Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

North Carolina Articles of Association of Unincorporated Church Association

Description

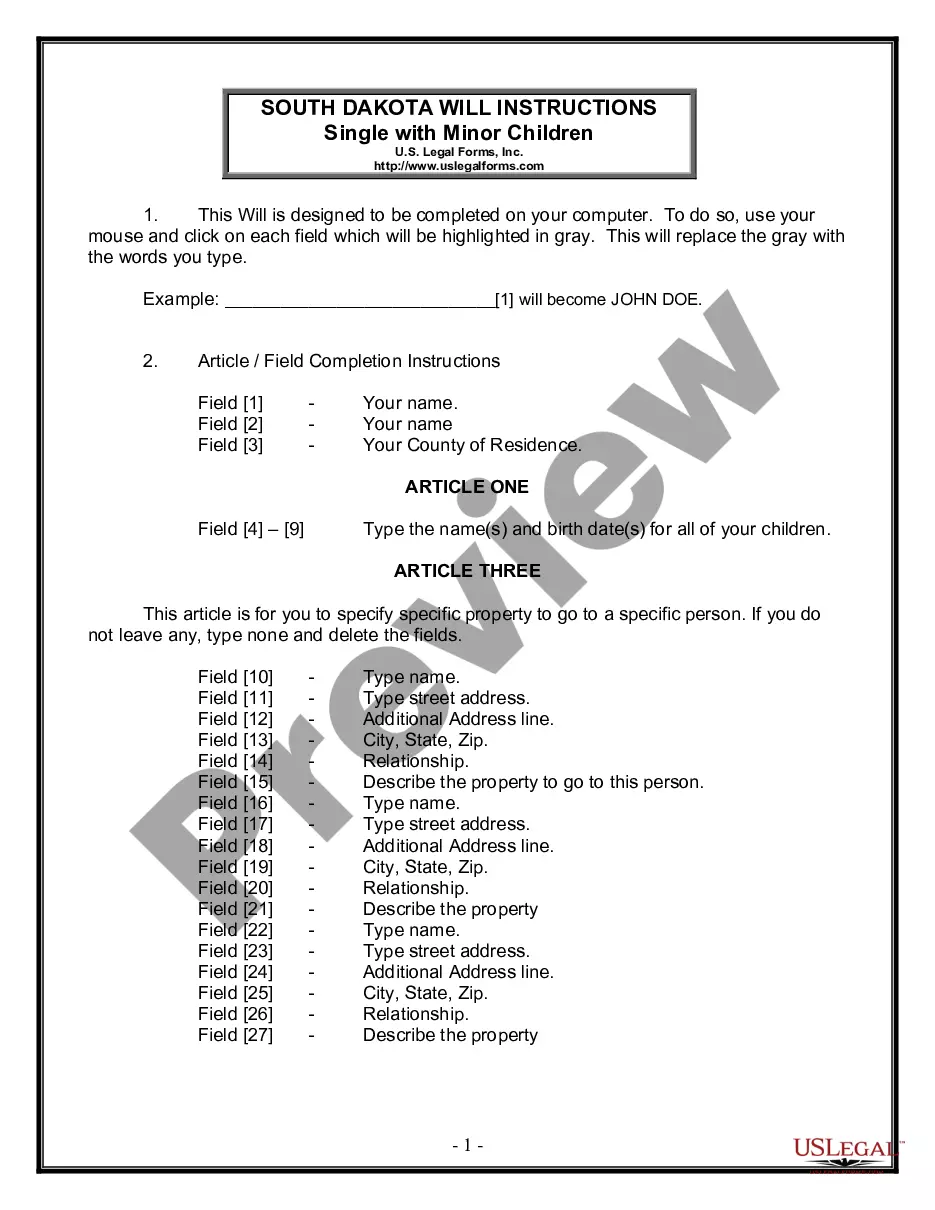

How to fill out Articles Of Association Of Unincorporated Church Association?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal template forms that you can access or print.

By utilizing the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of forms such as the North Carolina Articles of Association of Unincorporated Church Association within minutes.

If you already have a subscription, Log In and retrieve the North Carolina Articles of Association of Unincorporated Church Association from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your profile.

Complete the transaction. Utilize your credit card or PayPal account to finish the purchase.

Download the form to your device. Edit. Fill out, modify, print, and sign the downloaded North Carolina Articles of Association of Unincorporated Church Association.

Every document you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the North Carolina Articles of Association of Unincorporated Church Association with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to assist you.

- Ensure you have selected the correct form for your area/region. Click on the Preview button to check the form's content.

- Read the form description to confirm that you have chosen the right form.

- If the form does not fulfill your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, finalize your selection by clicking the Buy Now button.

- Then, choose the subscription plan you prefer and provide your information to set up an account.

Form popularity

FAQ

Establishing a nonprofit in North Carolina requires careful planning and execution. Start by defining your mission and purpose clearly. Next, file your Articles of Incorporation with the North Carolina Secretary of State and draft your bylaws. Additionally, it’s wise to consult platforms like uslegalforms to streamline the process and ensure compliance with the North Carolina Articles of Association of Unincorporated Church Association.

Yes, you can start a nonprofit organization by yourself, but involving others can provide valuable support. Many nonprofits begin with a founding member or a small group. This collective effort can enhance the organization’s credibility and effectiveness. It’s beneficial to gather like-minded individuals to discuss your goals and establish your North Carolina Articles of Association of Unincorporated Church Association.

Registering a nonprofit organization in North Carolina involves several key steps. First, you must choose a unique name and file your Articles of Incorporation with the Secretary of State. Next, you should apply for an Employer Identification Number (EIN) from the IRS. Finally, consider drafting bylaws and applying for tax-exempt status to effectively manage your North Carolina Articles of Association of Unincorporated Church Association.

To obtain a copy of the Articles of Incorporation in North Carolina, you can visit the North Carolina Secretary of State’s website. There, you can access the online database to search for the documents you need. Additionally, you may request copies through mail or in person at the office. This process is straightforward and essential when dealing with the North Carolina Articles of Association of Unincorporated Church Association.

The primary purpose of an unincorporated association is to serve a common interest or goal among its members, such as fostering community or addressing specific needs. For church groups, this can translate to spiritual engagement, mutual support, and organized activities. The North Carolina Articles of Association of Unincorporated Church Association can effectively support these objectives by outlining the association's mission and governance.

In a non-incorporated business, ownership rests with the individual or individuals who operate it. These owners are fully responsible for the business's debts and obligations. Understanding this ownership structure is vital for churches and similar organizations when utilizing the North Carolina Articles of Association of Unincorporated Church Association.

Choosing between incorporated and unincorporated status depends on the specific goals of your organization. Incorporated associations often benefit from liability protection and formal recognition, while unincorporated associations provide more flexibility with fewer administrative requirements. For many church groups, the North Carolina Articles of Association of Unincorporated Church Association may represent the right balance of formality and ease of management.

In an unincorporated association, ownership is not vested in individuals but rather in the collective group of members. This means that the members jointly oversee the association's assets and responsibilities. Operating under the North Carolina Articles of Association of Unincorporated Church Association can clarify these roles and ensure smooth governance.

Incorporated Homeowners Associations (HOAs) are formal entities with legal standing, offering liability protection to their members. Unincorporated HOAs operate on a more informal basis, guided by community agreements and the North Carolina Articles of Association of Unincorporated Church Association. The choice between the two often reflects the size, goals, and needs of the community.

Unincorporated associations typically do not fall under the same beneficial ownership requirements as corporations. This means members may not need to disclose their identities in the same way that incorporated entities do. Nonetheless, it's important to refer to state laws and guidelines related to associations in North Carolina.