North Carolina Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

If you wish to finalize, acquire, or print official document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Take advantage of the website's straightforward and convenient search functionality to locate the documents you require.

Various templates for business and personal applications are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to discover the North Carolina Sample Letter for New Business with Credit Application within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Acquire option to obtain the North Carolina Sample Letter for New Business with Credit Application.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

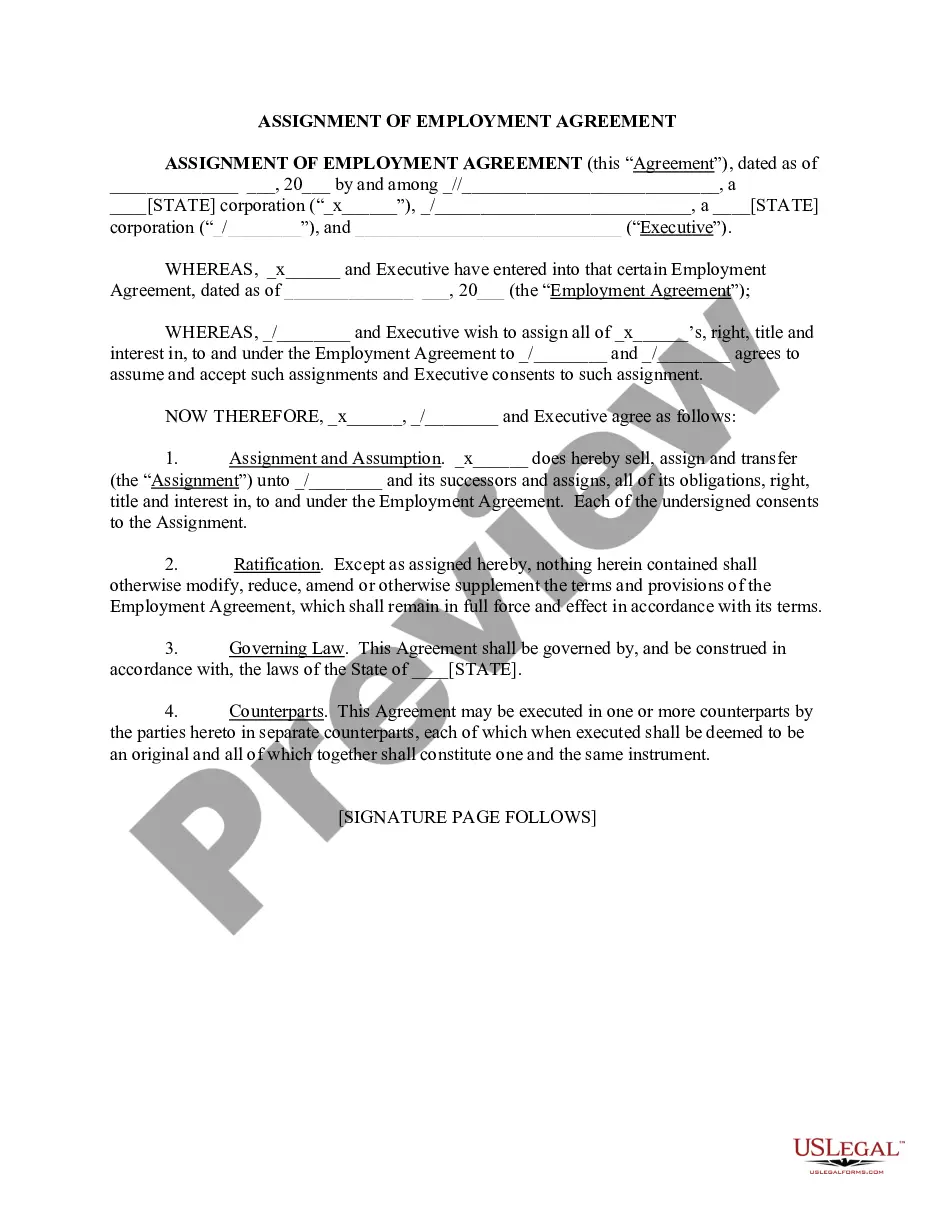

- Step 2. Use the Preview option to review the form's content. Be sure to carefully read the information.

- Step 3. If you are not satisfied with the template, utilize the Search field at the top of the screen to find alternative types of your legal document template.

Form popularity

FAQ

To write a credit application letter, begin by addressing the business to whom you are applying. Include necessary details such as your company's name, contact information, and the purpose of the letter. Clearly outline your request for credit, mentioning specific terms, and attach any relevant documents. For a structured approach, consider using a North Carolina Sample Letter for New Business with Credit Application as a template to guide you.

Businesses involved in international trade, manufacturing, and large-scale sales commonly use letters of credit to manage payment risks. These documents help ensure that sellers receive payment while protecting buyers from non-delivery of goods. For firms in North Carolina, utilizing a sample letter for new business with credit application can streamline their credit transactions and enhance business relationships.

Creating a business credit application form involves including essential fields such as business name, address, and financial history. You should also consider asking for trade references and banking information to evaluate credit risk. A North Carolina sample letter for new business with credit application can provide you with a solid template to start building your own form.

A credit application for a business is a form that potential customers fill out to request credit terms from a company. This document collects important financial information, allowing businesses to assess creditworthiness. Utilizing a North Carolina sample letter for new business with credit application can make the application process clearer and more efficient.

A letter of credit is a financial document issued by a bank on behalf of a buyer, assuring the seller that payment will be received. It serves as a guarantee for the seller, which reduces risk in transactions. In North Carolina, a sample letter for new business with credit application can help smooth the process between buyers and sellers.

Writing a credit letter involves clearly stating your request, providing relevant business details, and outlining your terms. You should ensure to maintain a professional tone and structure throughout the letter. A North Carolina Sample Letter for New Business with Credit Application can greatly assist you in this task, ensuring you include all essential elements.

LC, or letter of credit, is a document issued by a bank guaranteeing payment to a seller upon meeting specified conditions. For example, an LC may be issued to ensure a supplier receives payment once the goods have been shipped and relevant documents provided. Using a North Carolina Sample Letter for New Business with Credit Application can guide you in effectively requesting an LC.

A letter of credit for a new business serves as a guarantee from a bank that payment will be made to a seller once conditions are met. It helps mitigate risks associated with transactions, especially for new ventures that might not yet have established creditworthiness. A North Carolina Sample Letter for New Business with Credit Application is an essential tool to help you draft a professional request.

The steps involved in a letter of credit include applying for the letter, receiving confirmation from the financial institution, and presenting necessary documents to access the funds. Each step requires careful attention to detail to ensure compliance with the terms agreed upon. Utilizing a North Carolina Sample Letter for New Business with Credit Application can make this process smoother and clearer.

Writing a letter generally involves several steps, including choosing the correct format and beginning with your contact information and the date. Next, include the recipient's contact information, a subject line, and a formal greeting. Using a North Carolina Sample Letter for New Business with Credit Application can guide you in structuring your letter correctly and ensuring all necessary details are included.