North Carolina Triple Net Lease for Sale

Description

How to fill out Triple Net Lease For Sale?

Selecting the appropriate legal document format can be quite challenging.

Clearly, there are numerous web templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service provides a multitude of templates, including the North Carolina Triple Net Lease for Sale, which you can utilize for business and personal purposes.

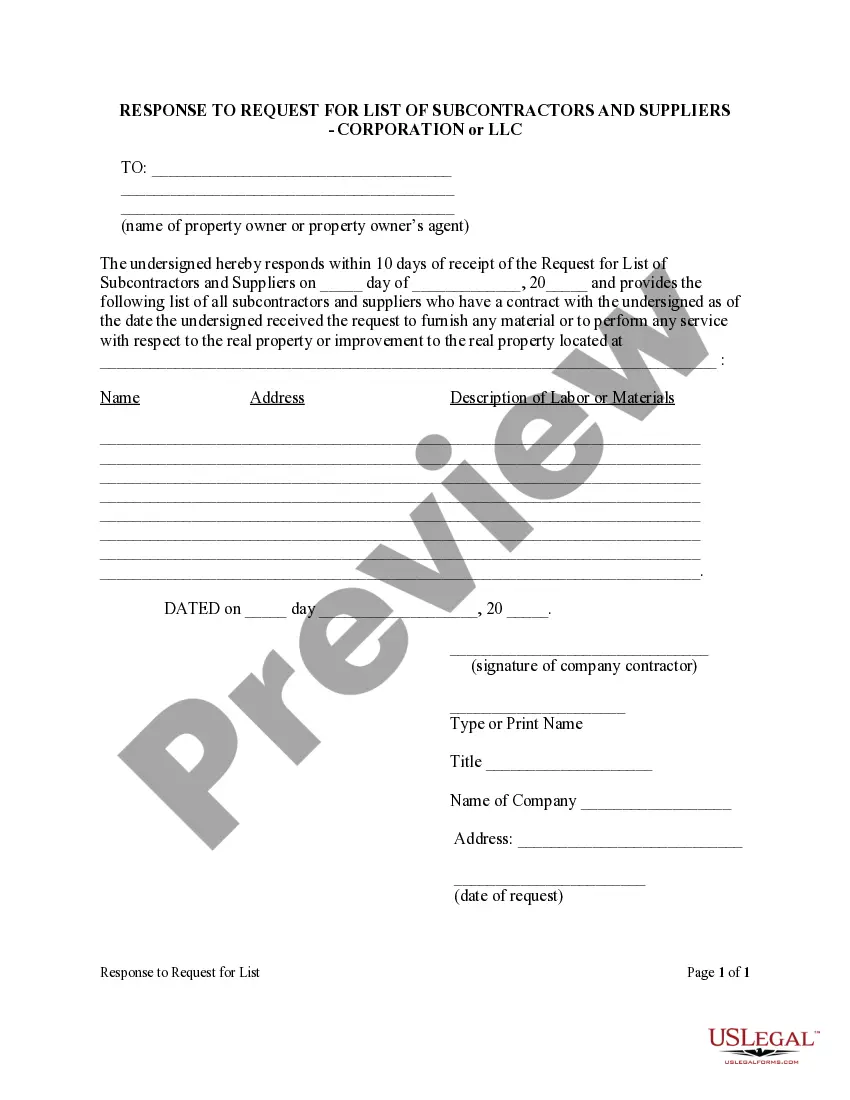

You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to acquire the North Carolina Triple Net Lease for Sale.

- Use your account to browse through the legal documents you have purchased previously.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you can follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Investing in NNN leases can be a sound strategy for those seeking stable income without the burden of extensive management. The tenant covers many operating expenses, providing a more passive income stream. Consequently, a North Carolina Triple Net Lease for Sale presents an attractive opportunity for investors who prefer minimal hands-on involvement.

To obtain a triple net lease, start by researching properties that offer this leasing structure. Platforms like US Legal Forms can provide listings and documents pertinent to North Carolina Triple Net Lease for Sale. Once you identify a suitable property, negotiate terms with the landlord, ensuring you understand all responsibilities outlined in the lease agreement.

The average return on a triple net lease generally falls between 5% to 10%, depending on various factors like location and property type. In the case of a North Carolina Triple Net Lease for Sale, investors often find competitive rates given the region's real estate market. Understanding your investment goals can help you select properties that align with these expected returns.

One downside of a triple net lease is the potential for unexpected costs. While tenants typically cover property taxes, insurance, and maintenance, these expenses can vary. Additionally, if the property requires significant repairs, the tenant may face substantial financial burdens. When considering a North Carolina Triple Net Lease for Sale, it's essential to evaluate these factors carefully.

NNN fees, associated with North Carolina Triple Net Leases for Sale, encompass property taxes, insurance, and maintenance charges. These fees can vary widely based on the property's location and specific expenses. It's essential to analyze these costs during your investment assessment to avoid surprises later. By using platforms like uslegalforms, you can get detailed insights into these fees and make well-informed decisions.

While North Carolina Triple Net Leases for Sale can offer advantages, there are downsides to consider. Tenants bear all operating costs, which can lead to unexpected expenses if maintenance or property taxes increase. Additionally, vacancies can pose a risk for landlords, as filling these spaces may take time and investment. Understanding these disadvantages can help you make informed investment choices.

Many investors find North Carolina Triple Net Leases for Sale worthwhile, as they often offer a reliable revenue stream. These leases reduce landlord responsibilities and allow for passive income generation. Additionally, the long-term nature of these agreements provides stability and potential appreciation of property value over time. It's a solid investment choice for those looking to diversify their portfolio.

In a North Carolina Triple Net Lease for Sale, operating expenses primarily include property taxes, insurance, and maintenance costs. Tenants typically cover these expenses in addition to the base rent. This arrangement provides landlords with predictable income while allowing tenants to manage their operational costs. Understanding these expenses is crucial for potential investors seeking stable returns.

Yes, triple net leases can be eligible for the Section 199A deduction, which allows you to deduct up to 20% of qualified business income. Qualifying for this deduction depends on several factors, including your overall income and how you manage the lease. Consulting with a tax professional can clarify how your North Carolina Triple Net Lease for Sale fits into this framework.

Triple net leases are generally treated as passive income, which means they can be subject to different tax rates compared to active income. Tenants often cover property taxes, insurance, and maintenance, impacting how the landlord reports income. This can offer tax advantages for those investing in a North Carolina Triple Net Lease for Sale.