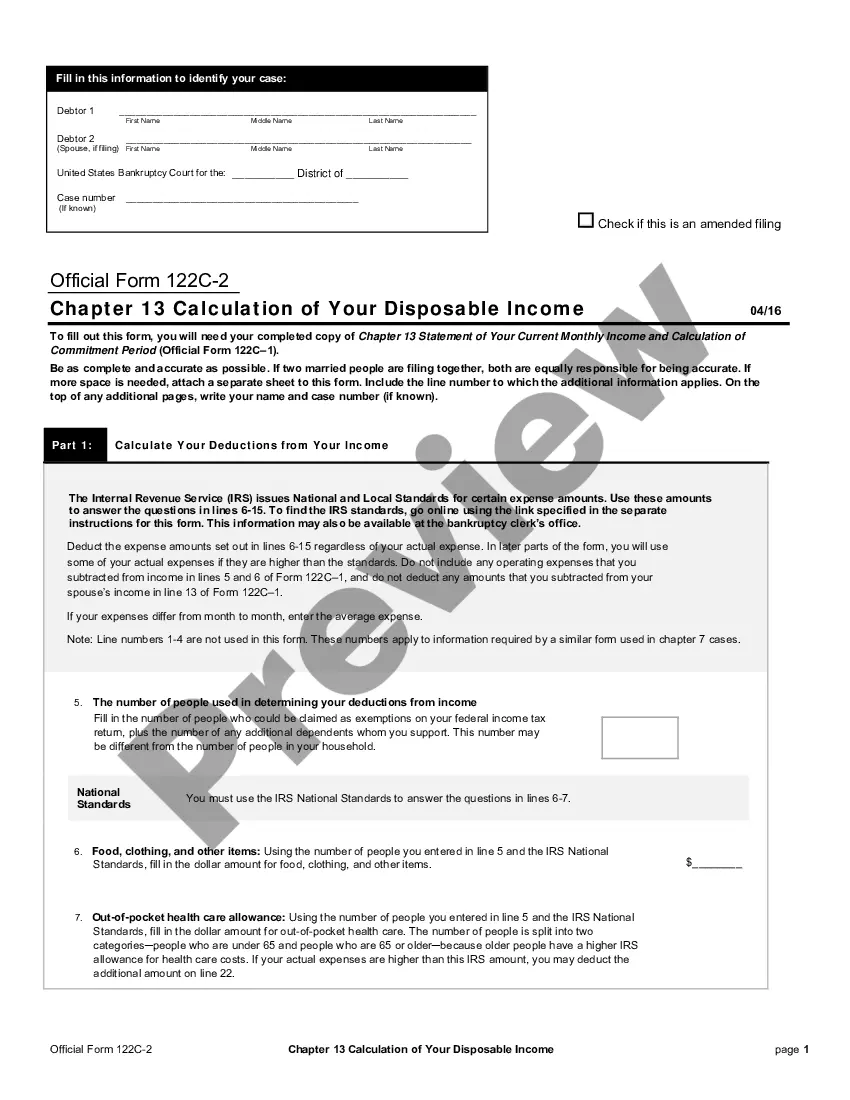

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

A debtor must have enough income, after deducting allowable expenses, for all debt obligations. A debtor may include income from a working spouse even if the spouse has not filed jointly for bankruptcy, wages and salary, self-employment income, Social Security benefits, and unemployment benefits.

How Is Disposable Income Calculated? Your last six months of income divided by six to get average monthly income. If you own a business or work for yourself, you must calculate average monthly income. Any money you get from rent on an asset you own, interests, dividends or royalties.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

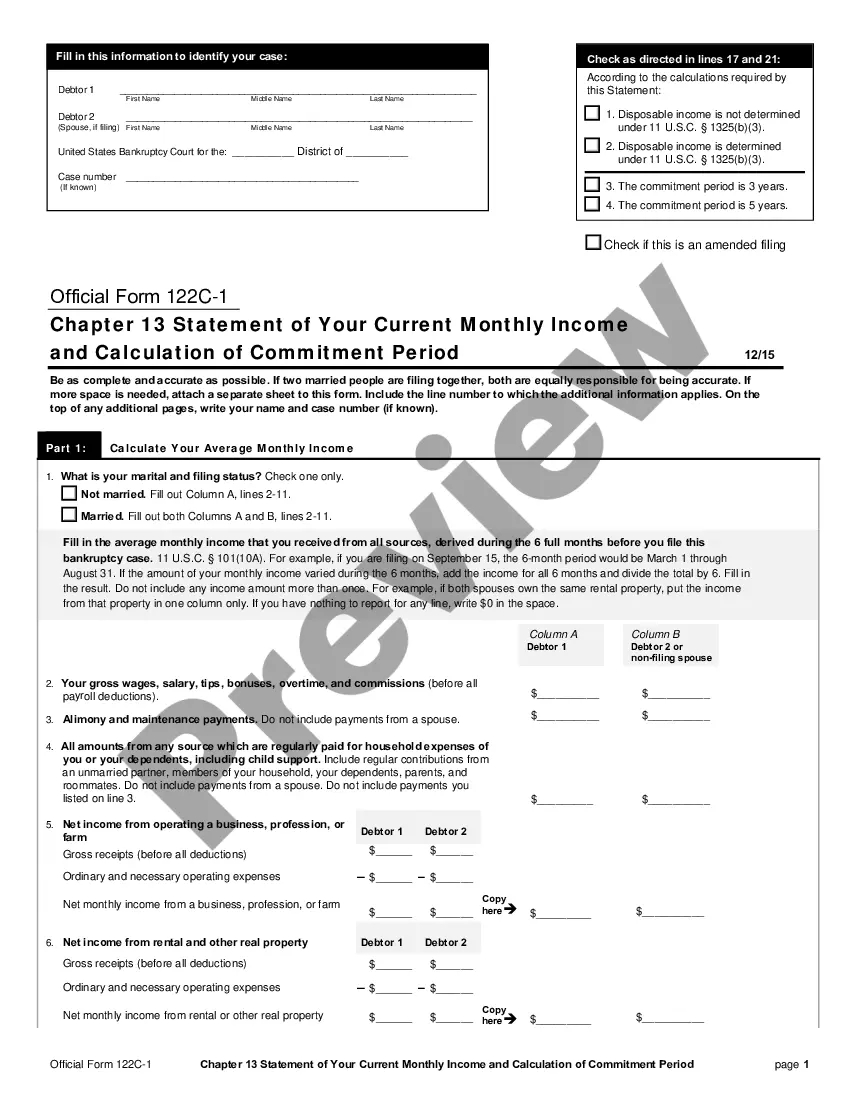

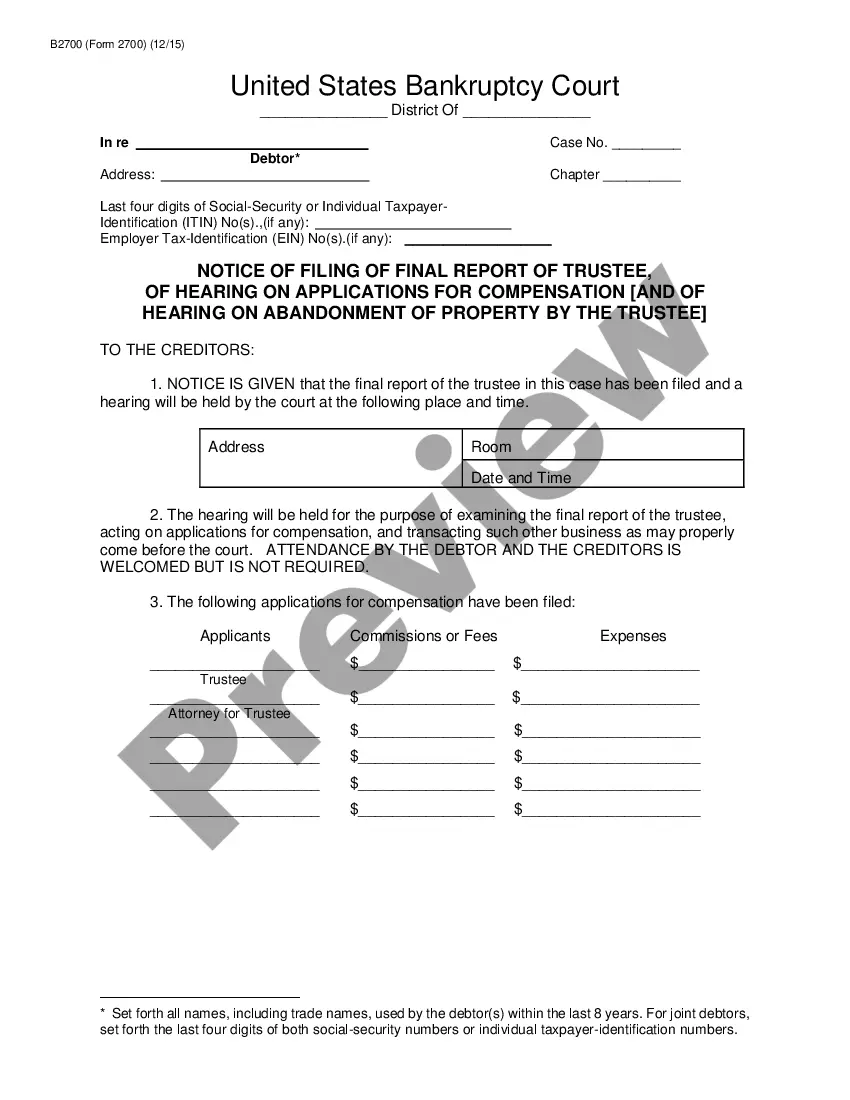

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.