North Carolina Log of Records Retention Requirements

Description

How to fill out Log Of Records Retention Requirements?

Selecting the finest legal document template can be a challenge. Clearly, there are numerous designs accessible online, but how do you acquire the legal template you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the North Carolina Log of Records Retention Requirements, which you can utilize for business and personal purposes. All of the forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Log of Records Retention Requirements. Use your account to navigate through the legal forms you have previously purchased. Go to the My documents section of your account and download an extra copy of the document you need.

US Legal Forms is the largest library of legal forms where you can find various document templates. Take advantage of the service to download professionally created documents that adhere to state requirements.

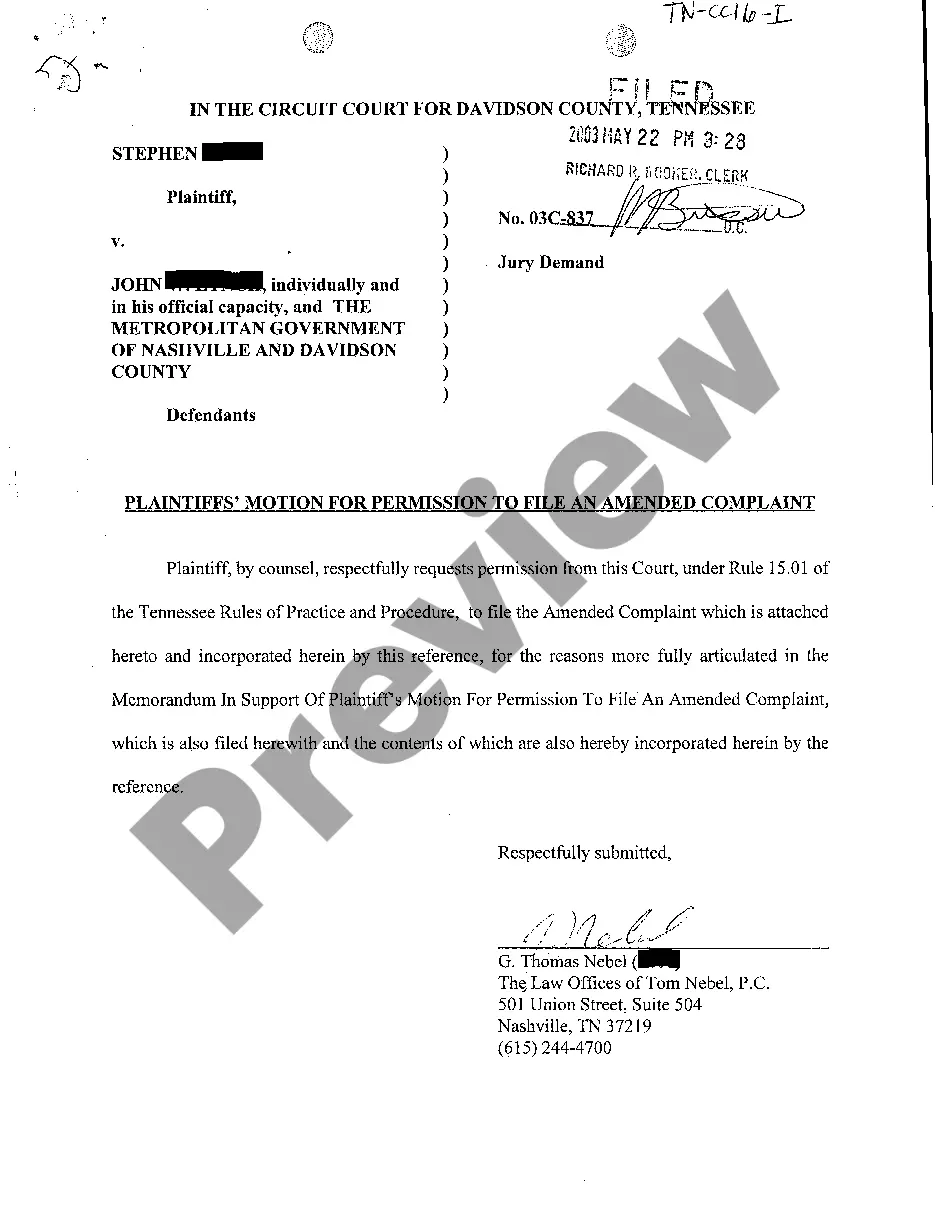

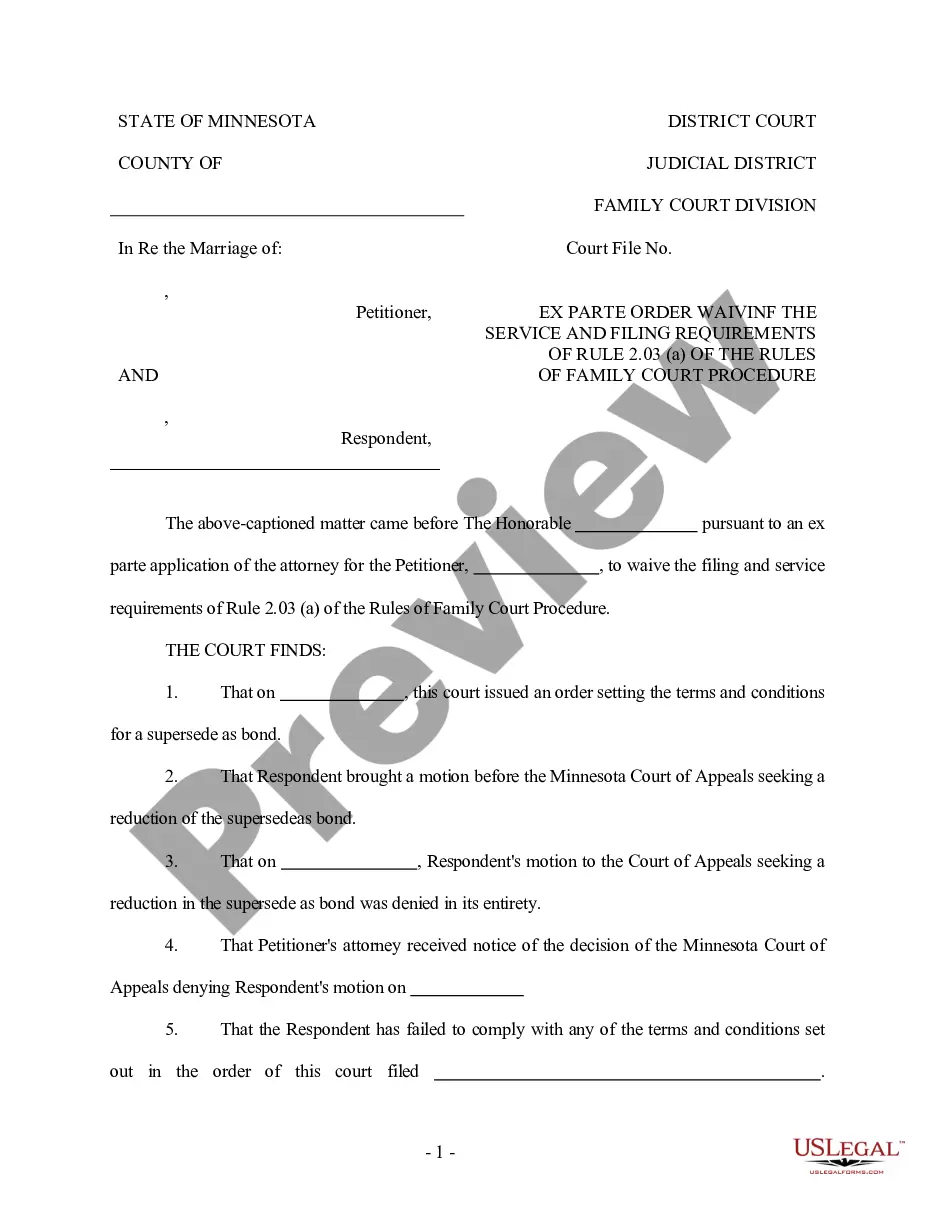

- First, make sure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to ensure this is suitable for you.

- If the form does not meet your needs, use the Search field to find the correct form.

- Once you are confident that the form is appropriate, click the Get now button to acquire the form.

- Select the pricing plan you desire and enter the necessary information. Create your account and pay for the order with your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Complete, edit, print, and sign the obtained North Carolina Log of Records Retention Requirements.

Form popularity

FAQ

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

Retention policies help to manage many risks including lost or stolen information, excessive backlog of paper files, loss of time and space while internally managing records and lack of organization system for records, making them hard to find, just to name a few.

A recordkeeping system is a shared filing system where records are captured, organized, accessed, protected, retained, and destroyed in accordance with approved records schedules. A recordkeeping system is about more than technology.

Records retention is a practice by which organizations maintain confidential records for set lengths of time, and then employ a system of actions to either redirect, store or dispose of them.

Records must be retained for a minimum of 5 years (13 NCAC 14B.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Records Management system (RMS) is the management of records for an organization throughout the records-life cycle. The activities in this management include the systematic and efficient control of the creation, maintenance, and destruction of the records along with the business transactions associated with them.

Data retention is the collection, storage, and management of data. Businesses, organizations, and governments have policies, regulations, and laws that define how data must be stored and for how long. The drivers for data retention programs include compliance, disaster recovery, and the need to feed analytic engines.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).