North Carolina Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Finding the appropriate legitimate document template can be quite a challenge.

Certainly, there are numerous formats available online, but how do you obtain the official form you need.

Utilize the US Legal Forms platform. This service offers thousands of templates, including the North Carolina Bill of Transfer to a Trust, which you can use for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Bill of Transfer to a Trust.

- Use your account to search for the legal forms you may have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure you have selected the right form for your city/state. You can browse the form using the Preview button and review the form description to confirm that it is suitable for you.

Form popularity

FAQ

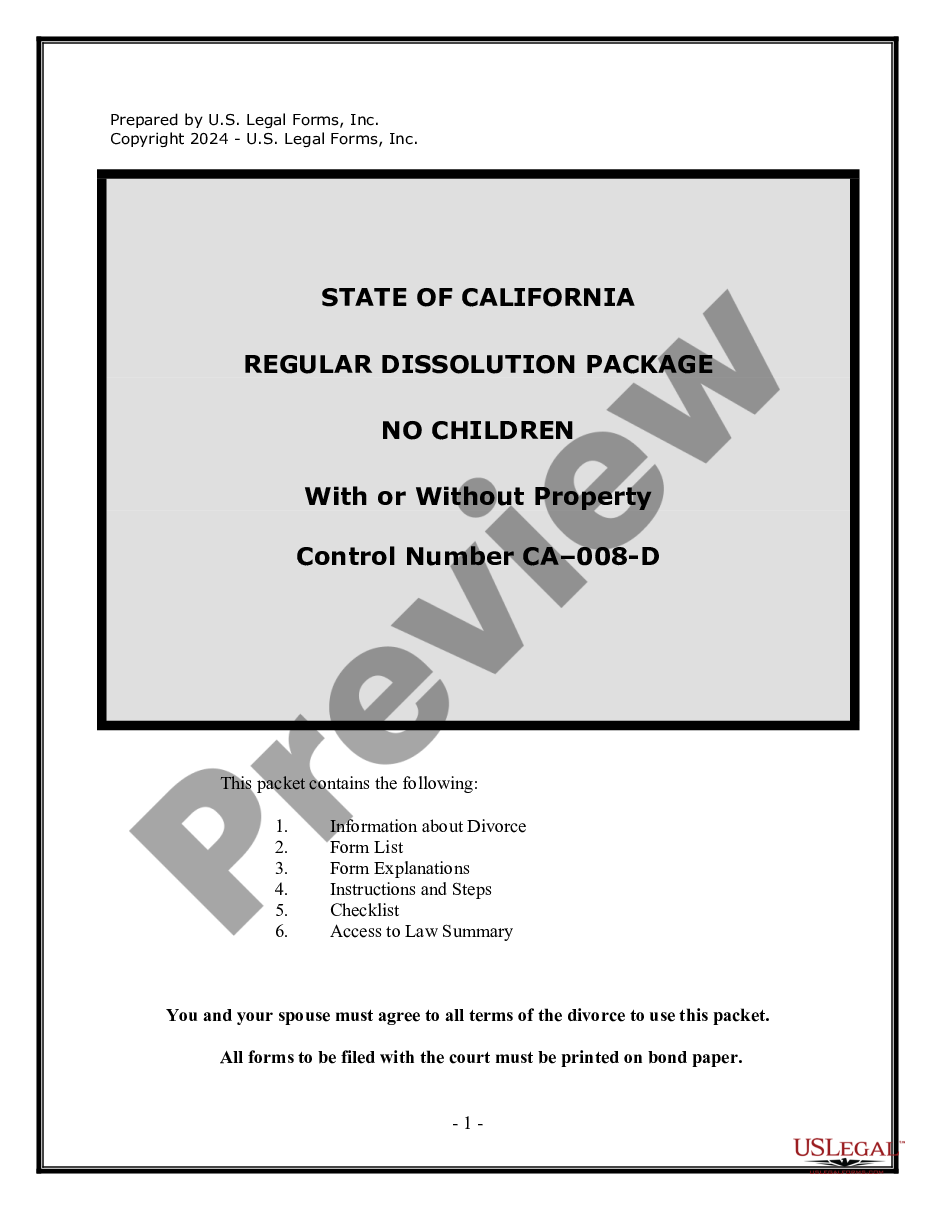

To transfer property to a trust in North Carolina, you need to execute a deed that names the trust as the new owner. This deed must meet specific legal requirements and be recorded in the county where the property is located. It’s advisable to consult an attorney who can help you navigate the complexities of the North Carolina Bill of Transfer to a Trust. They can ensure that your property transfer aligns with state laws and your estate planning goals.

To transfer assets into a trust, you first need to identify the assets you wish to include, such as real estate or bank accounts. Next, you must change the title or ownership of these assets to the trust, which may involve completing specific forms or creating new deeds. Working with legal professionals knowledgeable about the North Carolina Bill of Transfer to a Trust can simplify this process and ensure accuracy.

Transferring assets to a trust after death typically requires going through the probate process. This process validates the will and authorizes the executor to distribute assets according to both the will and any trust documents. It's important to consult legal experts familiar with the North Carolina Bill of Transfer to a Trust to ensure proper compliance and execution. They can help you navigate the complexities of asset transfer after death.

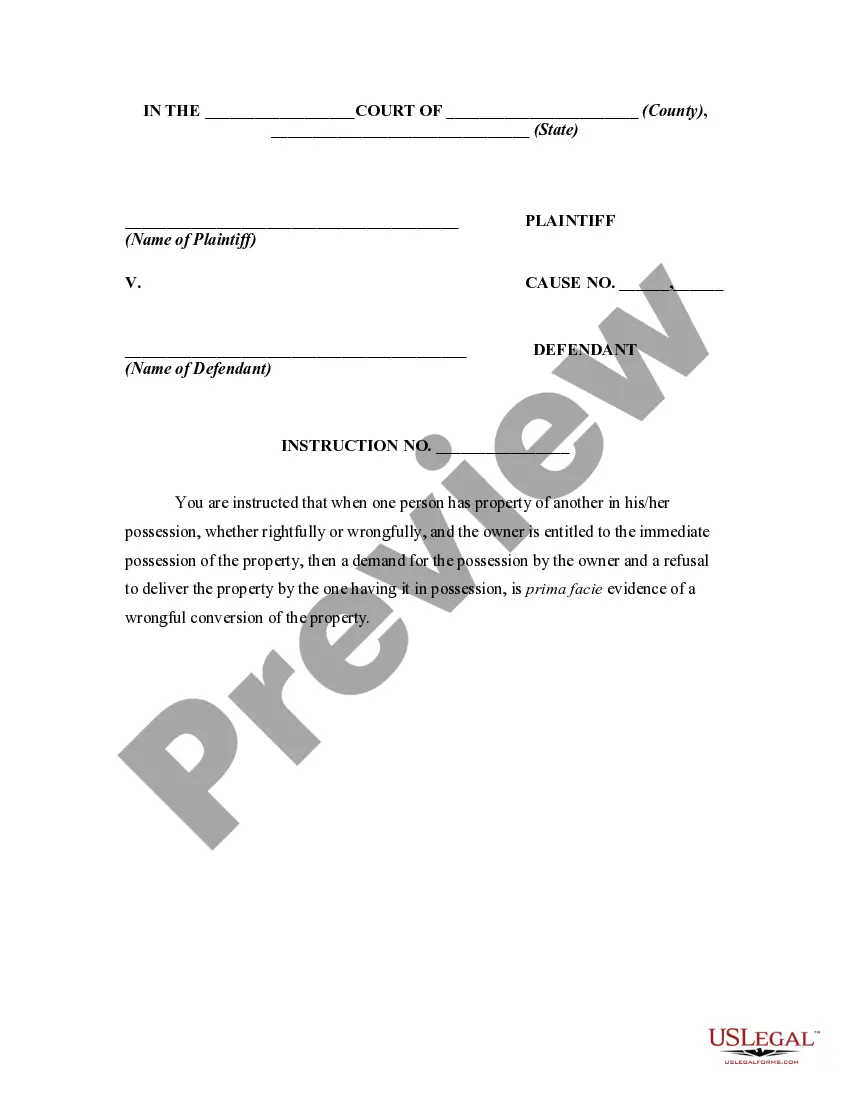

One of the biggest mistakes parents make is failing to clearly define the terms and conditions of the trust. Without clear instructions, beneficiaries might mismanage the funds or assets entrusted to them. Additionally, not updating the trust in response to life changes, like births or deaths, is a common oversight. The North Carolina Bill of Transfer to a Trust can guide you in creating a comprehensive and effective plan.

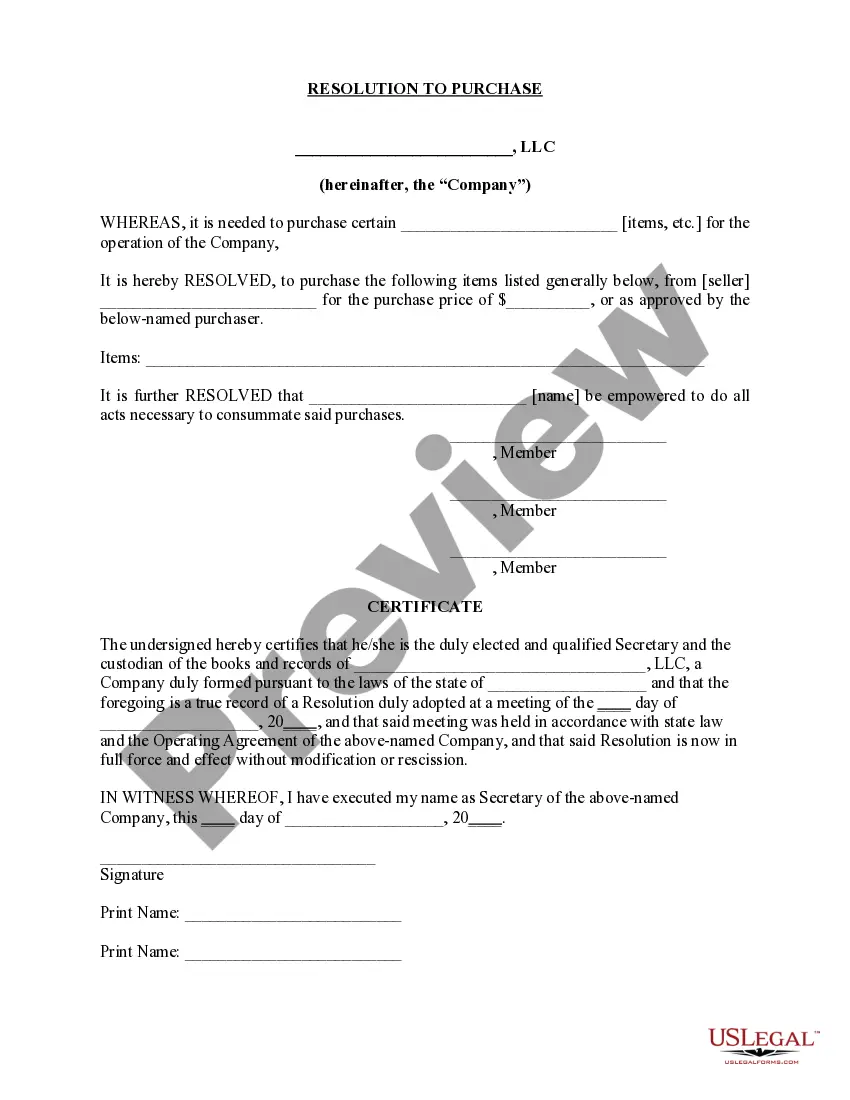

A bill of transfer in a trust is a legal document that facilitates the transfer of assets into a trust. It officially records the change of ownership from you to the trust, ensuring that your assets are effectively managed according to your wishes. This document is especially important when dealing with property or valuable assets. Familiarizing yourself with the North Carolina Bill of Transfer to a Trust ensures that your transfer process is smooth.

The choice between transfer on death arrangements and trusts largely depends on your individual needs. A transfer on death allows assets to pass directly to beneficiaries without going through probate, which is often faster. However, trusts provide more control over asset distribution and can offer protections for minors or special needs beneficiaries. Understanding the North Carolina Bill of Transfer to a Trust can help you make an informed decision for your situation.

You should avoid placing certain assets in a trust, like retirement accounts and health savings accounts. These accounts often have tax implications that can complicate your estate planning. Additionally, life insurance policies are typically better held outside of a trust, unless specifically designed to be in one. By understanding the North Carolina Bill of Transfer to a Trust, you can more effectively manage your assets.

You transfer items to a trust by formally changing the title or ownership of the items to the trust. For specific items, you may need to use a document like the North Carolina Bill of Transfer to a Trust. Additionally, ensuring each item is specifically mentioned in your trust declaration can prevent future disputes. If you're unsure about the process, consider using US Legal Forms to assist with proper documentation.

Assets are added to a trust by re-titling them in the name of the trust. You’ll need to fill out the necessary forms, which may include the North Carolina Bill of Transfer to a Trust for certain assets. It's important to make sure all documents are accurate, as this secures the intended ownership. Using resources like US Legal Forms can simplify this process.

To transfer accounts to a trust, you first need to create the trust document. Next, contact your financial institutions and provide them with a copy of the North Carolina Bill of Transfer to a Trust. They will guide you through their requirements for changing account ownership. This process ensures your accounts are protected under the trust's terms.