North Carolina General and Continuing Guaranty and Indemnification Agreement

Description

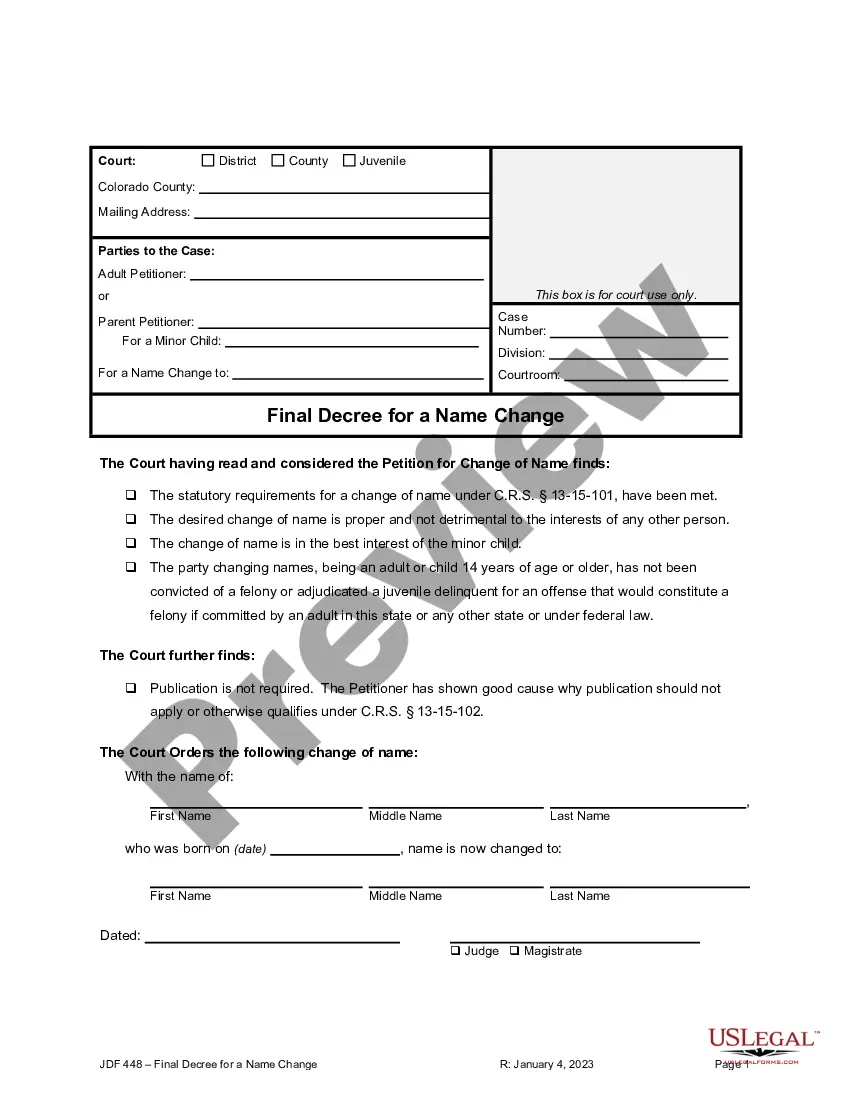

How to fill out General And Continuing Guaranty And Indemnification Agreement?

You can dedicate hours online attempting to locate the approved document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can download or print the North Carolina General and Continuing Guaranty and Indemnification Agreement from my service.

If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the North Carolina General and Continuing Guaranty and Indemnification Agreement.

- Each legal document template you download is yours forever.

- To obtain an additional copy of any downloaded form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions below.

- First, make sure that you have selected the appropriate document template for the state/city that you choose.

- Review the form details to ensure you have selected the correct form.

- If available, use the Review button to preview the document template as well.

Form popularity

FAQ

Yes, a guarantee is fundamentally an agreement between parties regarding a promise to fulfill obligations. In the context of the North Carolina General and Continuing Guaranty and Indemnification Agreement, this means one party agrees to cover another's debts or commitments. Such an agreement can be essential for ensuring compliance and securing transactions.

Certainly, a guarantee is a distinct type of contract wherein one party pledges to fulfill another's obligations if they fail to do so. This is crucial in the North Carolina General and Continuing Guaranty and Indemnification Agreement, as it defines responsibilities and protects interests. With the right legal framework, these agreements can provide significant peace of mind.

Yes, a guaranty is a specific type of contract where one party agrees to take responsibility for another's obligations. The North Carolina General and Continuing Guaranty and Indemnification Agreement exemplifies this, ensuring all parties understand their responsibilities. Clear terms in such agreements can prevent potential legal issues.

A warranty is indeed a form of contract as it creates an obligation for the warranty provider. In the context of the North Carolina General and Continuing Guaranty and Indemnification Agreement, warranties can be used to bolster the terms of the agreement. It’s key to recognize how warranties interact with guarantees for comprehensive protection.

A guarantee and indemnity agreement, such as the North Carolina General and Continuing Guaranty and Indemnification Agreement, is a legal document where one party guarantees the obligations of another. This agreement provides assurance that debts or obligations will be fulfilled, adding an extra layer of security in transactions. Understanding this document helps both parties avoid future disputes.

Yes, a guarantee is generally enforceable under the law, provided it meets certain legal requirements. The North Carolina General and Continuing Guaranty and Indemnification Agreement outlines these requirements, ensuring clarity and validity. You should consult a legal professional to ensure that your specific agreement meets enforceability standards.

The form of guarantee and indemnity typically includes specific clauses outlining the responsibilities and obligations of all parties involved. These documents often detail the extent of coverage, duration, and any conditions that may apply. For businesses in North Carolina, a well-structured General and Continuing Guaranty and Indemnification Agreement provides clarity and aids in mitigating risks associated with financial transactions.

A contract of indemnity provides compensation for losses suffered, while a contract of surety involves a third party guaranteeing a debtor's obligations. In essence, surety agreements add an additional layer by including another party, unlike indemnity agreements which focus solely on compensation for loss. Familiarity with these differences can enhance your understanding when creating a North Carolina General and Continuing Guaranty and Indemnification Agreement.

A contract of indemnity offers protection against specific losses, while a continuing guarantee ensures ongoing financial support for obligations over time. This distinction is significant when negotiating terms in a North Carolina General and Continuing Guaranty and Indemnification Agreement, as it dictates how parties approach risk and liability. Understanding these nuances can aid in crafting more effective agreements.

A guarantee primarily provides assurance that a debtor will meet their obligations, whereas an indemnity agreement compensates for any loss an injured party may suffer. Essentially, guarantees focus on ensuring performance, while indemnities focus on compensating for failure or loss. Knowing this distinction can be vital when drafting a North Carolina General and Continuing Guaranty and Indemnification Agreement, as it helps clarify roles and responsibilities.