North Carolina Sample Letter for Tax Deeds

Description

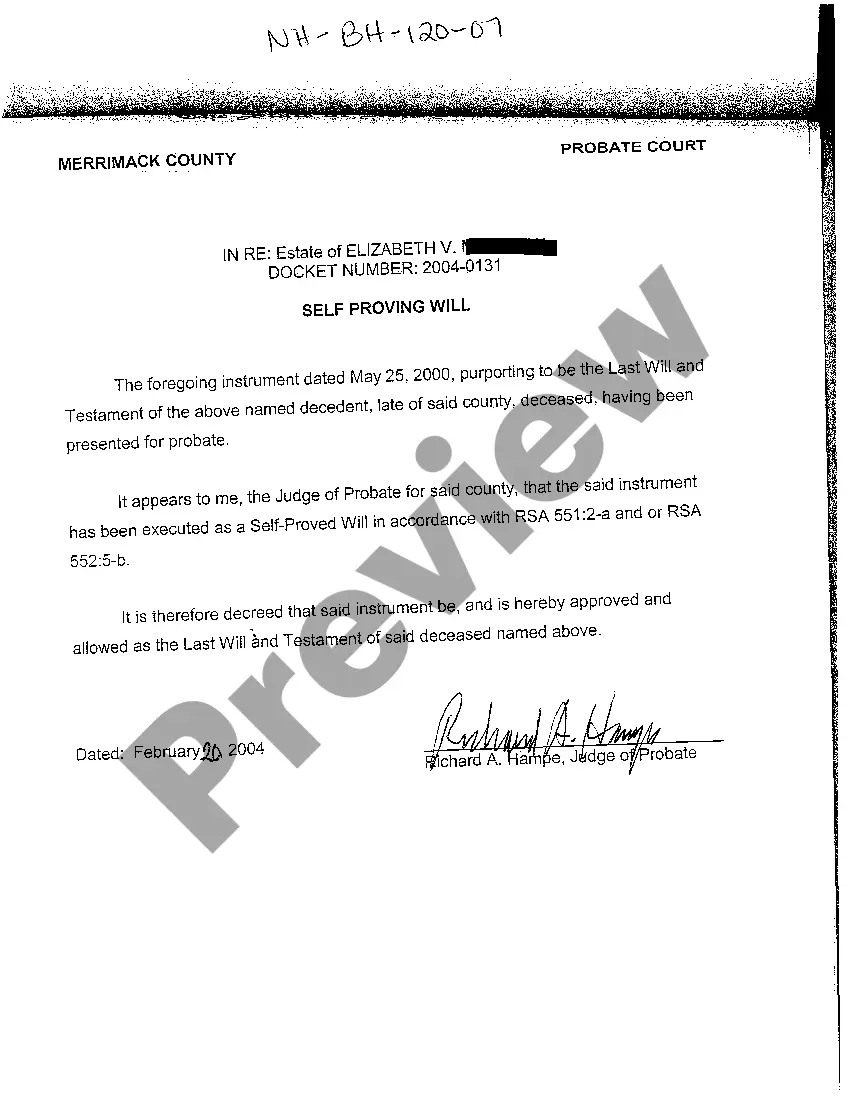

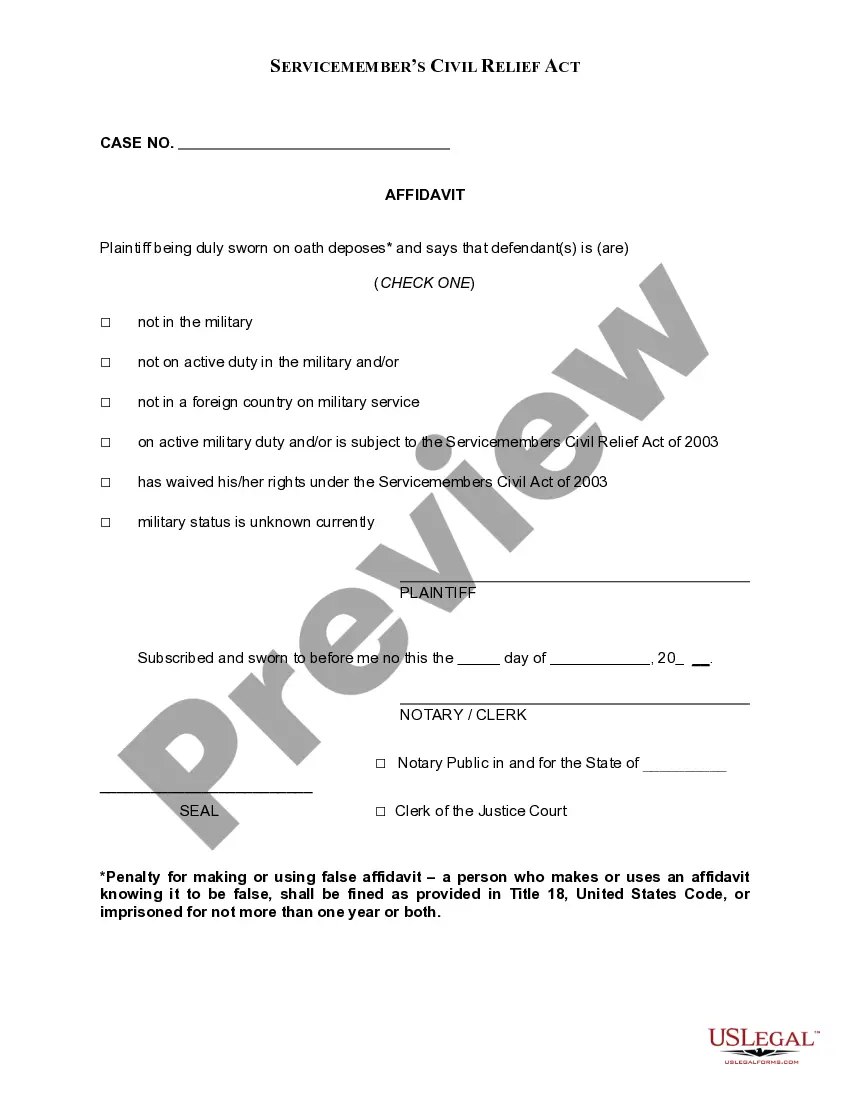

How to fill out Sample Letter For Tax Deeds?

If you wish to sum up, download, or print sanctioned document templates, utilize US Legal Forms, the largest compilation of sanctioned forms available online. Employ the site's straightforward and user-friendly search feature to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the North Carolina Sample Letter for Tax Deeds with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the North Carolina Sample Letter for Tax Deeds. You can also access forms you have previously downloaded from the My documents tab in your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have chosen the form for the correct city/state. Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description. Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other forms in the legal document format. Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your details to register for the account. Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the North Carolina Sample Letter for Tax Deeds.

- Every legal document format you purchase is yours permanently.

- You will have access to all forms you downloaded within your account.

- Visit the My documents section and select a form to print or download again.

- Compete and download, and print the North Carolina Sample Letter for Tax Deeds with US Legal Forms.

- There are various professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Is South Carolina a Tax Deed or Tax Lien State? South Carolina is a Tax Deed State.

How long do I have until my delinquent taxes become subject to foreclosure? In North Carolina, real property taxes become due on September 1 of each year, and become delinquent if not paid before January 6 of the following year. Any taxes which become delinquent are subject to potential tax foreclosure.

No. Paying someone else's taxes will not entitle you to any legal ownership to the property.

3. Can you pay someone's delinquent taxes and become the owner of the property? No. Paying someone else's taxes will not entitle you to any legal ownership to the property.

Tax Deed states auction off the real estate when property owners become delinquent. A Tax Lien state sells tax certificates to investors when homeowners become delinquent. Once the homeowner pays the taxes the investor is paid off their investment plus interest. Florida is a Tax Deed and a Tax Lien state.

The 1st option is the garnishment of wages, rents and / or other money due you and the attachment of bank accounts. Also, the seizure / levy of vehicle, your account turned over to the Sheriff and the credit agency. Finally foreclosure of your property.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

We hope you enjoyed Ted's lesson, ?Is North Carolina a Tax Lien or Tax Deed State?? North Carolina is a tax deed state. The state confiscates property for unpaid property taxes and sells it to the highest bidder at a tax defaulted auction.