This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

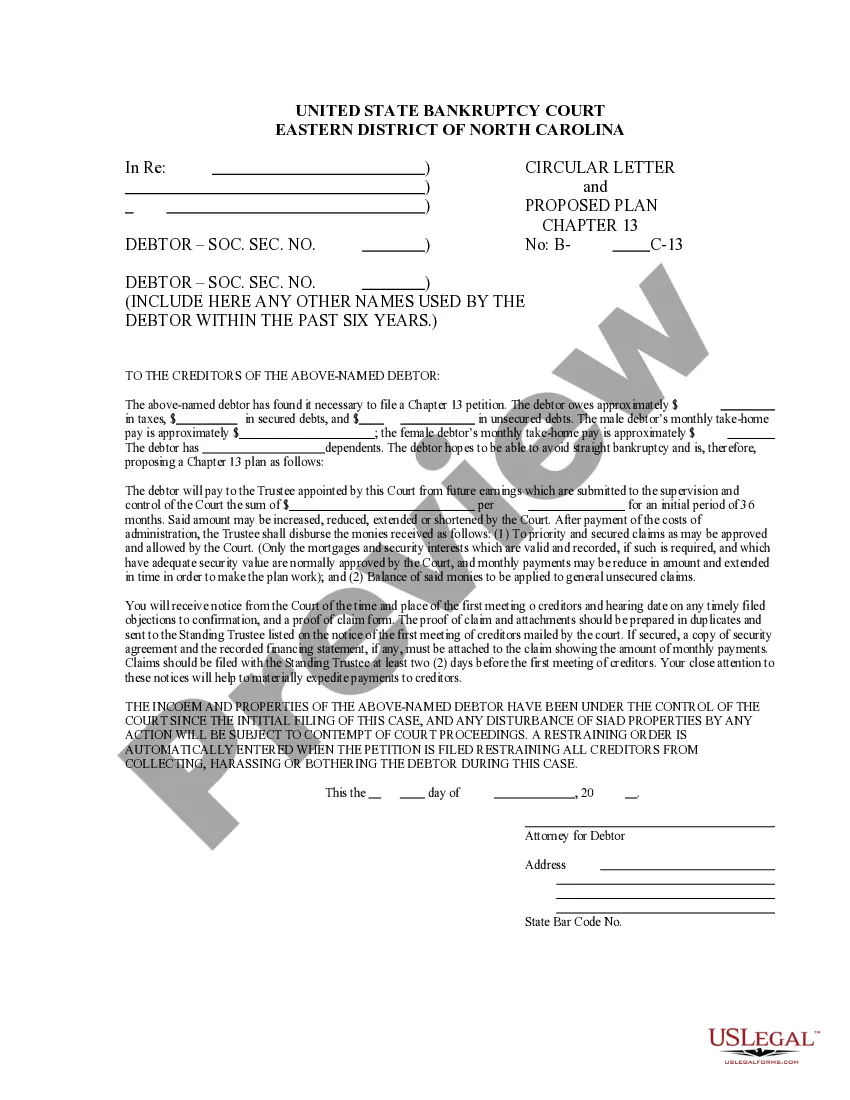

North Carolina Agreement to Extend Debt Payment Terms

Description

How to fill out Agreement To Extend Debt Payment Terms?

It is feasible to spend hours online searching for the sanctioned file format that complies with the state and federal requirements you will need.

US Legal Forms offers thousands of sanctioned templates which can be assessed by experts.

You can indeed download or print the North Carolina Agreement to Extend Debt Payment Terms from your service.

If available, use the Review button to browse through the file format as well. If you wish to obtain another version of the form, utilize the Search field to find the format that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the North Carolina Agreement to Extend Debt Payment Terms.

- Every sanctioned file format you purchase is yours indefinitely.

- To obtain another copy of any acquired type, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct file format for the county/city of your choice.

- Review the type information to confirm you have selected the proper type.

Form popularity

FAQ

The NC file extension often refers to certain forms related to debts or other legal filings within the state. Specifically, the North Carolina Agreement to Extend Debt Payment Terms may include relevant forms requiring proper submission. Knowing how to navigate these forms is crucial for successfully managing your debts. Using resources from uslegalforms can provide the clarity needed for these filings.

Yes, tax deadlines in North Carolina can be extended under certain conditions, especially during unprecedented events. To find the most current information, reviewing the North Carolina Agreement to Extend Debt Payment Terms is wise. Making sure you are up-to-date can help you navigate your financial obligations smoothly. Our resources can assist you in understanding any changes effectively.

The extension under the North Carolina Agreement to Extend Debt Payment Terms is not automatically granted to everyone. Rather, qualifications must be met based on your financial situation. It’s essential to review the guidelines thoroughly to determine if you can receive an automatic extension. Utilizing resources available through platforms like uslegalforms can simplify this process.

Filing for an extension in North Carolina depends on your specific circumstances and the type of debt involved. The North Carolina Agreement to Extend Debt Payment Terms can provide relief without the need for extensive filing, but you should ensure that you meet the requirements. Understanding these terms can save you time and help you manage your debts effectively. You may want to consult a tax professional for personalized advice.

In North Carolina, the automatic extension of debt payment terms generally applies under specific circumstances. You need to check if your situation qualifies for the North Carolina Agreement to Extend Debt Payment Terms. This agreement allows for extended payment deadlines without the need for additional paperwork in certain cases. Therefore, it is vital to understand the rules and terms governing these extensions.

Yes, NC State does offer payment plans for various obligations, including state taxes. By entering into a North Carolina Agreement to Extend Debt Payment Terms, you can organize your payment schedule comfortably. This arrangement helps you avoid penalties and stay compliant with state requirements. Always check with the state directly to see what options are available for your specific situation.

Yes, you can set up a payment plan for North Carolina state taxes. This can often be achieved through a North Carolina Agreement to Extend Debt Payment Terms, which allows you to manage your tax liability over time. It is important to contact the North Carolina Department of Revenue to understand the specific terms and eligibility requirements. Utilizing this agreement can help alleviate immediate financial pressure.

If you never received your NC tax refund, first check your status online with the North Carolina Department of Revenue. They have resources to help track your refund. If financial difficulties arise and you owe taxes, consider a North Carolina Agreement to Extend Debt Payment Terms to ease your situation while resolving your refund concerns.

In North Carolina, the statute of limitations for tax returns is generally three years from the due date of the return. This means you need to file your returns within this time frame to avoid penalties and interest. Knowing this timeframe can help you strategically plan your tax filings, especially if you consider a North Carolina Agreement to Extend Debt Payment Terms.

To set up a payment plan for NC state taxes, you can contact the North Carolina Department of Revenue directly or use their online services. They will help you outline your payment terms based on your income and tax liability. If you anticipate difficulties in managing these payments, consider a North Carolina Agreement to Extend Debt Payment Terms as a strategic solution.