North Carolina Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

You can spend hours on the Internet looking for the authorized papers design that meets the federal and state demands you want. US Legal Forms gives a large number of authorized varieties that are analyzed by pros. It is possible to download or produce the North Carolina Line of Credit Promissory Note from the support.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Download switch. Afterward, it is possible to comprehensive, revise, produce, or indication the North Carolina Line of Credit Promissory Note. Each authorized papers design you purchase is your own forever. To acquire another copy of any obtained kind, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms website the very first time, keep to the straightforward recommendations below:

- Initially, be sure that you have chosen the right papers design for the county/metropolis that you pick. Read the kind outline to make sure you have picked out the appropriate kind. If available, utilize the Preview switch to check with the papers design also.

- If you would like locate another model from the kind, utilize the Look for discipline to find the design that suits you and demands.

- Once you have located the design you need, simply click Purchase now to move forward.

- Find the costs prepare you need, enter your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal bank account to fund the authorized kind.

- Find the structure from the papers and download it for your device.

- Make alterations for your papers if necessary. You can comprehensive, revise and indication and produce North Carolina Line of Credit Promissory Note.

Download and produce a large number of papers themes using the US Legal Forms web site, which provides the most important selection of authorized varieties. Use expert and condition-particular themes to deal with your business or personal requires.

Form popularity

FAQ

Statute of Limitations in North Carolina In North Carolina, the statute of limitations for debt is three years from the last activity on your account. That is how much time a debt collector has to file a lawsuit to recover the debt through the court system,. It's one of the shortest such limits in the country.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Promissory notes have a statute of limitations. Depending on which U.S. state you live in, a written loan agreement may expire 3?15 years after creation.

§ 1-47(2) sealed instruments are governed by a ten-year statute of limitations. Thus, since the note in Pedlow was signed under seal, and no payments were made, the court concluded that the statute of limitations would run ten years from the date of the debtor's signature.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

3 Year Statute of Limitations on Most Debts in North Carolina. In North Carolina, Section 1-52.1 of the North Carolina Rules of Civil Procedure explains the statute of limitations for debts is 3 years for auto and installment loans, promissory notes, and credit cards.

Depending on which state you live in, the statute of limitations with regard to promissory notes can vary from three to 15 years. Once the statute of limitations has ended, a creditor can no longer file a lawsuit related to the unpaid promissory note.

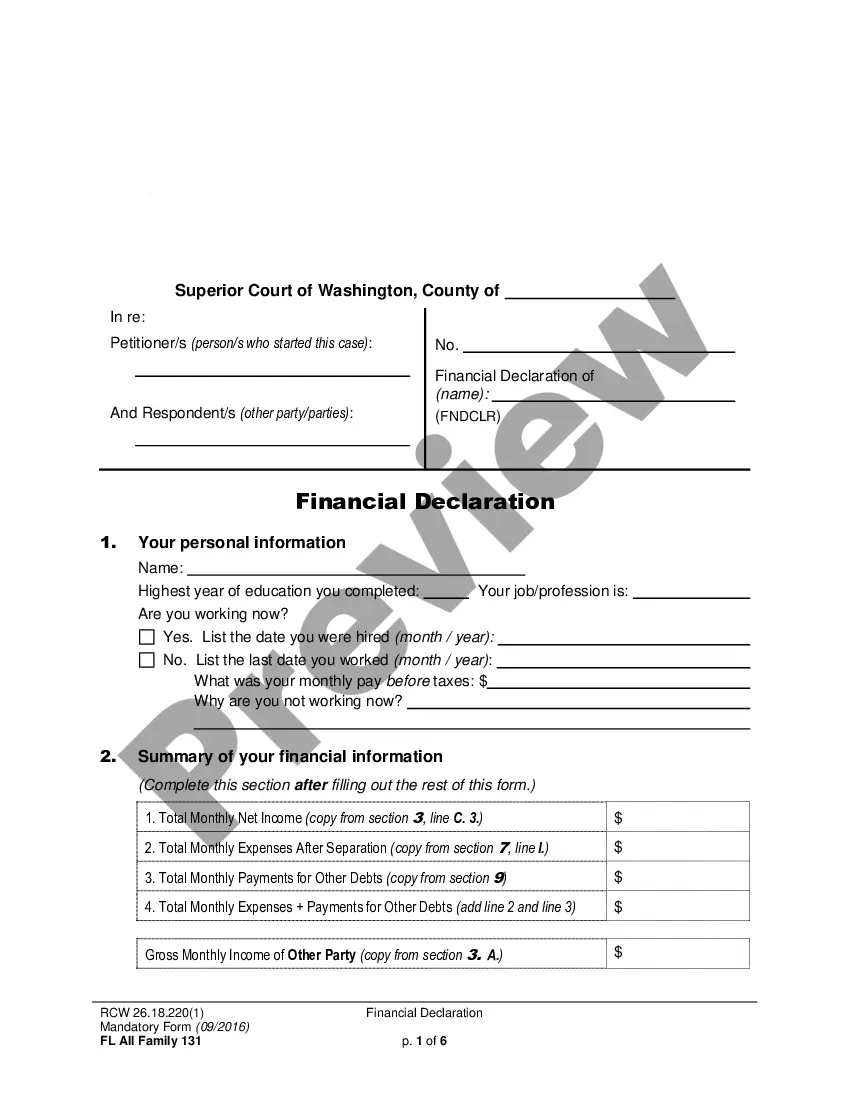

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

You don't need a witness to sign a North Carolina promissory note. Obtaining a witness or signature from a notary public, for example, would strengthen the note's validity if you were to use this document in court.