North Carolina Personal Representative Request Form

Description

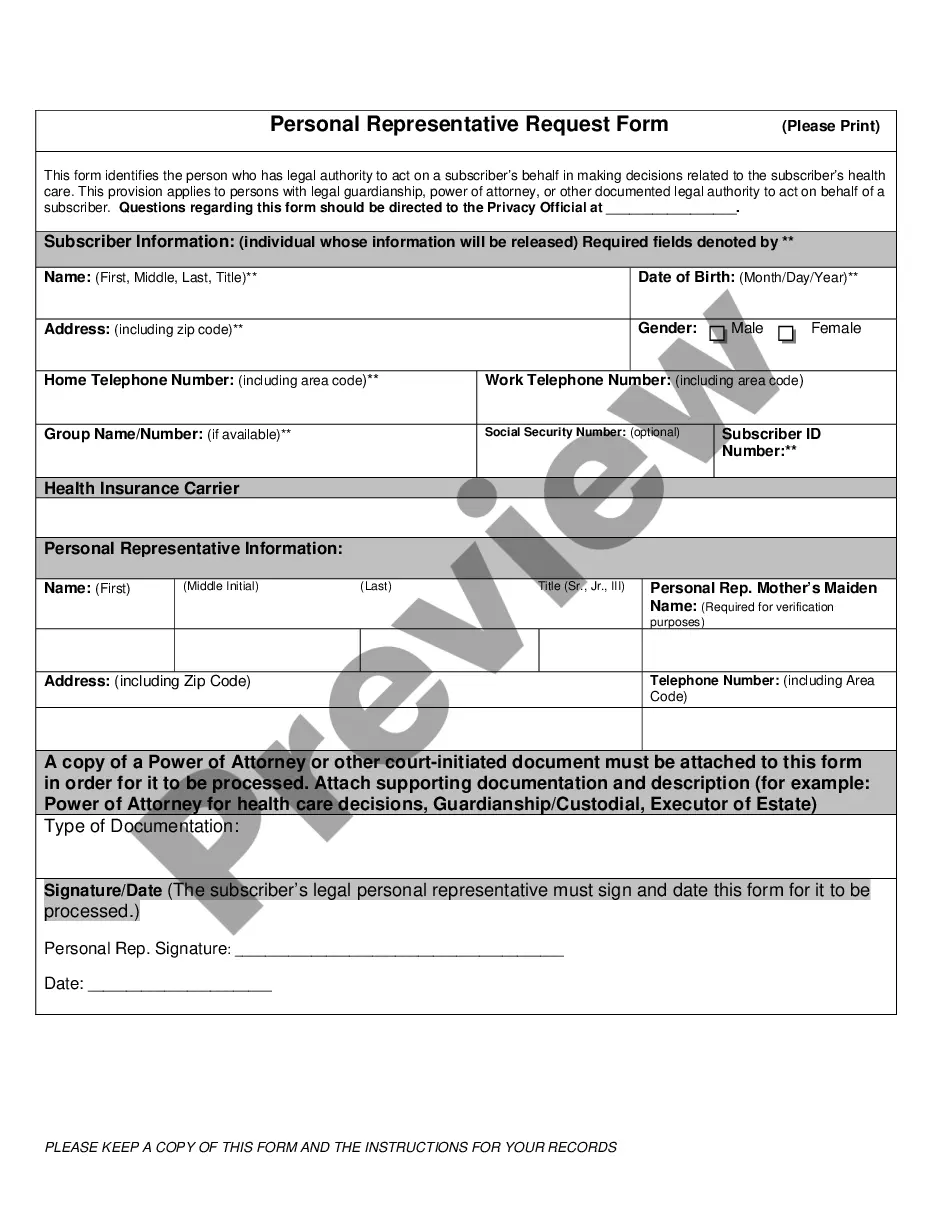

How to fill out Personal Representative Request Form?

Selecting the correct legal document format can be challenging. There are numerous templates accessible online, but how do you obtain the legal form you require.

Utilize the US Legal Forms website. This platform provides thousands of templates, including the North Carolina Personal Representative Request Form, suitable for both business and personal use. All documents are vetted by professionals and meet state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the North Carolina Personal Representative Request Form. Use your account to review the legal forms you have previously purchased. Navigate to the My documents tab of your account to obtain another copy of the document you require.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to download professionally-crafted documents that adhere to state requirements.

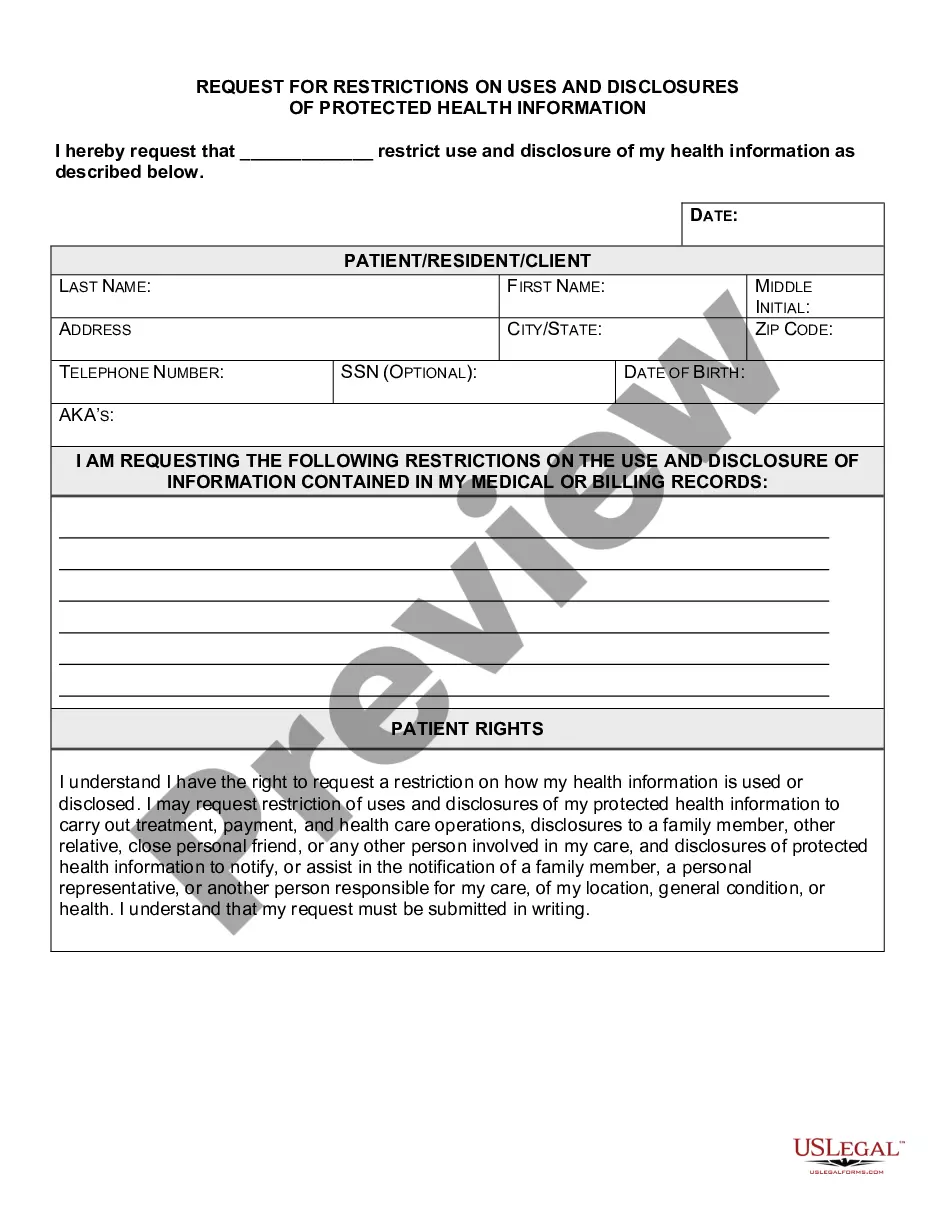

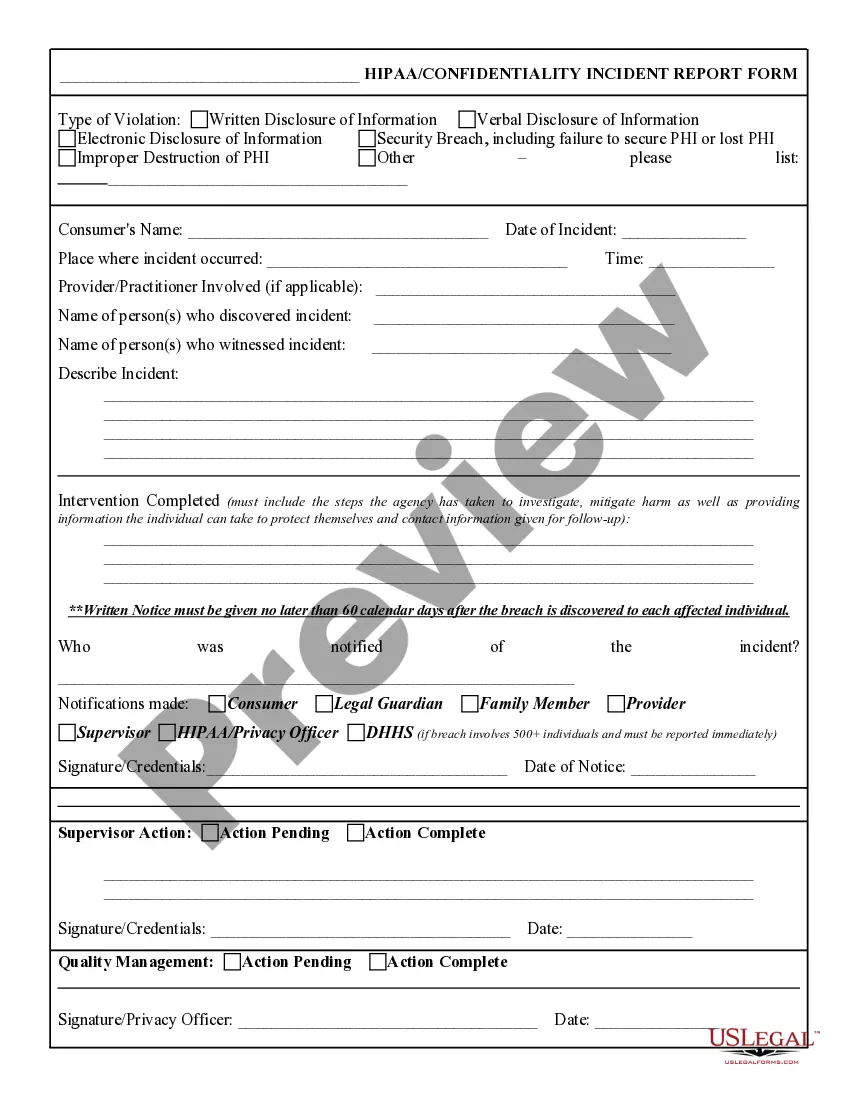

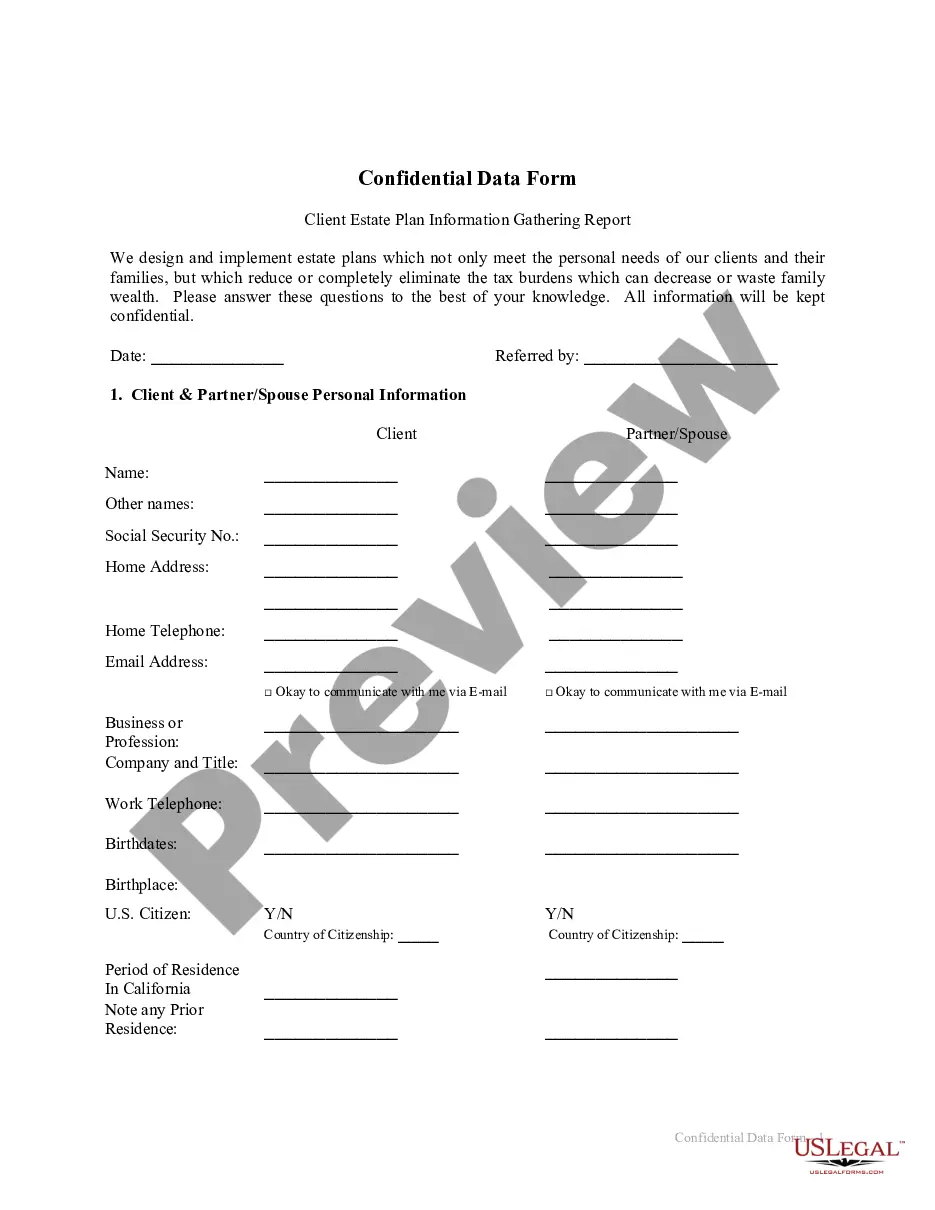

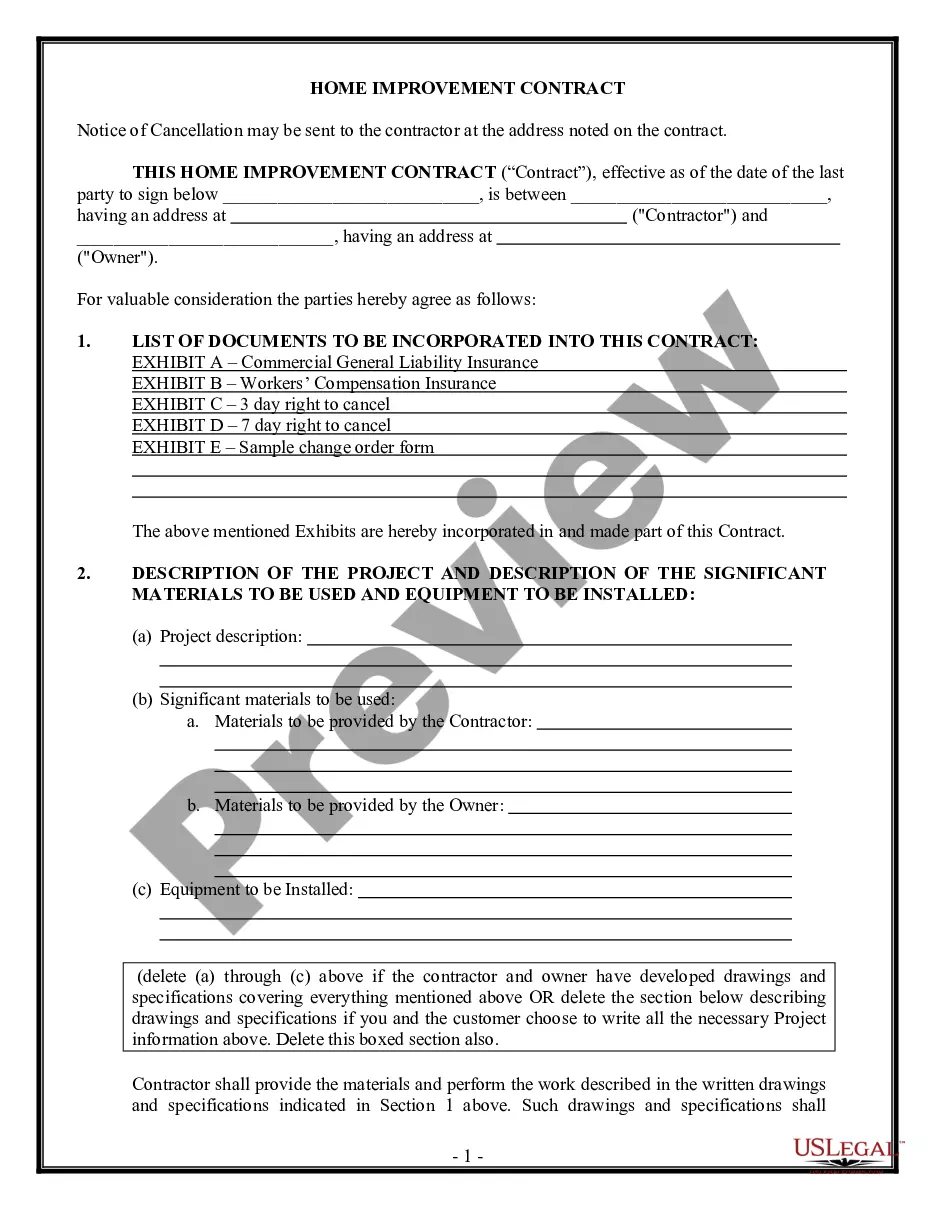

- First, ensure you have chosen the correct form for your city/region. You can review the form using the Preview button and check the form outline to verify it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to acquire the form.

- Select the payment plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document format to your device.

- Complete, modify, print, and sign the received North Carolina Personal Representative Request Form.

Form popularity

FAQ

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

On the form, you state that the value of the estate's personal property (everything but real estate) is less than $20,000 (or less than $30,000 if the surviving spouse inherits everything under state law) and that at least 30 days have passed since the person's death.

Whether a person dies with or without a will, probate is the only way to get assets out of their name to pass those assets on. In North Carolina, the probate process is managed by the Clerk of Superior Court. The process for probate in North Carolina is necessary in every situation after a person dies.

You should expect it to take a minimum of six months to a year to settle an estate because of the legal notice requirements and time that creditors have to submit claims against the estate. Creditors have 90 days from the first publication date of the notice of probate.

Probate is the only legal way to transfer the assets of someone who has died. Without probate, titled assets like homes and cars remain in the deceased's name indefinitely. You won't be able to sell them or keep registrations current because you won't have access to the individual's signature and consent.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

If the court grants the extension, the executor will be responsible for filing an annual accounting of the estate with the court at the 12-month mark. At the 12 month mark, the year extension will kick in and the executor will have another 12 months before the final accounting becomes due once again.

You can use an affidavit to claim personal property (that's anything but real estate) if the value of the deceased person's personal property, less liens and encumbrances, is $20,000 or less ($30,000, not counting spousal allowance, if the surviving spouse is the sole heir). There is a 30-day waiting period.

Will Probate Be Necessary? Probate court proceedings are required only if the deceased person owned assets in his or her name alone. Other assets can usually be transferred to their new owners without probate.

Living Trusts In North Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).