North Carolina Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

If you intend to completely, download, or print approved documents templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you need.

A range of templates for business and personal uses are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Select your preferred pricing plan and provide your details to create an account.

Step 6. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the purchase.

- Use US Legal Forms to find the North Carolina Guaranty without Pledged Collateral in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Acquire button to obtain the North Carolina Guaranty without Pledged Collateral.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have chosen the form for your specific region/state.

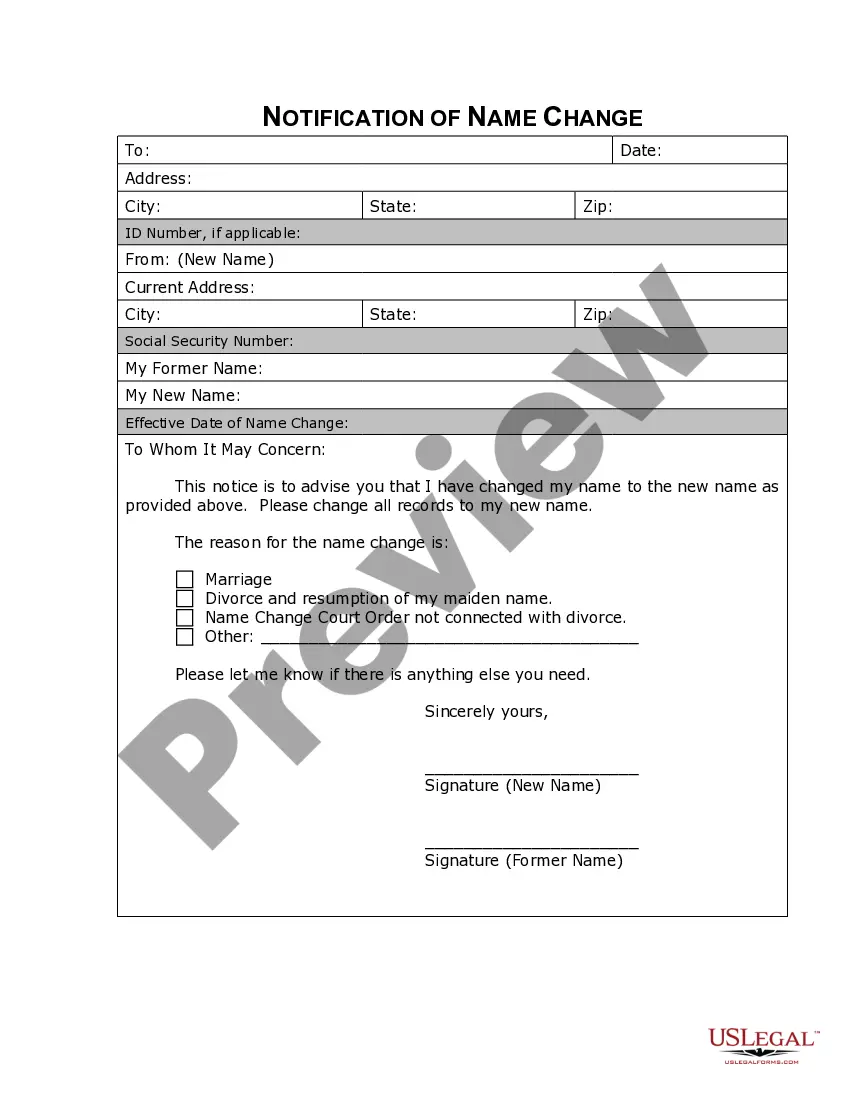

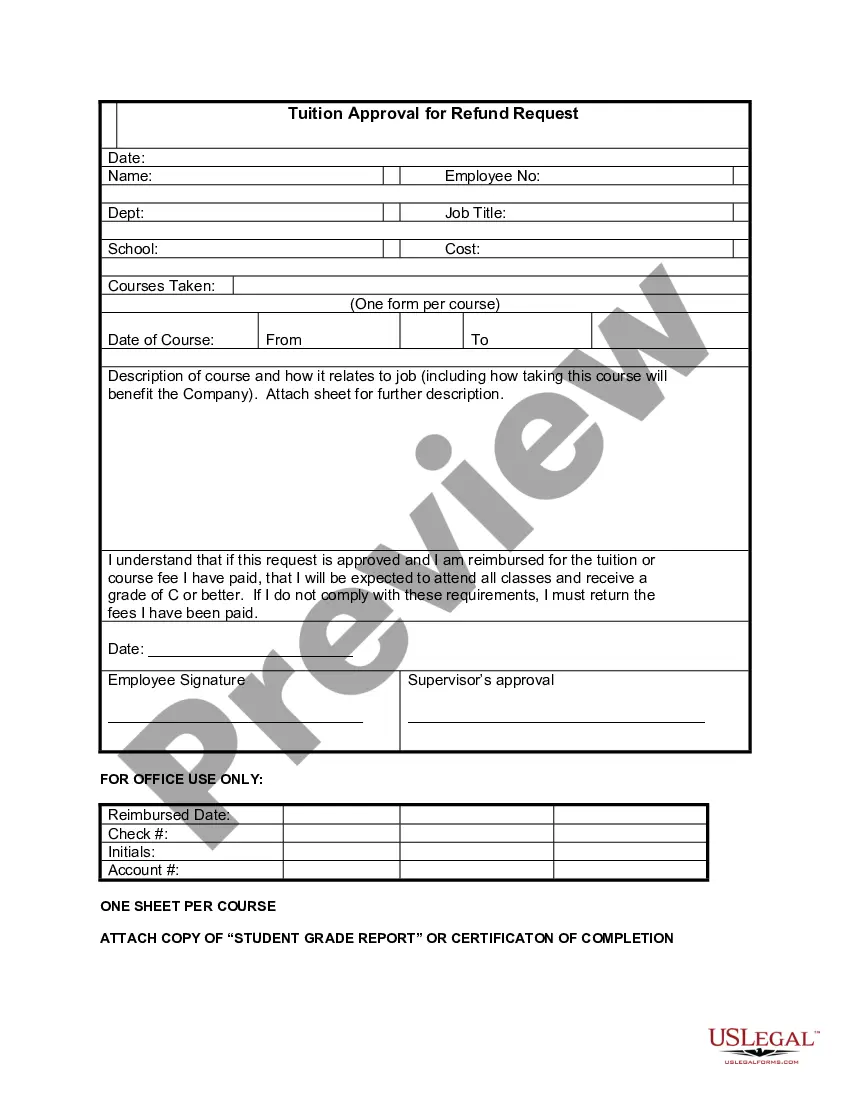

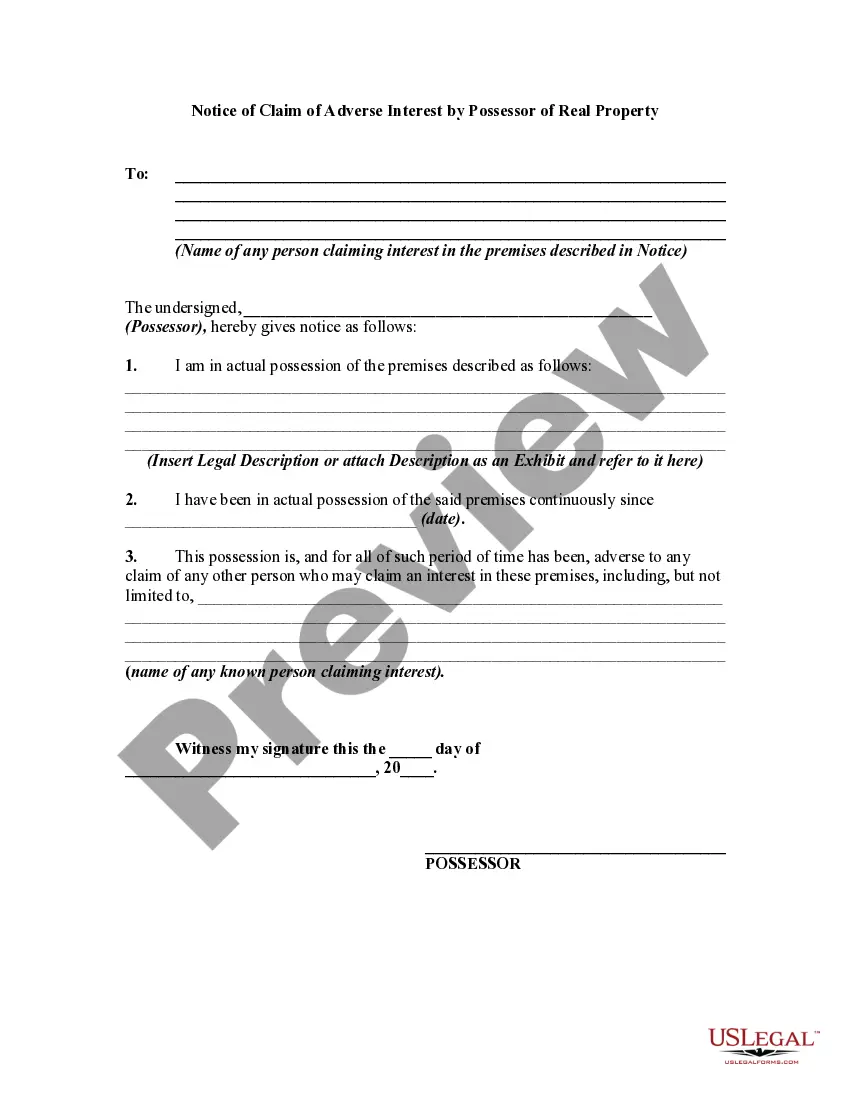

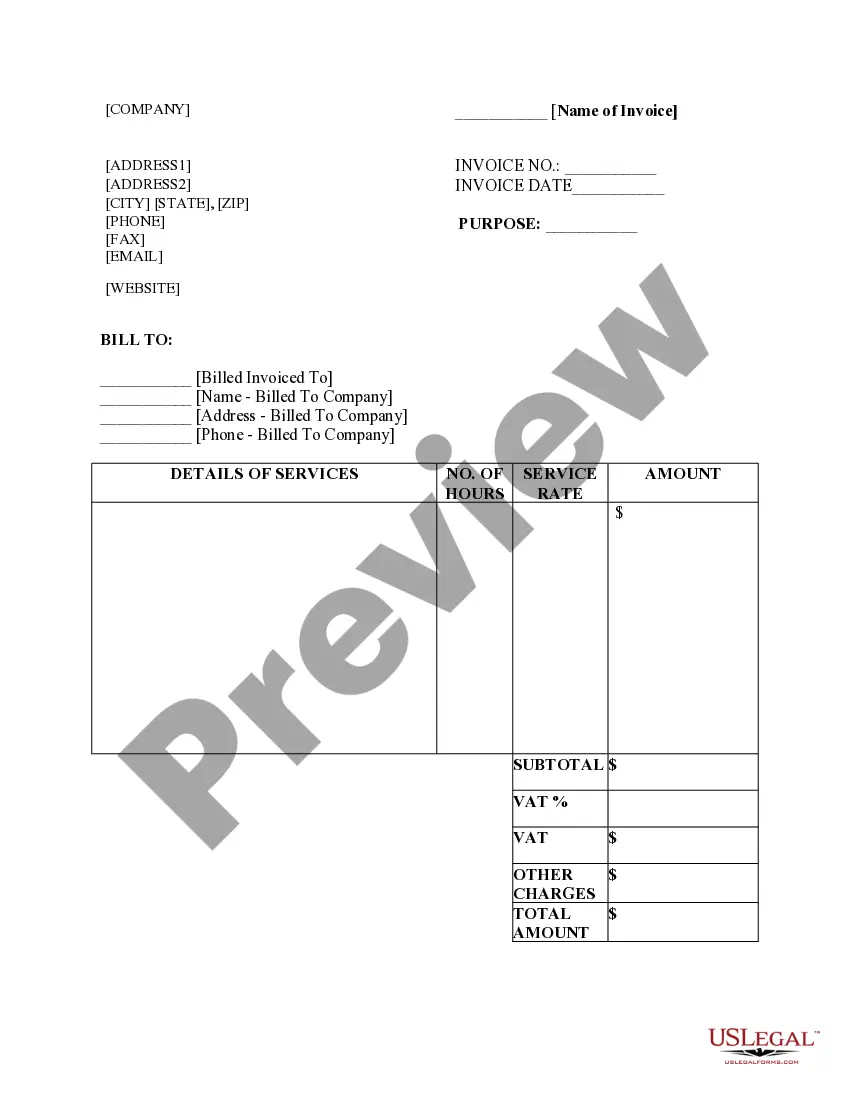

- Step 2. Use the Review feature to examine the form’s content. Don’t forget to read the description.

- Step 3. If you do not like the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Public Deposits refer to the unsecured deposits or money invited by companies from the public mainly to finance their short or long-term working capital needs.

Intercompany Loan Pledge Agreement means that certain agreement between and among the Debtor, the Trustee and the Collateral Agent, pursuant to which the Debtor pledged its rights and interests in that certain intercompany loan from Plan Sponsor to secure its obligations under the Senior Secured Notes.

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

A pledged asset is a valuable asset that is transferred to a lender to secure a debt or loan. Pledged assets can reduce the down payment that is typically required for a loan. The asset may also provide a better interest rate or repayment terms for the loan.

1) Movable and immovable assets So, pledge is used for movable assets like shares, securities, fixed deposits etc. On the other hand, you would never say, "I pledged by apartment". So, in short, mortgage is a term that is used for fixed assets like land, buildings, apartments etc.

In a sale both possession and ownership of property are permanently transferred to the buyer. In a pledge only possession passes to a second party. The first party retains ownership of the property in question, while the second party takes possession of the property until the terms of the contract are satisfied.

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.