North Carolina Equity Share Agreement

Description

How to fill out Equity Share Agreement?

It is feasible to dedicate time online searching for the valid file format that complies with the federal and state regulations you require.

US Legal Forms offers an extensive selection of valid forms that are evaluated by professionals.

You can easily obtain or print the North Carolina Equity Share Agreement from our platform.

If you want to find another version of the form, make use of the Search field to locate the format that suits your needs and requirements. Once you have found the format you need, click Get now to proceed. Select the pricing plan you desire, enter your information, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the valid form. Choose the file format and download it to your device. Make adjustments to your file if necessary. You can complete, edit, sign, and print the North Carolina Equity Share Agreement. Download and print a vast array of file templates using the US Legal Forms website, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have an account with US Legal Forms, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the North Carolina Equity Share Agreement.

- Each valid file format you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct file format for the location/city of your choice. Check the form description to confirm you have chosen the right form.

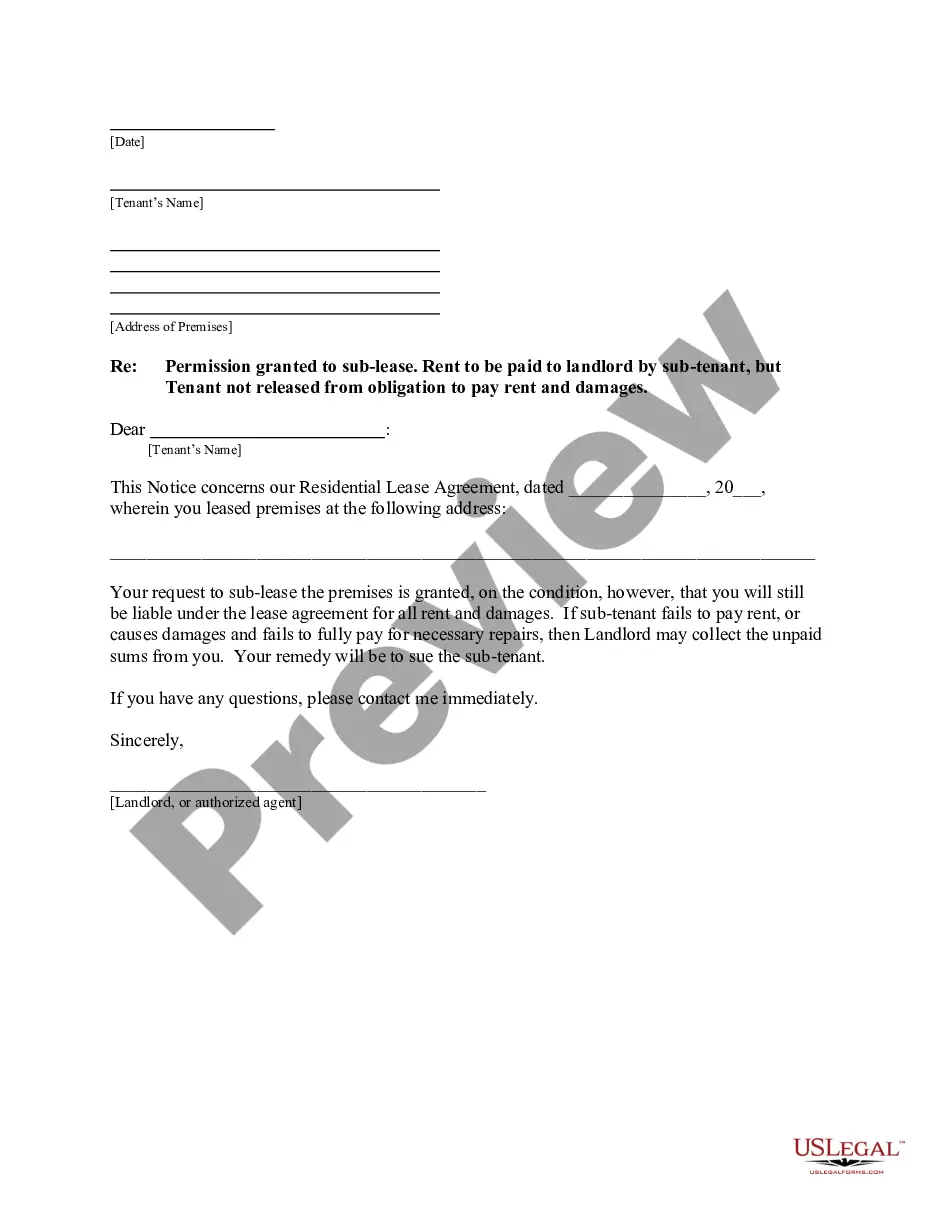

- If available, utilize the Preview button to view the file format as well.

Form popularity

FAQ

While a North Carolina Equity Share Agreement offers many advantages, it also comes with potential downsides. Homeowners must share future appreciation with investors, which might mean giving up a significant portion of your home's value. Additionally, the terms of the agreement can be complex, and it's crucial to thoroughly understand your obligations and rights. Utilizing platforms like US Legal Forms can provide you with the necessary resources and documents to navigate these agreements effectively.

Choosing the best lender for a home equity agreement involves comparing options based on interest rates, fees, and customer service. Look for lenders that specialize in North Carolina Equity Share Agreements, as they may offer tailored solutions for local homeowners. Online platforms like uslegalforms can assist you in finding reputable lenders and understanding your financing options. Always read reviews and ask for recommendations to make an informed decision.

To secure a home equity agreement, start by assessing your home's current value and determining how much equity you possess. Next, research lenders who offer North Carolina Equity Share Agreements, as not all institutions provide the same options. After selecting a lender, you can begin the application process, often involving a professional appraisal of your home. Platforms like uslegalforms can help you find the right documentation and support along the way.

One of the drawbacks of a Home Equity Agreement is that it reduces your future profits from selling your home. By entering a North Carolina Equity Share Agreement, you share potential appreciation with investors, which could lessen your returns. Additionally, homeowners must consider the terms of the agreement carefully. Make sure to fully understand the consequences before committing to this financial choice.

The percentage taken in a North Carolina Equity Share Agreement can vary depending on the terms negotiated between you and the investor. Typically, the investor may seek a share of appreciation or an agreed percentage of the home’s equity, which can range from 10% to 50%. It’s essential to discuss these percentages openly and ensure they align with your long-term goals.

While a North Carolina Equity Share Agreement has its benefits, there are also potential drawbacks to consider. The main concern is that sharing equity means sharing profits, which can reduce your financial gain if the property appreciates significantly. Additionally, having a partner in ownership complicates decision-making and may lead to conflicts over property management.

Writing a North Carolina Equity Share Agreement involves several key components. First, clearly outline the investment contributions from each party, specifying the ownership percentage. Next, detail how future profits or losses are shared and establish terms regarding the sale or buyout process to ensure clarity and avoid disputes down the line.

A North Carolina Equity Share Agreement can be a beneficial solution for many homeowners. It allows individuals to access funds by sharing ownership with investors, which helps lower the burden of upfront costs. Moreover, it can foster a collaborative approach to homeownership, but it's essential to assess your personal financial situation before proceeding.