An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

You can invest hrs on the Internet looking for the legal file design that meets the federal and state requirements you want. US Legal Forms supplies a large number of legal varieties which are examined by pros. It is simple to down load or print out the North Carolina Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage from our assistance.

If you already possess a US Legal Forms bank account, you can log in and then click the Down load button. Following that, you can comprehensive, modify, print out, or signal the North Carolina Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage. Every legal file design you buy is your own for a long time. To have an additional backup of any obtained kind, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site the very first time, stick to the simple directions listed below:

- Very first, ensure that you have chosen the proper file design for the state/town that you pick. Read the kind explanation to make sure you have picked out the right kind. If offered, take advantage of the Review button to check through the file design too.

- If you wish to find an additional variation of your kind, take advantage of the Search industry to get the design that meets your requirements and requirements.

- When you have located the design you want, click on Acquire now to move forward.

- Pick the costs program you want, enter your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal bank account to purchase the legal kind.

- Pick the format of your file and down load it to the device.

- Make changes to the file if possible. You can comprehensive, modify and signal and print out North Carolina Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage.

Down load and print out a large number of file web templates making use of the US Legal Forms web site, that provides the largest selection of legal varieties. Use skilled and express-distinct web templates to handle your small business or individual requirements.

Form popularity

FAQ

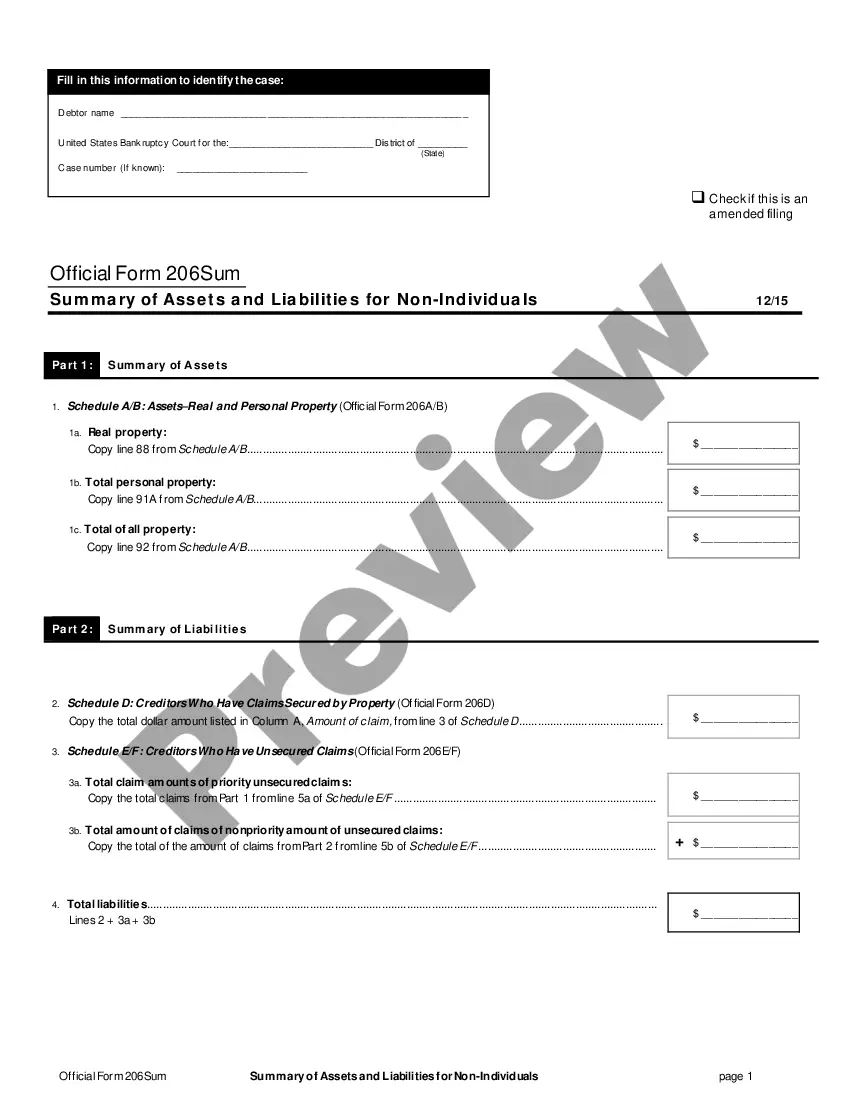

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A mortgage note represents a home loan for a given borrower. The note is a security instrument that allows the loan to be grouped with other mortgages after closing and sold to investors. A mortgage note comes with a promissory note, which is the borrower's promise to repay the loan.

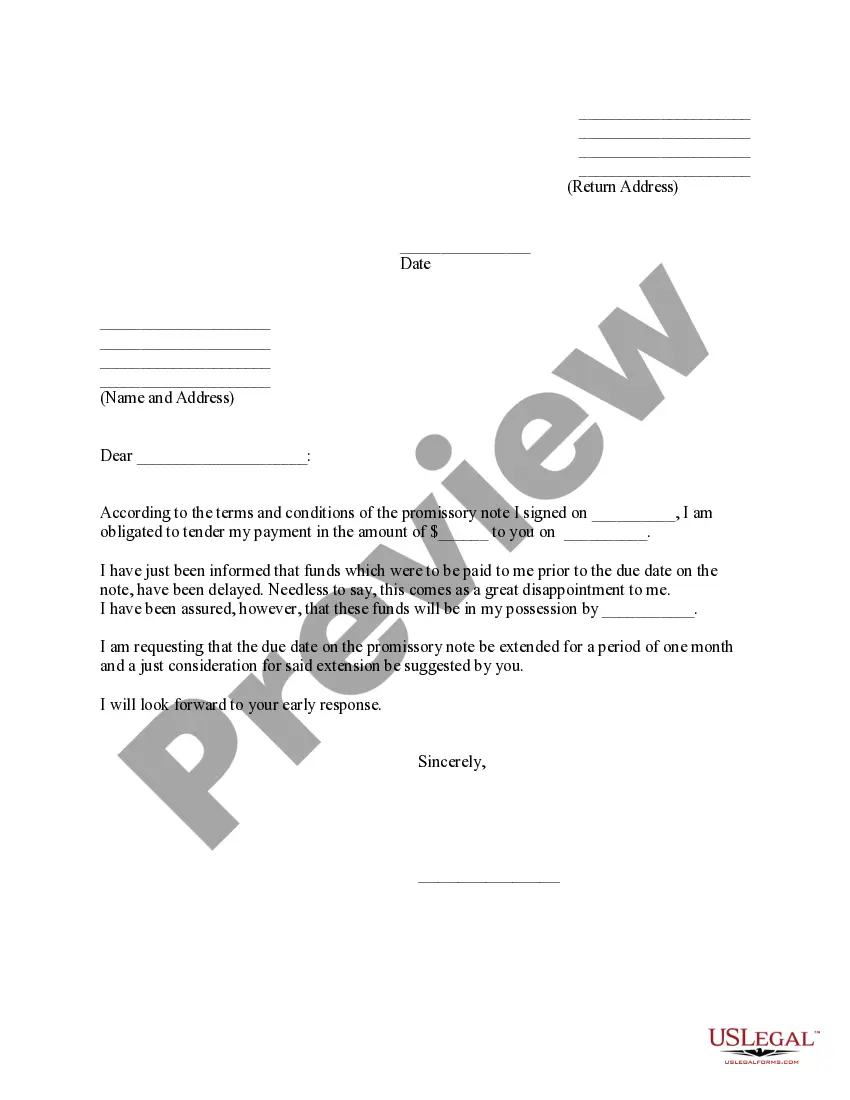

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

Mortgage Note: --is a type of promissory note that is secured by a mortgage loan. --provides security for the loan held by the promissory note. --agreements between the borrower and lender that allow the lender to demand full repayment of a loan should the borrower default on the loan.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.