North Carolina Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Revocable Trust Agreement With Corporate Trustee?

Are you currently in the situation where you require documents for potential business or personal purposes every time.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the North Carolina Revocable Trust Agreement with Corporate Trustee, which can be tailored to comply with state and federal regulations.

Once you find the correct document, click Purchase now.

Select the pricing plan you need, fill out the required information to create your account, and complete the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you've purchased in the My documents menu. You can retrieve another copy of the North Carolina Revocable Trust Agreement with Corporate Trustee at any time; just click on the required template to download or print the document template.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Revocable Trust Agreement with Corporate Trustee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct area/region.

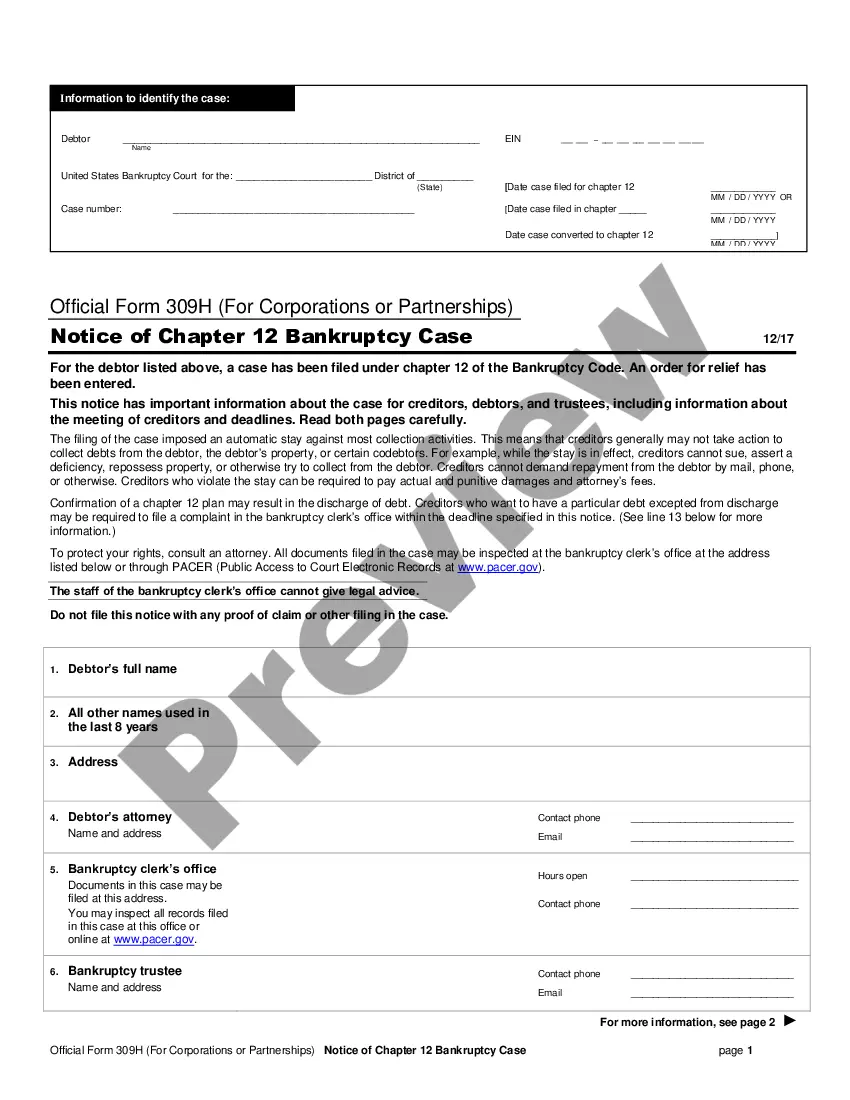

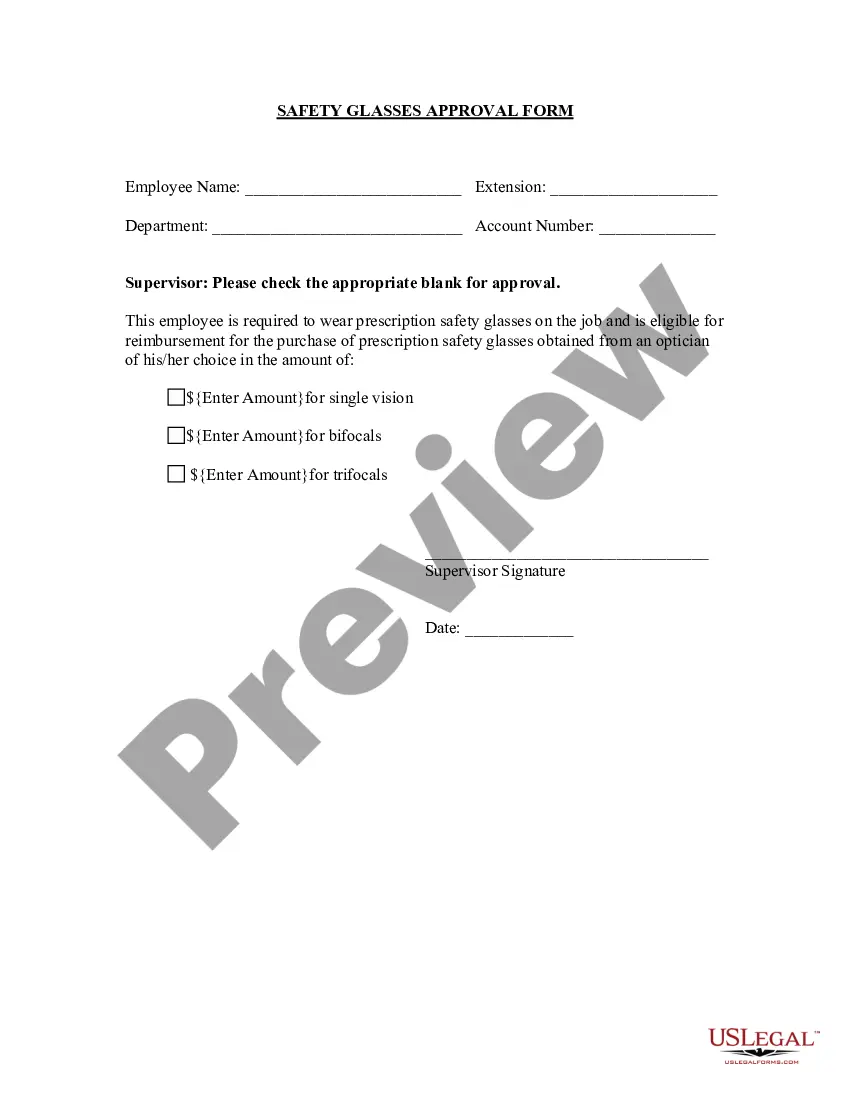

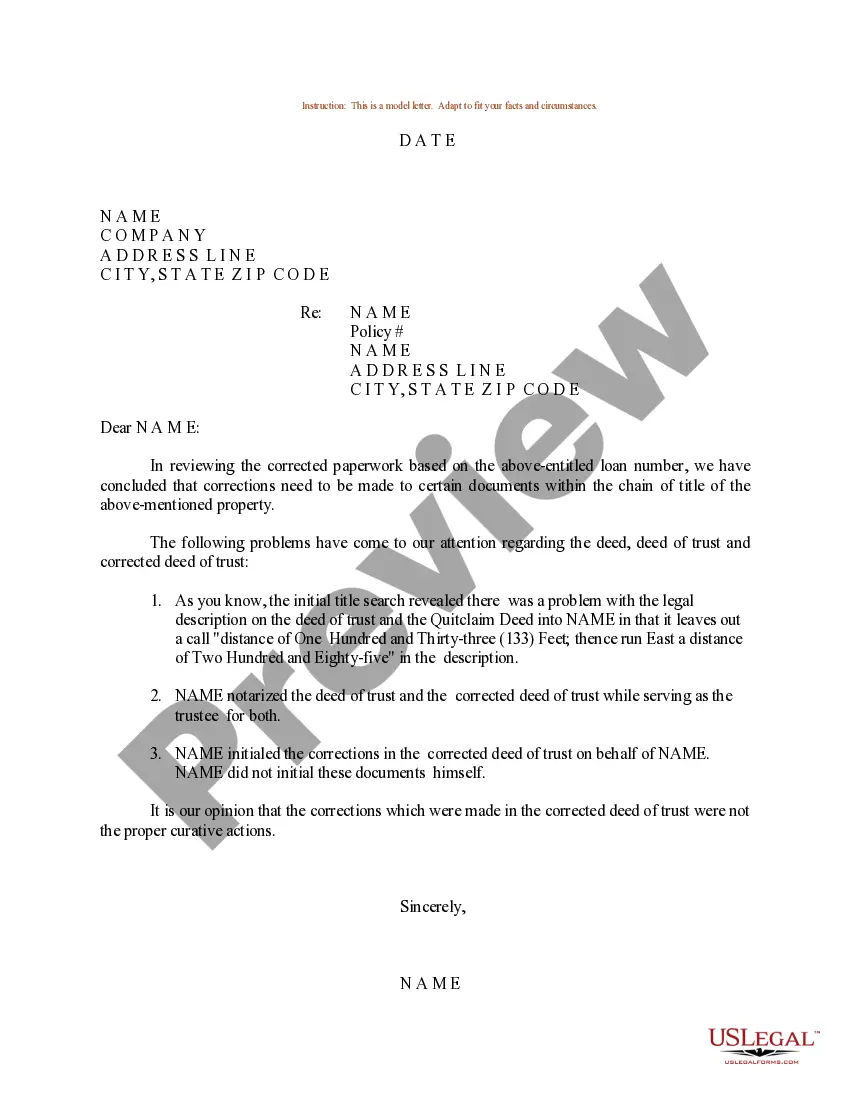

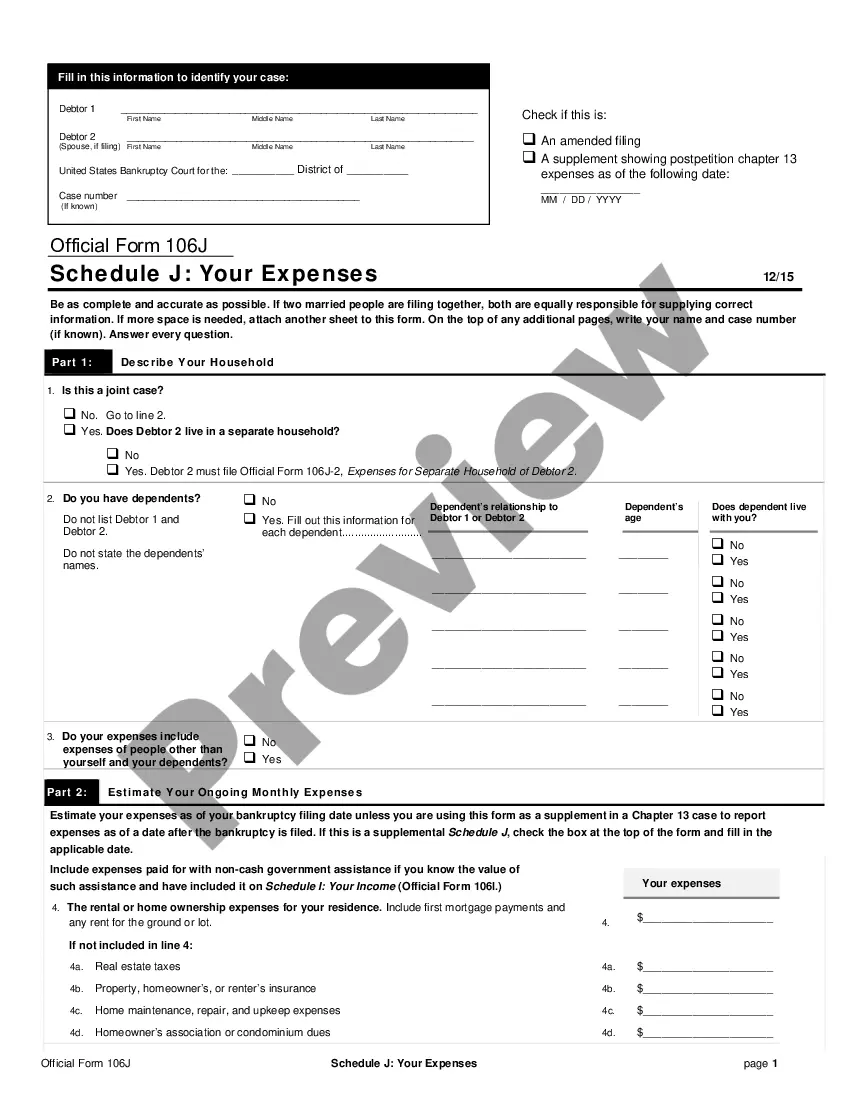

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

The short answer is yes, a trustee can also be a trust beneficiary. One of the most common types of trust is the revocable living trust, which states the person's wishes for how their assets should be distributed after they die. Many people use living trusts to guide the inheritance process and avoid probate.

When creating a living trust in North Carolina, you complete the trust document and sign it in front of notary. You then must take the final step of transferring ownership of the assets into the trust for it to be effective.

The trustee has the power to manage, control, divide, develop, improve, exchange, partition, change the character of, or abandon trust property or any interest therein. 16228.

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

To make a living trust in North Carolina, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property.

Wills must be probated and become part of the public record when they are filed with the court. However, most states, including North Carolina, afford privacy to a living trust's creator and beneficiaries by not requiring public registration of trusts.