North Carolina Financing Statement

Description

How to fill out Financing Statement?

Are you presently in a situation where you need documents for various company or personal activities almost all the time.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, like the North Carolina Financing Statement, which are designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Select the payment plan you want, enter the required information to set up your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Carolina Financing Statement template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your specific area/state.

- Use the Review button to view the form.

- Check the description to ensure you have selected the correct document.

- If the document isn't what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Clearing a UCC-1 financing statement involves filing a UCC termination statement to indicate that the underlying obligation has been fulfilled. This step is essential for updating public records in North Carolina and protecting your credit and financial standing. You can rely on services like US Legal Forms to provide resources and templates for filing correctly. Once submitted, review your records to confirm that the statement has been properly cleared.

Filling out a UCC financing statement in North Carolina requires you to provide essential information about the debtor, the secured party, and the collateral involved. You can access the required forms online and use step-by-step instructions to ensure accuracy. Utilizing services like US Legal Forms simplifies this process, helping you avoid mistakes so your North Carolina Financing Statement meets all legal standards. Double-check your details before submitting to maintain the integrity of your filing.

To terminate a UCC financing statement in North Carolina, you must file a termination statement with the Secretary of State. This document officially indicates that the secured party has released their claim on the collateral. You can easily complete this process online through platforms like US Legal Forms, which guide you through the necessary steps. After filing, make sure to confirm that the termination has been processed to ensure your records are up to date.

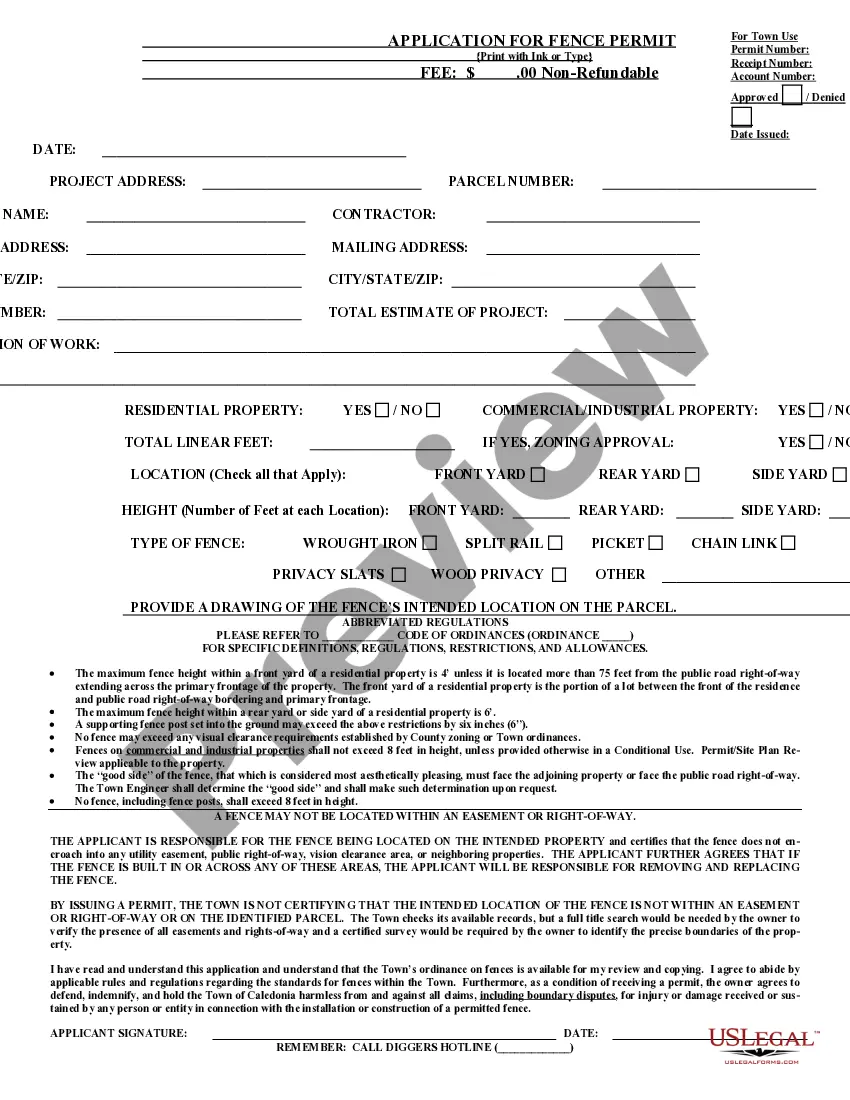

A North Carolina Financing Statement typically consists of several key sections, including the debtor’s name, the secured party’s name, and a description of the collateral involved. The format may vary, but it generally follows the guidelines set by the UCC. This form serves as legal proof of a security interest. If you want to ensure your statement is correctly filled out, uSLegalForms offers templates that streamline the process.

A financing statement on title indicates a secured interest in an asset, like vehicles or real estate. This North Carolina Financing Statement validates that a secured party has rights to the item listed on the title. It protects the party's investment in the event of the debtor’s default. When you understand this document, you can better navigate the financial landscape of buying or leasing assets.

A NC UCC statement is a type of North Carolina Financing Statement that adheres to the Uniform Commercial Code. It serves to perfect a security interest by notifying others of your lien on certain personal property. By filing a UCC statement, you create a public record of your claim, thus protecting your rights as a creditor. Using the uSLegalForms platform can help simplify the filing process.

Yes, a North Carolina Financing Statement is a public document. This means anyone can access it, which helps maintain transparency in financial transactions. The filing of this statement allows potential creditors to see the security interests claimed against a debtor's assets. When you file a financing statement, it shows other parties that you have a legitimate claim.

A financing statement plays a crucial role in the world of secured transactions. It puts other creditors and interested parties on notice about the secured interest held by a lender in a debtor's property. By filing a North Carolina Financing Statement, the creditor ensures they are legally recognized and prioritized in case of default. This protection is vital for both lenders and borrowers in maintaining clear financial relationships.

The financing statement is an essential tool in secured transactions, particularly in North Carolina. It is used to formally declare that a creditor holds an interest in the debtor's collateral. This document must be filed with the appropriate government entity to protect the creditor's rights. By becoming familiar with the North Carolina Financing Statement, you can better navigate lending agreements and protect your interests.

A financing statement is a legal document that provides interested parties with information regarding a secured transaction. Specifically, the North Carolina Financing Statement allows lenders to record their security interests in the borrower's property. This document serves as a public record, helping to establish the priority of claims against assets. Understanding this concept helps safeguard your rights and interests in credit transactions.