North Carolina Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

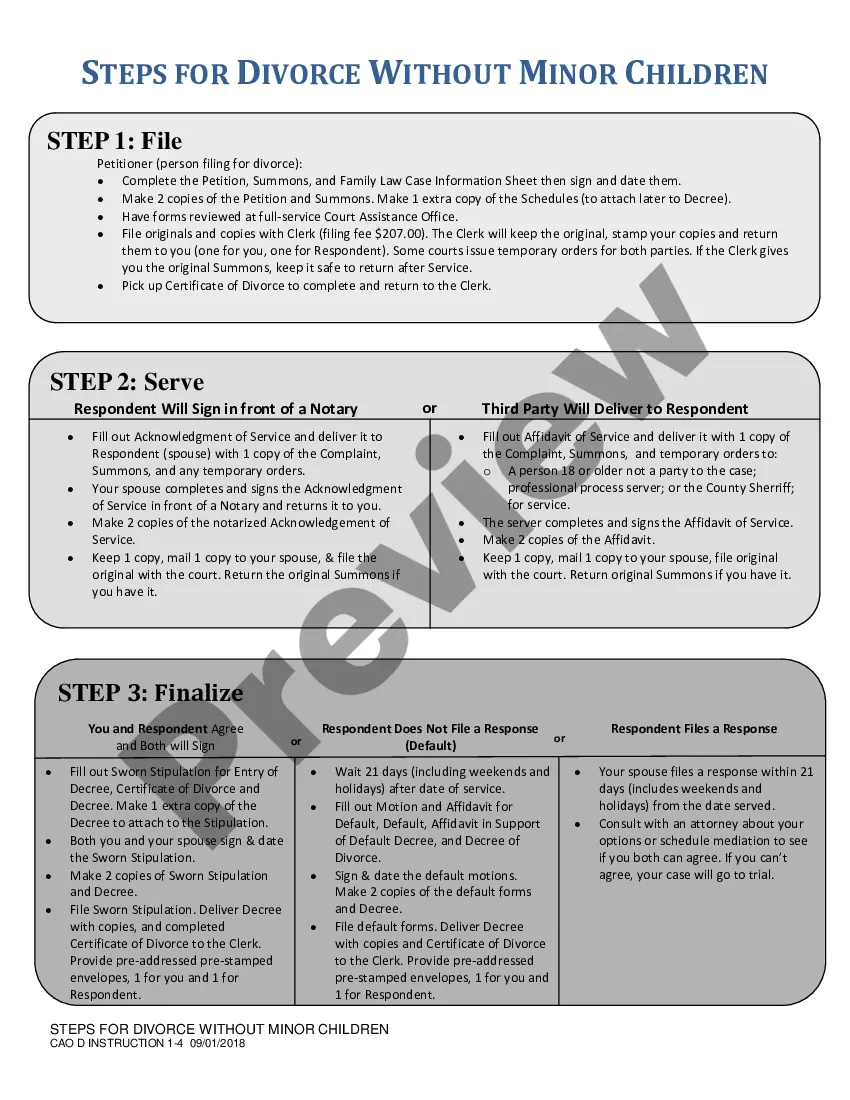

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Choosing the right legal papers format can be a struggle. Naturally, there are tons of templates available on the net, but how do you discover the legal form you need? Use the US Legal Forms web site. The assistance provides a huge number of templates, including the North Carolina Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, which you can use for enterprise and private requires. All the types are checked by specialists and meet state and federal requirements.

In case you are presently authorized, log in to your bank account and then click the Acquire key to obtain the North Carolina Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Make use of bank account to look through the legal types you may have ordered formerly. Proceed to the My Forms tab of your respective bank account and have another version in the papers you need.

In case you are a brand new customer of US Legal Forms, allow me to share easy guidelines for you to comply with:

- Initial, be sure you have chosen the appropriate form for your area/county. You may examine the shape using the Preview key and look at the shape description to ensure this is basically the right one for you.

- In case the form fails to meet your expectations, make use of the Seach field to get the correct form.

- When you are positive that the shape would work, go through the Buy now key to obtain the form.

- Opt for the pricing program you would like and type in the necessary info. Create your bank account and pay for your order using your PayPal bank account or bank card.

- Select the submit format and download the legal papers format to your product.

- Comprehensive, modify and print and sign the received North Carolina Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

US Legal Forms may be the largest local library of legal types in which you can find various papers templates. Use the service to download skillfully-produced files that comply with state requirements.

Form popularity

FAQ

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation. Security Agreement: An agreement creating or memorializing a security interest granted by a debtor to a secured party. Secured Transactions shsu.edu ? klett shsu.edu ? klett

A mortgage involves two parties: a borrower (or mortgagor) and a lender (or mortgagee). When a borrower signs a mortgage, they pledge the property as security to the lender to ensure repayment. In contrast, a trust deed involves three parties: a borrower (or trustor), a lender (or beneficiary), and the trustee.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include cars?only if they are paid off in full?bank savings deposits, and investment accounts. Collateral Definition, Types, & Examples - Investopedia investopedia.com ? terms ? collateral investopedia.com ? terms ? collateral

Deed of trust / Mortgage An instrument that secures a debt, the repayment of the loan/mortgage encumbered by real property.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A mortgage involves two parties: a borrower (or mortgagor) and a lender (or mortgagee). When a borrower signs a mortgage, they pledge the property as security to the lender to ensure repayment. In contrast, a trust deed involves three parties: a borrower (or trustor), a lender (or beneficiary), and the trustee. Trust Deed: What It Is, How It Works, Example Form - Investopedia investopedia.com ? terms ? trustdeed investopedia.com ? terms ? trustdeed

This document may be called the Security Instrument, Deed of Trust, or Mortgage. When you sign this document, you are giving the lender the right to take your property by foreclosure if you fail to pay your mortgage ing to the terms you've agreed to.

Under Section 9?334(d), a security interest in fixtures can take priority over the earlier?recorded interest of an owner or encumbrancer if: the debtor has an interest of record or is in the possession of the real property; the secured party has a purchase?money security interest; and the security interest is perfected ... Understanding UCC Security Interests in Fixtures - CSC Blog cscglobal.com ? understanding-ucc-security-i... cscglobal.com ? understanding-ucc-security-i...