North Carolina Sample Letter for Request for Payment Plan concerning Default

Description

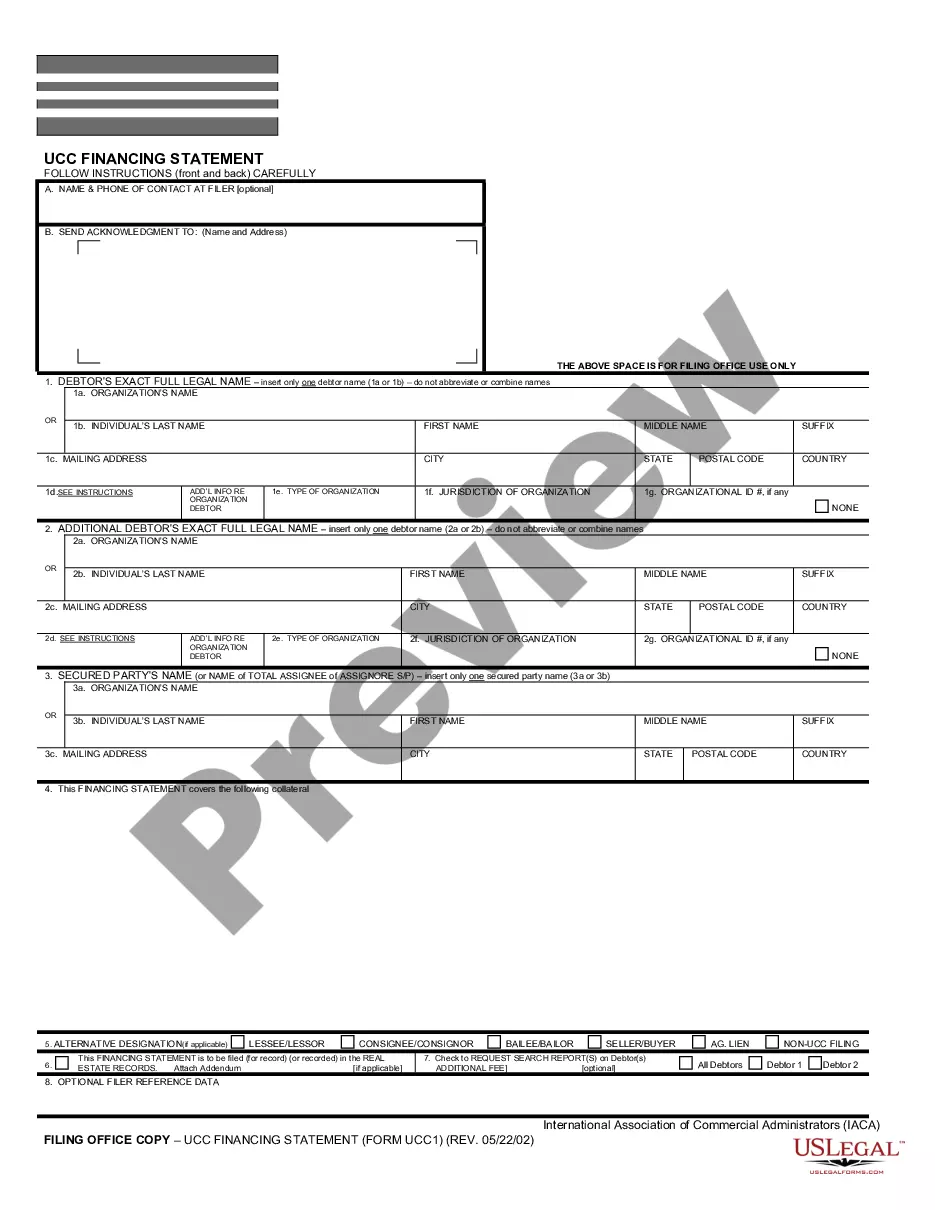

How to fill out Sample Letter For Request For Payment Plan Concerning Default?

If you want to full, obtain, or produce authorized document themes, use US Legal Forms, the largest variety of authorized forms, which can be found on the web. Make use of the site`s basic and handy look for to get the papers you need. Different themes for company and individual reasons are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the North Carolina Sample Letter for Request for Payment Plan concerning Default in a few click throughs.

If you are currently a US Legal Forms buyer, log in in your accounts and click on the Download button to obtain the North Carolina Sample Letter for Request for Payment Plan concerning Default. You can even gain access to forms you previously saved within the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for that correct area/land.

- Step 2. Take advantage of the Preview option to examine the form`s content. Don`t forget about to read through the information.

- Step 3. If you are unsatisfied using the form, use the Look for field towards the top of the screen to locate other types of your authorized form design.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the rates prepare you choose and put your qualifications to register on an accounts.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the formatting of your authorized form and obtain it on the product.

- Step 7. Comprehensive, edit and produce or indication the North Carolina Sample Letter for Request for Payment Plan concerning Default.

Each and every authorized document design you acquire is your own for a long time. You may have acces to each and every form you saved in your acccount. Go through the My Forms section and decide on a form to produce or obtain once again.

Be competitive and obtain, and produce the North Carolina Sample Letter for Request for Payment Plan concerning Default with US Legal Forms. There are millions of specialist and status-particular forms you may use for your company or individual demands.

Form popularity

FAQ

Long-term Payment Plan (Installment Agreement) Apply online: $31 setup fee. Apply by phone, mail, or in-person: $107 setup fee. Low income: Apply online, by phone, or in-person: setup fee waived. Plus accrued penalties and interest until the balance is paid in full.

Follow these six easy steps to set up a debt repayment plan. Make a List of All Your Debts. ... Rank Your Debts. ... Find Extra Money To Pay Your Debts. ... Focus on One Debt at a Time. ... Move On to the Next Debt on Your List. ... Build Up Your Savings.

Card payments cannot be canceled once submitted. If you make a card payment and later decide to reverse the transaction, you may be subject to penalties, interest or other fees imposed by the Department of Revenue for nonpayment or late payment of tax.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

You should use the DOR website to initiate an installment payment agreement electronically. The Form RO-1033 Installment Agreement Request must be completed by using our website. Please keep in mind that this form is a request and there may be additional steps to confirm your agreement with NCDOR.

If you do not pay in full, the Department may garnish your wages, bank account, or other funds, seize and sell personal property, issue a tax warrant to your sheriff, or record a certificate of tax liability against you. If you willfully fail to pay the tax, you may be subject to criminal charges.

You may request a payment plan (including an installment agreement) using the OPA application. Even if the IRS hasn't yet issued you a bill, you may establish a pre-assessed agreement by entering the balance you'll owe from your tax return. OPA is quick and has a lower user fee compared to other application methods.