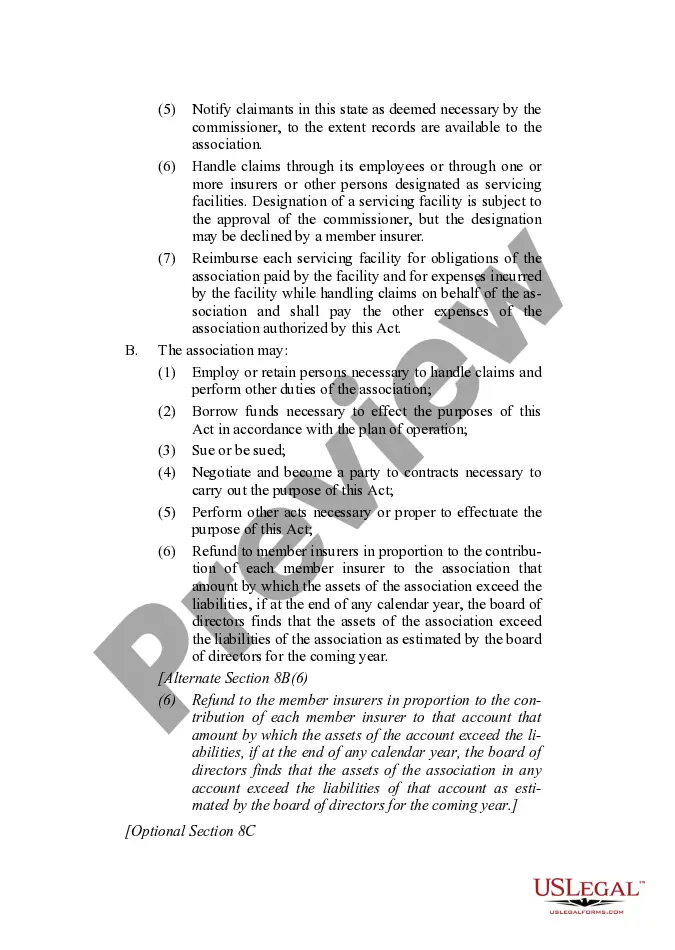

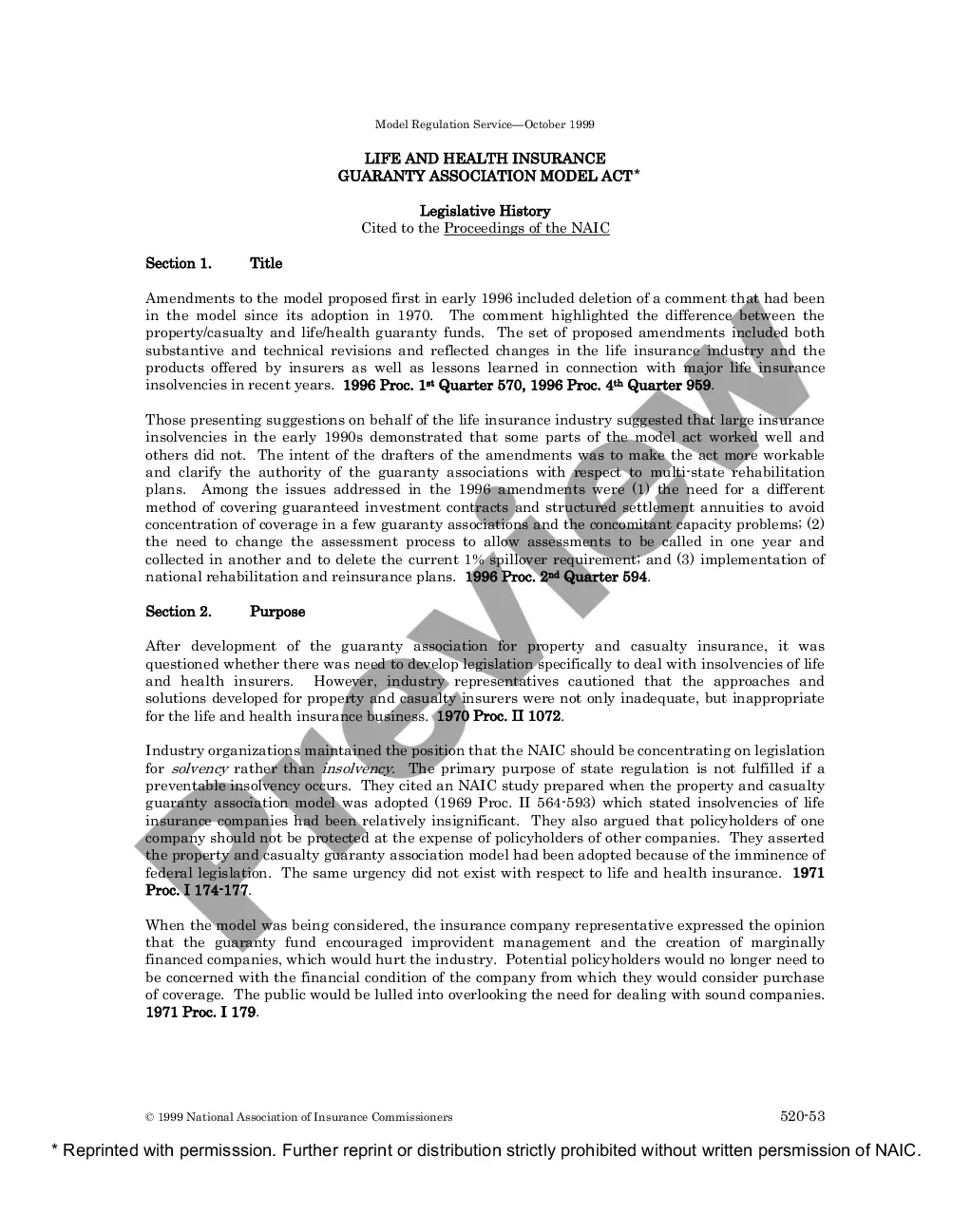

Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

North Carolina Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

You can spend hrs on the web attempting to find the legitimate record design which fits the federal and state requirements you need. US Legal Forms provides a huge number of legitimate types that happen to be analyzed by pros. You can easily download or produce the North Carolina Post Assessment Property and Liability Insurance Guaranty Association Model Act from my services.

If you currently have a US Legal Forms account, it is possible to log in and click the Down load option. Following that, it is possible to total, revise, produce, or sign the North Carolina Post Assessment Property and Liability Insurance Guaranty Association Model Act. Every single legitimate record design you buy is yours for a long time. To get one more version of any obtained develop, check out the My Forms tab and click the related option.

If you use the US Legal Forms web site the very first time, adhere to the basic directions under:

- Initial, be sure that you have selected the right record design to the state/area of your liking. Look at the develop description to make sure you have chosen the appropriate develop. If available, utilize the Review option to appear from the record design as well.

- If you want to discover one more model from the develop, utilize the Research field to obtain the design that suits you and requirements.

- Once you have found the design you want, simply click Purchase now to move forward.

- Find the prices plan you want, type your credentials, and register for a free account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal account to fund the legitimate develop.

- Find the structure from the record and download it for your product.

- Make alterations for your record if needed. You can total, revise and sign and produce North Carolina Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Down load and produce a huge number of record templates making use of the US Legal Forms site, which offers the largest variety of legitimate types. Use professional and condition-certain templates to handle your organization or person demands.

Form popularity

FAQ

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

If your insurance company fails, the maximum amount of protection provided by the North Carolina guaranty association for each individual is $300,000 no matter how many policies you bought from your company.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

Examples of the types of insurance that fall under the guaranty fund are automobile, homeowners, liability and workers' compensation insurance.

You say the guaranty funds pay these claims. Where do they get the money to pay them? Guaranty funds largely are funded by industry assessments, which are usually collected following insolvencies.