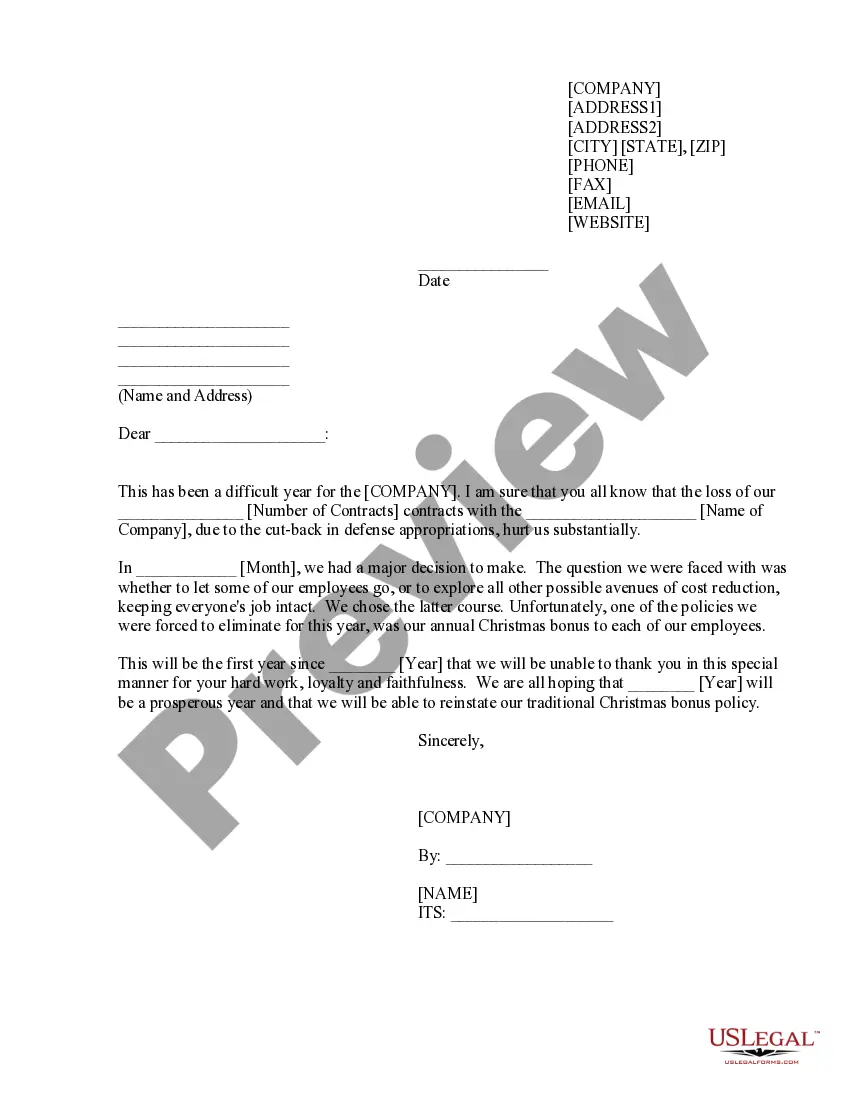

North Carolina Sample Letter for Tax Clearance Letters

Description

How to fill out Sample Letter For Tax Clearance Letters?

If you wish to full, acquire, or printing legal papers layouts, use US Legal Forms, the biggest variety of legal varieties, that can be found on-line. Make use of the site`s simple and practical search to discover the documents you want. Numerous layouts for company and person functions are sorted by types and claims, or search phrases. Use US Legal Forms to discover the North Carolina Sample Letter for Tax Clearance Letters with a couple of click throughs.

Should you be already a US Legal Forms buyer, log in for your bank account and then click the Download switch to have the North Carolina Sample Letter for Tax Clearance Letters. You can also access varieties you earlier acquired from the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape to the proper city/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Do not neglect to learn the description.

- Step 3. Should you be unhappy together with the form, use the Look for area near the top of the display to find other versions from the legal form template.

- Step 4. When you have identified the shape you want, click on the Purchase now switch. Opt for the costs strategy you choose and put your references to sign up for the bank account.

- Step 5. Method the deal. You can use your credit card or PayPal bank account to perform the deal.

- Step 6. Find the file format from the legal form and acquire it in your system.

- Step 7. Complete, edit and printing or indication the North Carolina Sample Letter for Tax Clearance Letters.

Every single legal papers template you buy is your own property permanently. You possess acces to every form you acquired within your acccount. Select the My Forms portion and pick a form to printing or acquire again.

Be competitive and acquire, and printing the North Carolina Sample Letter for Tax Clearance Letters with US Legal Forms. There are thousands of expert and express-particular varieties you may use for your company or person needs.

Form popularity

FAQ

If you do not pay in full, the Department may garnish your wages, bank account, or other funds, seize and sell personal property, issue a tax warrant to your sheriff, or record a certificate of tax liability against you. If you willfully fail to pay the tax, you may be subject to criminal charges.

Notices are sent out when the department determines taxpayers owe taxes to the State that have not been paid for a number of reasons.

A Tax Compliance Certificate is a document issued by a Secretary of State or State Department of Revenue. The Tax Compliance Certificate is evidence that a Corporation, LLC or Non Profit is in Good Standing with respect to any tax returns due and taxes payable to the state.

The North Carolina Department of Revenue is a cabinet-level executive agency charged with administering tax laws and collecting taxes on behalf of the people of the State. The Secretary of Revenue is appointed by the Governor.

A clearance certificate certifies that all amounts for which the taxpayer is, or can reasonably be expected to become, liable under the Act at or before the time of distribution have been paid, or that the Minister of National Revenue has accepted security for payment.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.