Idaho Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

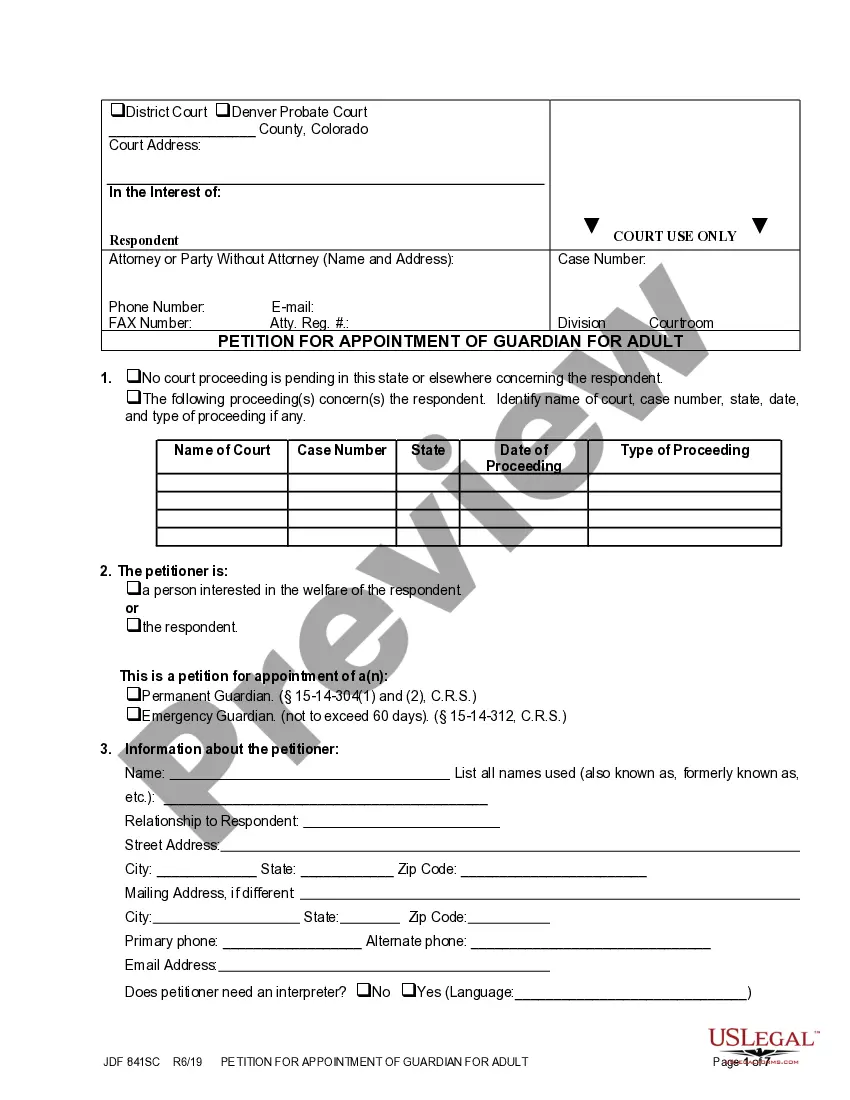

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse selection of legal paper templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Idaho Liquidation of Partnership with Authority, Rights and Obligations during Liquidation in minutes.

If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you already have a monthly subscription, Log In and download Idaho Liquidation of Partnership with Authority, Rights and Obligations during Liquidation from the US Legal Forms library.

- The Download button appears on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some basic tips to help you get started.

- Ensure you have selected the right form for your area/region. Click the Preview button to review the form's content.

- Examine the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Once partners agree to liquidate the partnership, they must follow specific legal procedures outlined in Idaho law. This includes notifying all partners and creditors about the decision, preparing for asset liquidation, and documenting the process thoroughly. Following these steps ensures that the liquidation abides by the Idaho Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, protecting the interests of all parties involved.

These three stages are: (1) dissolution, (2) winding up, and (3) termination.

How to Dissolve a California Business PartnershipReview the Partnership Agreement.Vote or Take Action to Dissolve.Pay Remaining Debts & Distribute Remaining Assets.File a Dissolution Form with the State.Notify Concerned Parties.Resolve Remaining Tax Issues.Complete Any Out-of-State Regulations.

All partnership distributions are either current or liquidating. A liquidating distribution terminates a partner's entire interest in the partnership. A current distribution reduces a partner's capital accounts and basis in his interest in the partnership (outside basis) but does not terminate the interest.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

There are three necessary elements for there to be a partnership between two or more persons:carrying on a business;in common; and.with a view to profit.23-Mar-2018

Dissolution terminates the partners' authority to act for the partnership, except for winding up, but remaining partners may decide to carry on as a new partnership or may decide to terminate the firm.

The partnership framework can help to reduce risks commonly associated with failed partnerships.Stage 1 Partnerless.Stage 2 - Strategy Assessment and Visioning.Stage 3 Partnership Readiness.Stage 4 - Partnership Search and Prospect Identification.Stage 5 - Engagement.Stage 6 - Relationship Building.More items...

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.