North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

If you need to download, save, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s simple and efficient search feature to find the documents you require.

Various templates for business and personal needs are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental with just a couple of clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental.

- You can also view forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

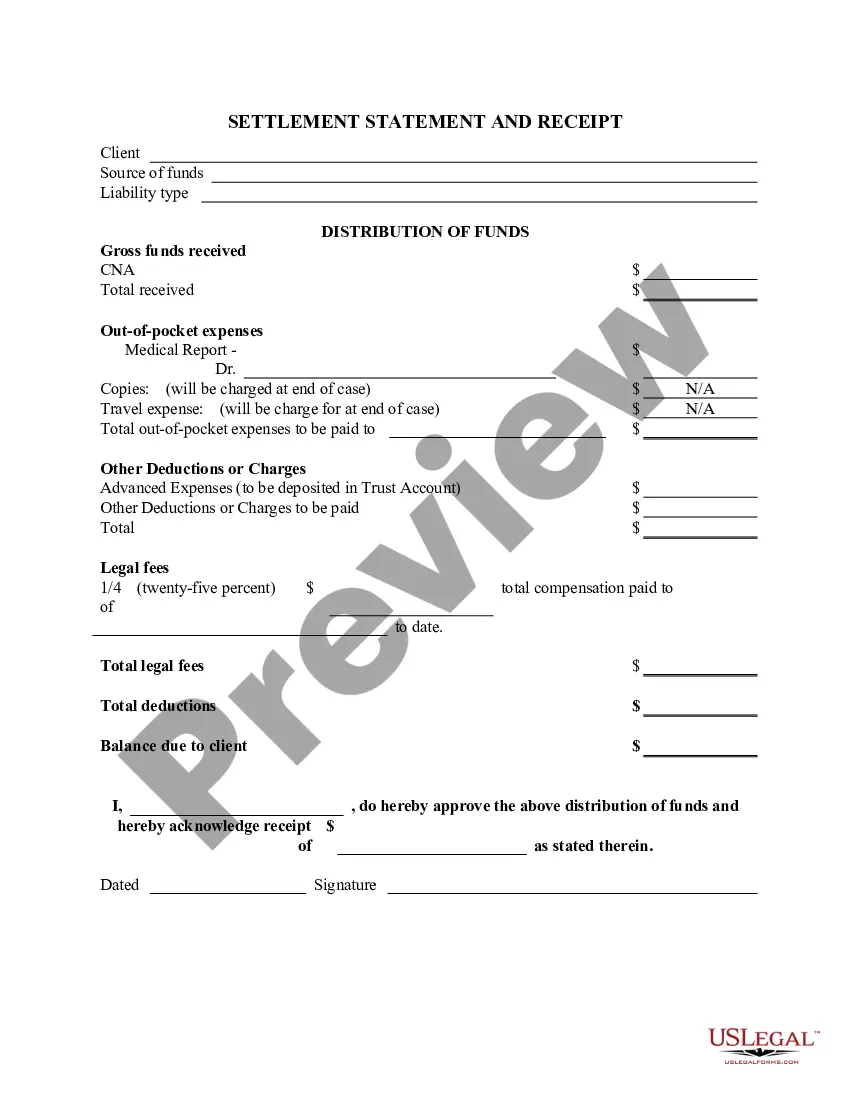

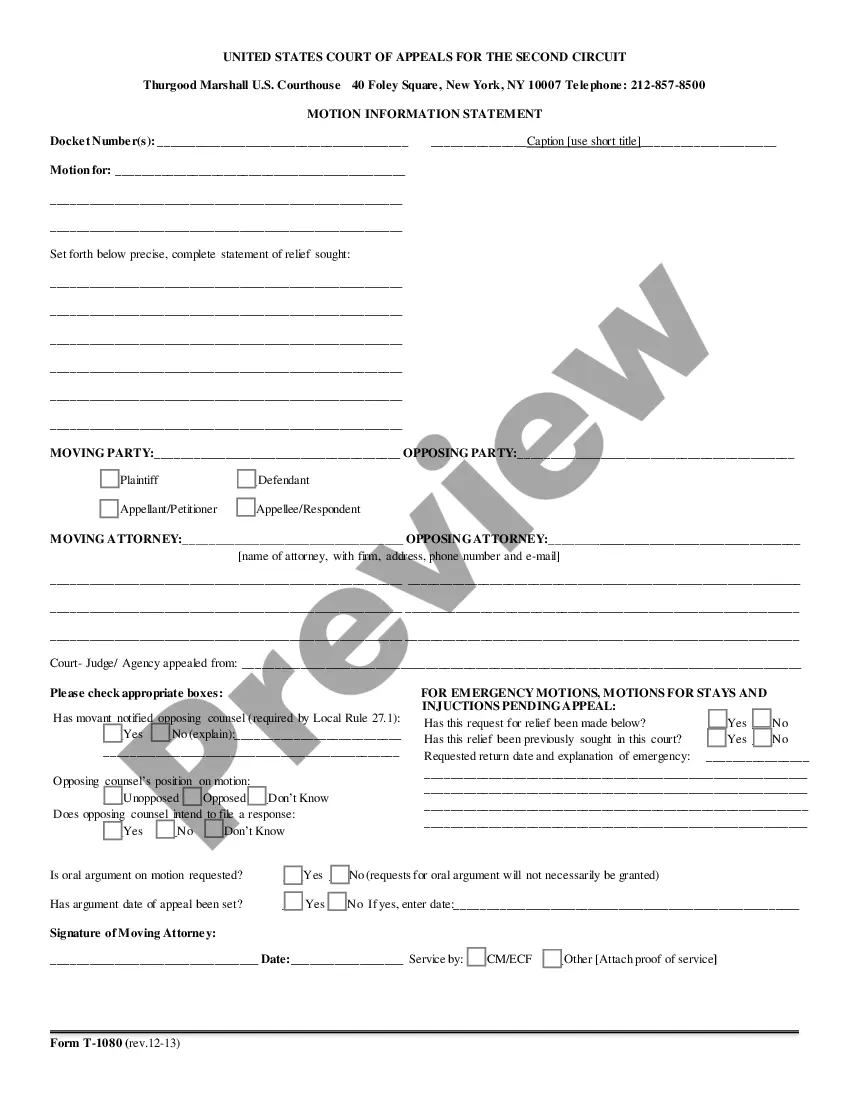

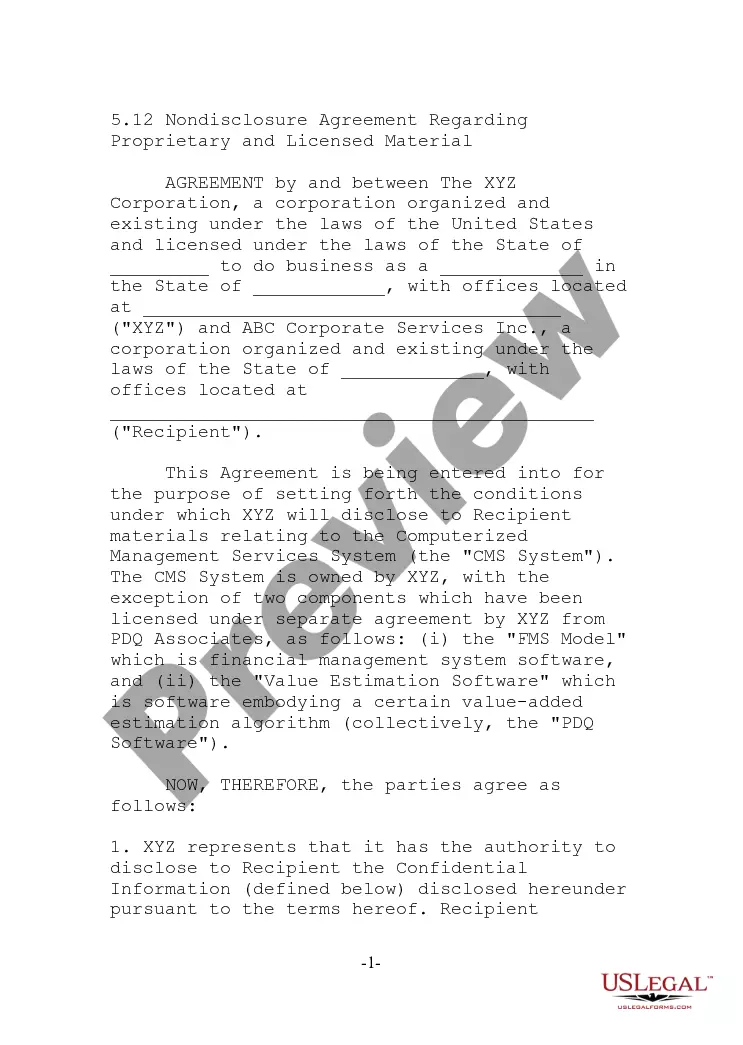

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Identifying the best website or broker for obtaining a NNN lease often depends on your specific needs and property type. Consider exploring dedicated commercial real estate websites that specialize in North Carolina properties for a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental. These platforms usually offer comprehensive databases, allowing you to compare various listings efficiently. Additionally, working with an experienced broker can help streamline the process, ensuring you find a lease that suits your investment strategy.

Triple net leases work by transferring the financial responsibilities of property management to the tenant. Under a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, the tenant covers all operating expenses, including property taxes, insurance premiums, and maintenance costs, while the landlord receives a stable rental income. This arrangement simplifies property ownership for landlords, as they do not have to manage daily expenses. Furthermore, tenants often benefit from lower base rents due to the assumption of these costs.

Calculating a triple net lease involves determining the base rent and adding the estimated costs of property taxes, insurance, and maintenance. These costs are typically calculated on a per-square-foot basis, which you then multiply by the total square footage of the leased space. In a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, you can often find detailed breakdowns of these expenses in the lease documents. It is advisable to use platforms like uslegalforms to ensure all calculations are clear and legally sound.

A net lease REIT, or Real Estate Investment Trust, primarily invests in properties leased to tenants under net lease agreements. This type of REIT benefits from the predictable income generated from rental payments while allowing tenants to manage property expenses. By investing through a net lease REIT, you can participate in the income potential of properties subject to a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, without managing the properties directly.

The opposite of a triple net lease is typically a gross lease. In a gross lease, the landlord retains responsibility for all property expenses, including taxes, insurance, and maintenance. This arrangement contrasts with the financial structure described in a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, where tenants cover those additional costs, maximizing passive income for property owners.

An example of a triple net lease could involve a fast-food restaurant located in North Carolina. In this scenario, the franchisee pays a fixed monthly rent along with taxes, insurance, and maintenance of the property. This arrangement is common in a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, as it motivates tenants to take good care of the property and minimizes costs for the landlord.

The best triple net lease tenants typically include large, well-established corporations such as retail chains, drugstores, and fast-food franchises. These tenants usually have strong credit ratings and stable operating histories, making them reliable choices for landlords. When considering a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, it's crucial to evaluate the tenant's financial health to ensure long-term, consistent rental income.

The most common commercial lease agreement in North Carolina is the gross lease, where the landlord covers expenses like taxes and maintenance. However, the North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental has gained popularity, where tenants assume responsibility for property costs, including utilities and maintenance. This agreement creates clear financial responsibilities for all parties involved.

Not all contracts in North Carolina must be notarized, but doing so can strengthen their enforceability. Certain types of contracts, such as those involving real estate, may benefit from notarization to establish legitimacy. If you're entering a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental, consider notarizing it for enhanced legal protection.

To rent a house in North Carolina, you typically need a stable income, a good credit history, and references. Landlords may also check your rental history to ensure you are a reliable tenant. Understanding the details of a North Carolina Triple Net Commercial Lease Agreement - Real Estate Rental can help ensure you comply with all landlord requirements and conditions.