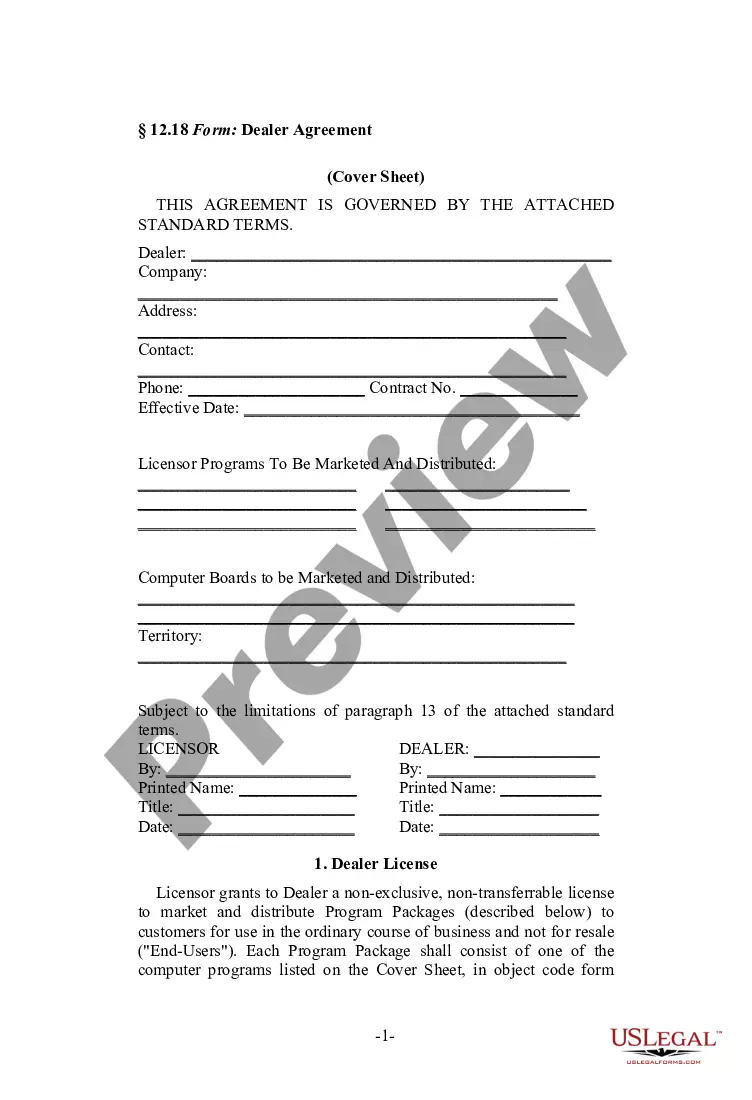

North Carolina Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software

Description

How to fill out Agreement Between Licensor And Dealer For Sale Of Computers, Internet Services, Or Software?

Are you currently in a situation where you need documents for either business or personal purposes daily.

There are numerous legal document templates accessible online, but finding trustworthy ones isn’t simple.

US Legal Forms provides thousands of form templates, such as the North Carolina Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software, which can be crafted to comply with federal and state requirements.

Choose a convenient file format and download your copy.

You can view all the document templates you have purchased in the My documents list. You can obtain another copy of the North Carolina Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software at any time, if required. Just click the necessary form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal templates, to save time and avoid errors. The service offers professionally designed legal document templates suitable for a wide range of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Carolina Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need while ensuring it is for your correct city/region.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are searching for, use the Search section to find the form that meets your needs and criteria.

- Once you locate the appropriate form, click Get now.

- Select the pricing option you want, enter the necessary details to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

In the state of North Carolina, only computer software which meets certain descriptions is considered to be exempt. Sales of custom software - delivered on tangible media are exempt from the sales tax in North Carolina. Sales of custom software - downloaded are exempt from the sales tax in North Carolina.

Traditional Goods or Services Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

Based on the documentation provided, fees charged by Taxpayer on the initial sale of the software to customize the software are exempt from North Carolina sales and use tax pursuant to N.C. Gen. Stat. § 105-164.13(43).

North Carolina generally does not require sales tax on Software-as-a-Service.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.