North Carolina Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

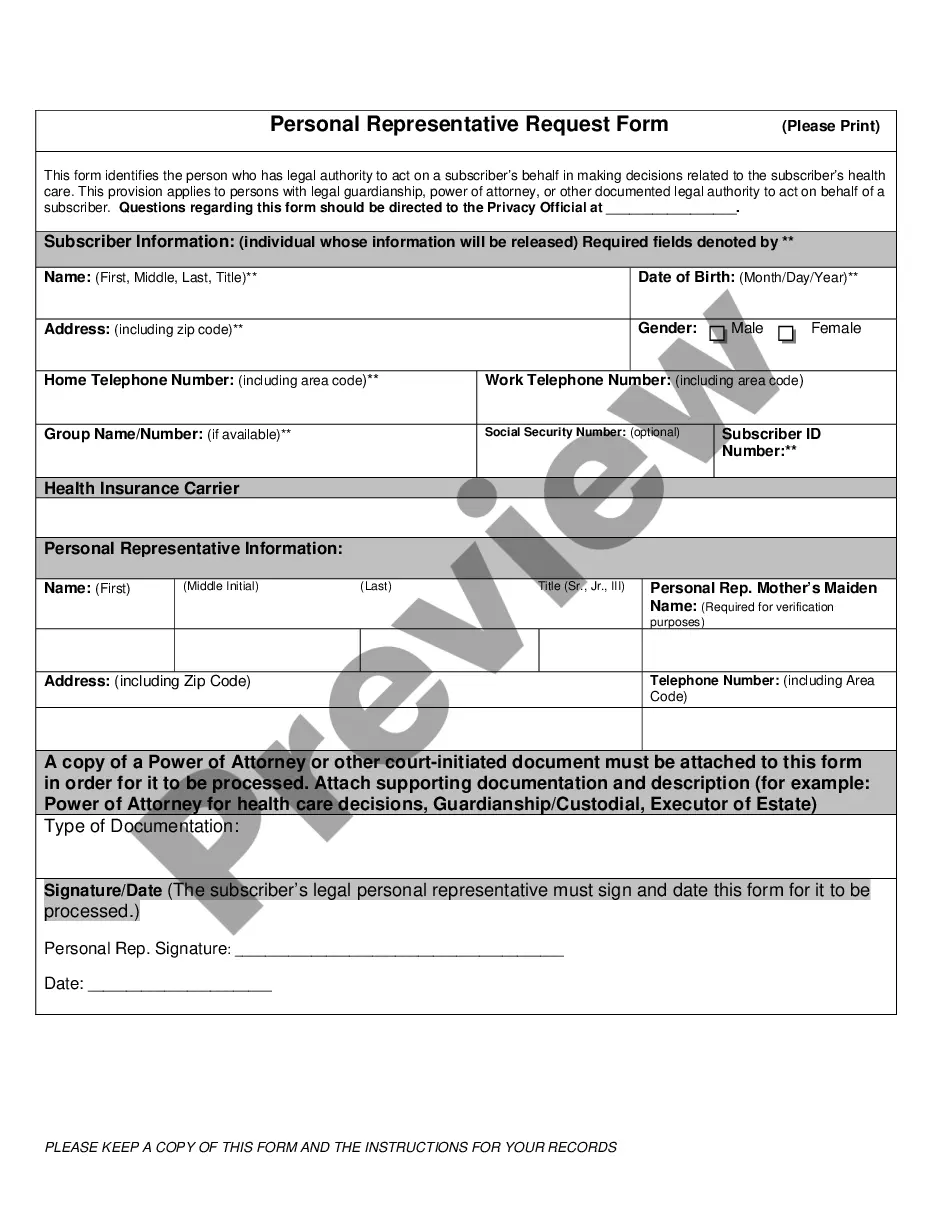

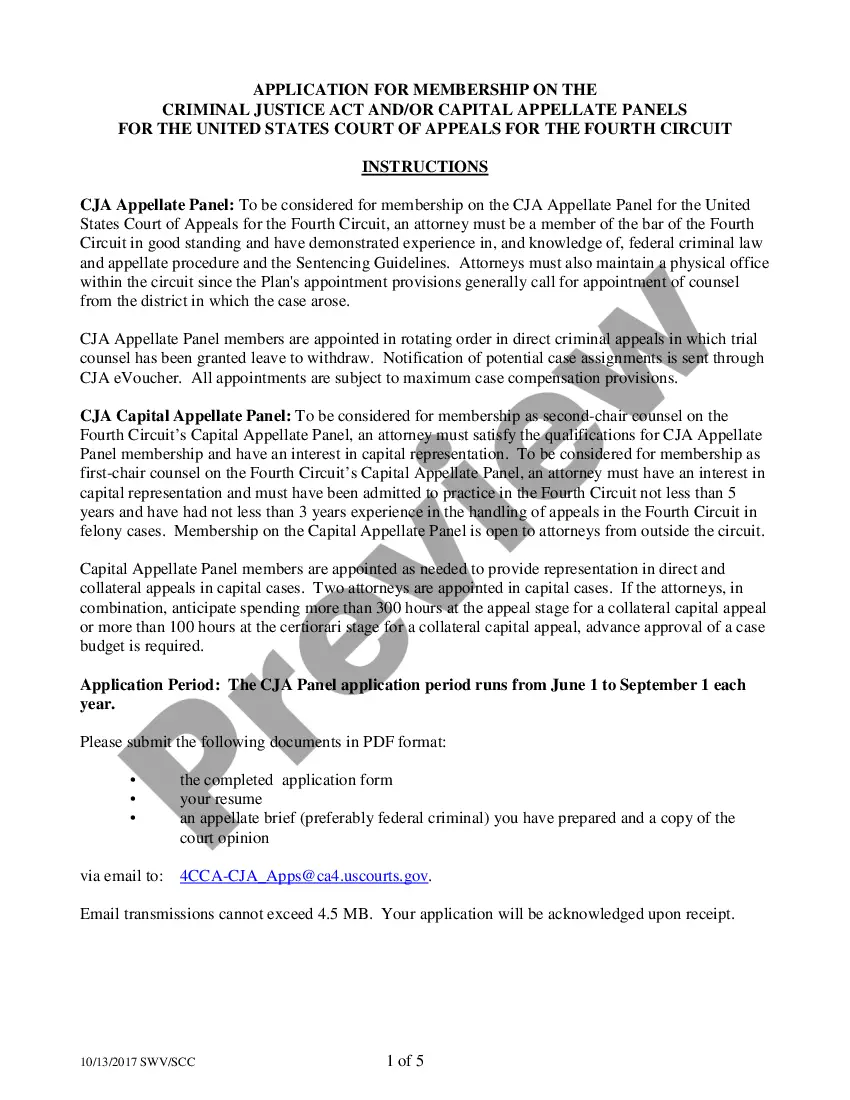

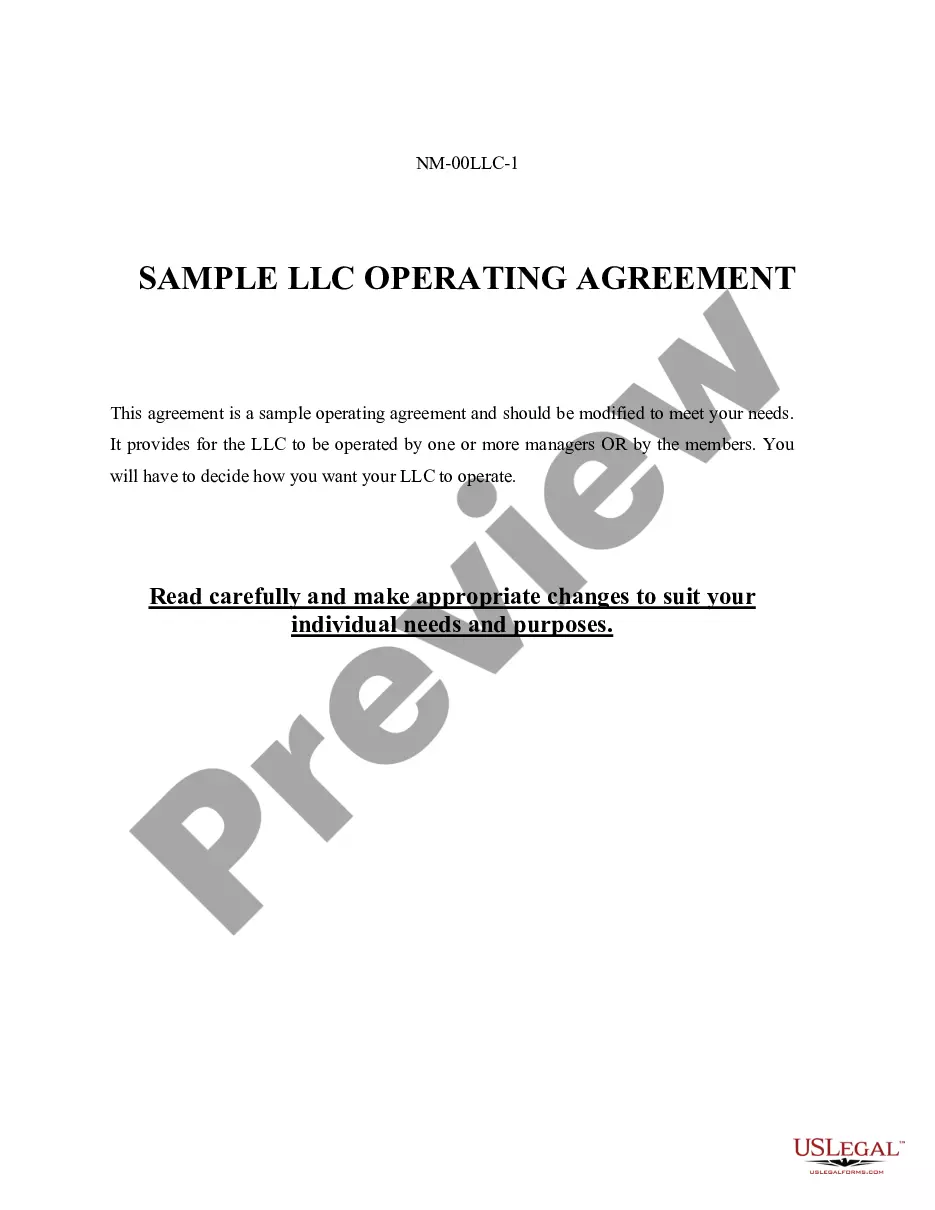

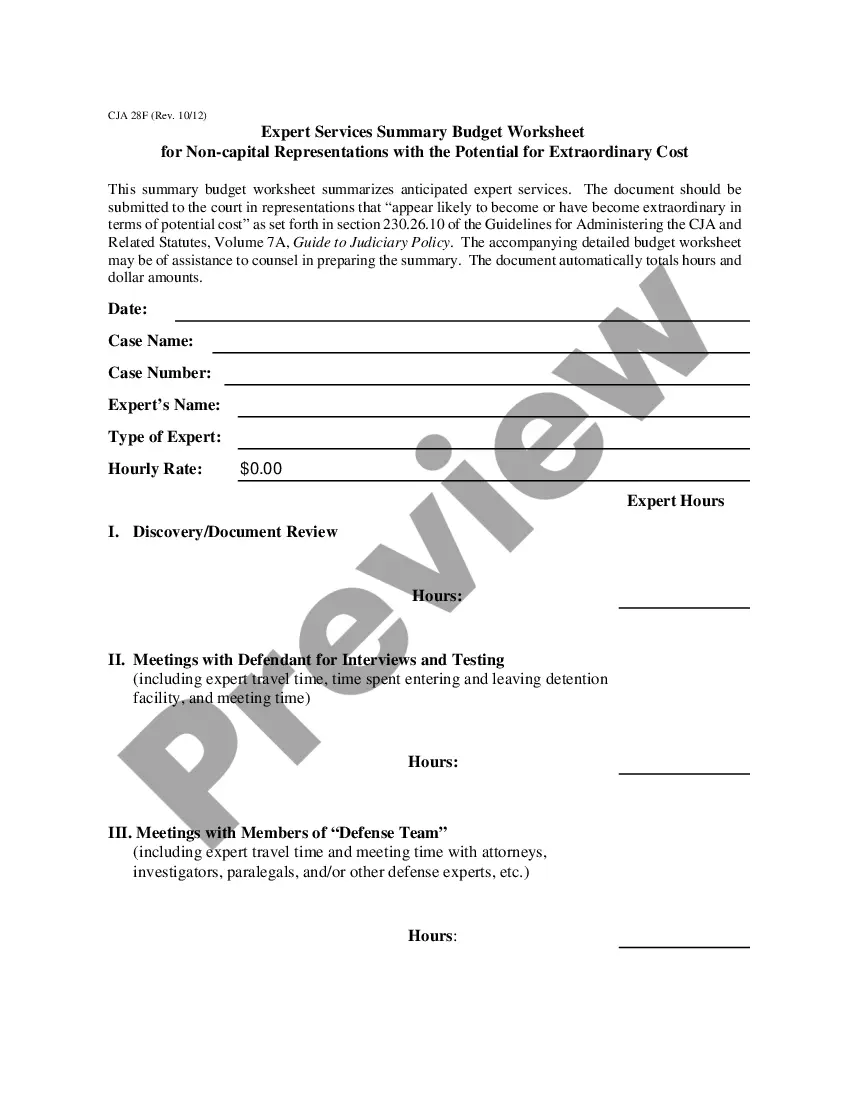

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

It is possible to commit hours on the Internet attempting to find the legitimate document web template that meets the state and federal requirements you want. US Legal Forms provides a huge number of legitimate forms which can be evaluated by specialists. You can actually acquire or printing the North Carolina Receipt and Release Personal Representative of Estate Regarding Legacy of a Will from the support.

If you currently have a US Legal Forms account, you can log in and click the Obtain key. Following that, you can full, modify, printing, or sign the North Carolina Receipt and Release Personal Representative of Estate Regarding Legacy of a Will. Every legitimate document web template you purchase is the one you have eternally. To have an additional copy of the obtained type, proceed to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms website for the first time, keep to the simple guidelines below:

- Initially, make sure that you have selected the correct document web template for your state/city of your choice. See the type description to make sure you have picked the proper type. If readily available, use the Preview key to look from the document web template at the same time.

- If you want to get an additional version of your type, use the Search field to find the web template that fits your needs and requirements.

- After you have found the web template you desire, just click Purchase now to move forward.

- Pick the costs program you desire, key in your qualifications, and register for an account on US Legal Forms.

- Total the purchase. You can utilize your credit card or PayPal account to purchase the legitimate type.

- Pick the formatting of your document and acquire it for your gadget.

- Make changes for your document if needed. It is possible to full, modify and sign and printing North Carolina Receipt and Release Personal Representative of Estate Regarding Legacy of a Will.

Obtain and printing a huge number of document web templates making use of the US Legal Forms Internet site, which offers the biggest assortment of legitimate forms. Use specialist and condition-distinct web templates to deal with your company or personal requires.

Form popularity

FAQ

An itemized list of the estate's assets. Any funds or property received by the estate during its administration. All expenses paid by the estate, including payment to the Executor, funeral expenses, taxes, debts, etc. Any distributions to beneficiaries, already made and planned.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...

How Does the Court Determine the Executor? Review the Will. First, the court will review the person's will to determine if they named anyone executor of the estate. ... Ask for Applications. First, the court will ask specific people close to the decedent to assume the executor's responsibility. ... Grant Letters of Administration.

Beneficiaries May Request an Accounting There are situations when a beneficiary will request that the executor or trustee provide an accounting. This may be a formal or informal accounting, depending on the request. Regardless, the fiduciary has a responsibility to provide an accounting when requested.

Notice to Heirs, Devisees, and Creditors: North Carolina law requires the personal representative to send a notice to all beneficiaries named in the will, to the decedent's heirs, and to the known creditors of the estate. This should happen within three months of someone being named the estate's executor.

After your death, the beneficiary has a right to collect any money remaining in your account. They need to go to the bank with proper identification. They must also bring a certified copy of the death certificate.

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements. However, the unique regulations and limitations on gaining access to bank statements may also range relying on the jurisdiction and the particular circumstances of the estate.