Idaho Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

If you want to acquire, download, or print sanctioned document templates, utilize US Legal Forms, the largest array of legal forms, which are accessible online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Idaho Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to obtain the Idaho Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- You can also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

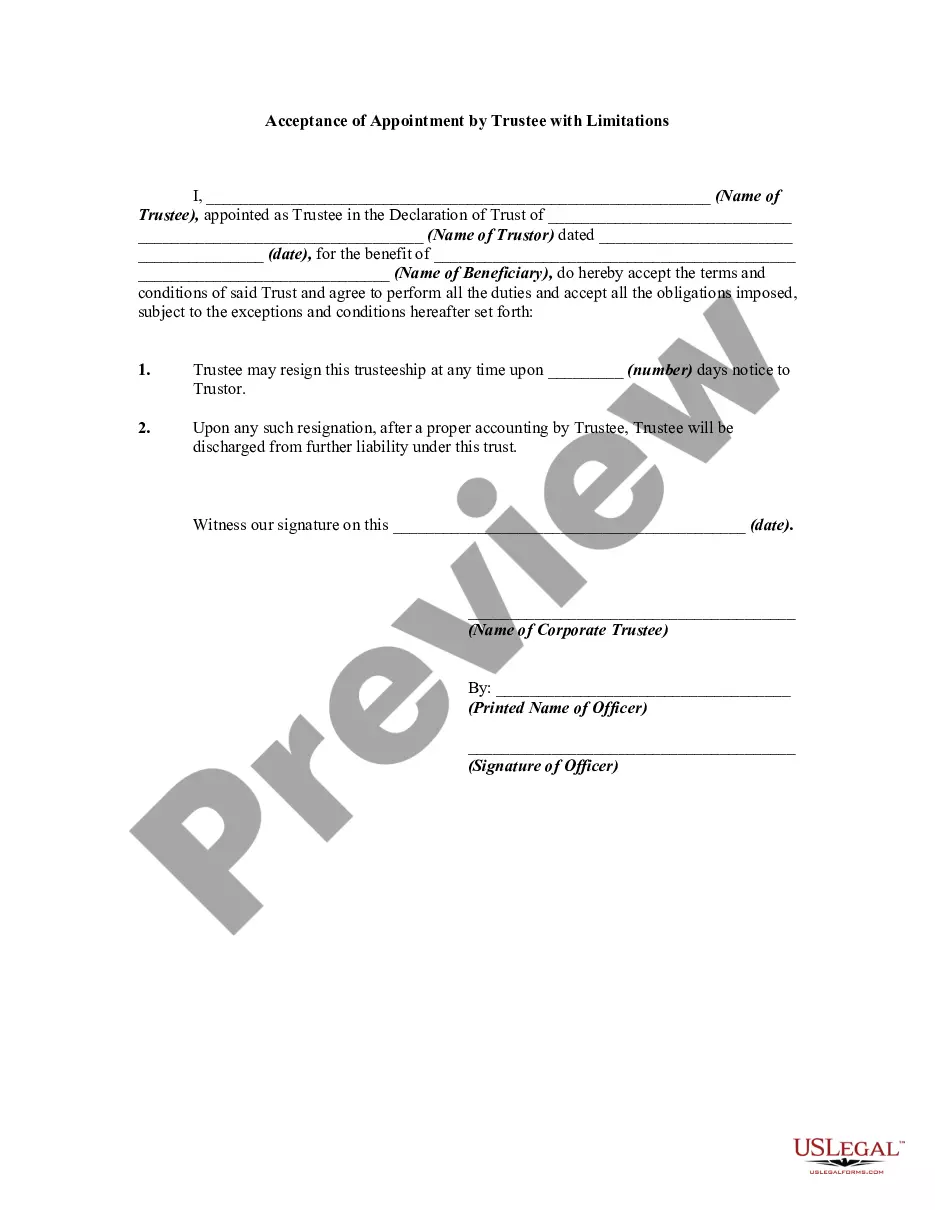

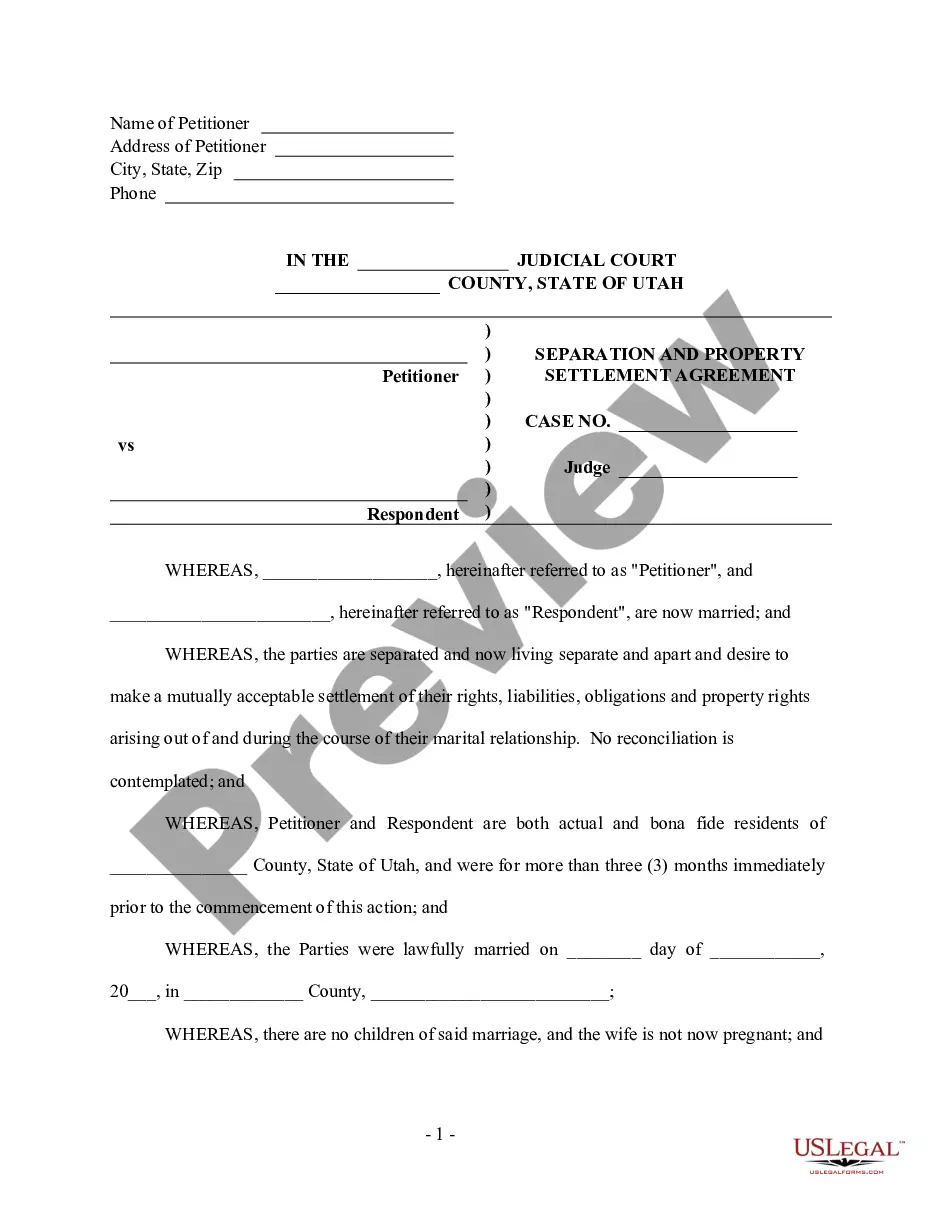

- Step 2. Use the Review option to examine the content of the form. Don’t forget to verify the details.

- Step 3. If you’re not satisfied with the form, take advantage of the Search bar at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

When a partnership dissolves, the assets can indeed be liquidated, but this is not always the case. It depends on the Idaho Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets. Some assets may be sold to partners, while others might be distributed in kind. Therefore, reviewing the specific terms laid out in the agreement is crucial.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

To dissolve your Domestic LLC in Idaho, you can sign in to your SOSBiz account and choose terminate business. Or, you can provide the completed Statement of Dissolution Limited Liability Company form in duplicate to the Secretary of State by mail, fax or in person.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.