North Carolina Declare None - Resolution Form - Corporate Resolutions

Description

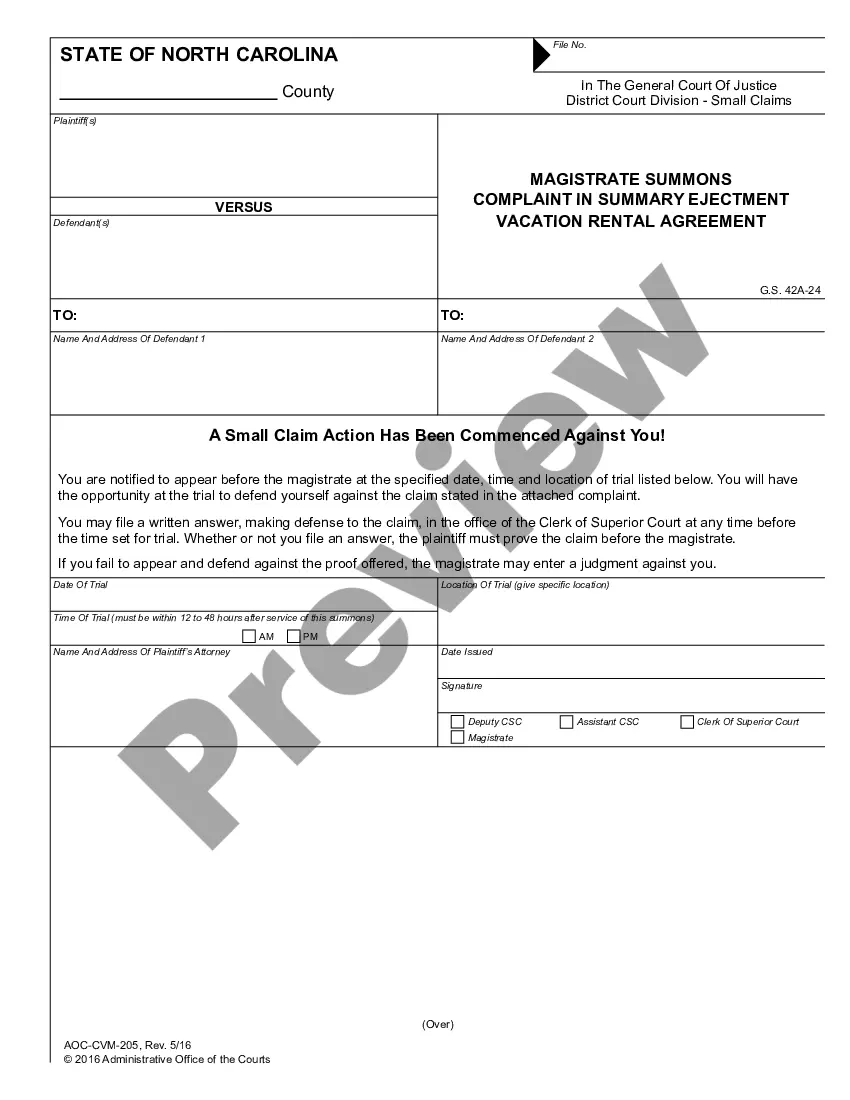

How to fill out Declare None - Resolution Form - Corporate Resolutions?

It is feasible to spend hours online seeking the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides countless legal forms that are reviewed by experts.

You can easily download or print the North Carolina Claim None - Resolution Form - Corporate Resolutions from the service.

To find another version of the document, use the Search area to locate the template that suits your needs and criteria.

- If you already own a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, modify, print out, or sign the North Carolina Claim None - Resolution Form - Corporate Resolutions.

- Every legal document template you obtain is yours forever.

- To acquire another copy of any purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Read the form description to verify that you have chosen the appropriate form.

Form popularity

FAQ

The approval time for an LLC in North Carolina typically ranges from a few days to several weeks, depending on the filing method you choose. Online submissions are usually processed faster than paper filings. Once your LLC is approved, having the North Carolina Declare None - Resolution Form - Corporate Resolutions prepared can aid in establishing clear operational guidelines and maintaining your company’s compliance.

06 form is used by businesses operating in North Carolina to report their taxes on a yearly basis. This form collects information on income, expenses, and other financial data to calculate your tax obligations. Utilizing the North Carolina Declare None Resolution Form Corporate Resolutions can provide structure to your corporate governance and help streamline this reporting process.

The BE-17 form is a key document that businesses in North Carolina must file if they are claiming a corporate tax credit. This form helps businesses report their income and determine eligibility for various tax benefits. To ensure proper filing, the North Carolina Declare None - Resolution Form - Corporate Resolutions can guide you through this process, making it easier to handle your business's paperwork.

Doing business in North Carolina includes any activity that generates income or provides services within the state. This might involve having a physical office, employing staff, or selling products locally. If your business activities meet these criteria, you should register your LLC in North Carolina. The North Carolina Declare None - Resolution Form - Corporate Resolutions can help you maintain your corporate compliance.

To form an LLC in North Carolina, you must file the Articles of Organization with the Secretary of State. The requirements include providing the name of your LLC, the registered agent's information, and addressing any necessary fees. Additionally, your LLC must comply with state regulations, including having a unique name and a physical address. Using the North Carolina Declare None - Resolution Form - Corporate Resolutions can simplify the process of establishing your company's governing rules.

A good example of a resolution could be one that authorizes a merger or acquisition. This resolution would clearly outline the parties involved, the rationale, and the terms agreed upon. Such resolutions ensure that all stakeholders are aligned and aware of significant changes within the company. To draft this type of resolution correctly, consider using the North Carolina Declare None - Resolution Form - Corporate Resolutions available on the US Legal Forms site.

A company resolution is a formal document that records decisions made by a company’s board. For example, a company resolution may authorize the issuance of new shares or approve a significant expenditure. These documents help keep stakeholders informed and protect the company legally. To create effective company resolutions, use the North Carolina Declare None - Resolution Form - Corporate Resolutions, which is designed for this purpose.

To write a resolution for a company, start by outlining the key decision and its context. Include the company's name, the date, and the specific action being authorized. Clarity is vital, so be sure to express the resolution's intent clearly and concisely. For added assurance that your resolution meets all legal standards, refer to the North Carolina Declare None - Resolution Form - Corporate Resolutions available through US Legal Forms.

A resolution in an organization is a formal decision made by the board or management regarding a significant action. It typically outlines the details of the decision and provides necessary authorizations. Resolutions serve as essential records for accountability and compliance purposes. Utilizing the North Carolina Declare None - Resolution Form - Corporate Resolutions can streamline the process of crafting clear and legal resolutions.

An example of a resolution for a company could be the approval of a new policy or the appointment of a new officer. The resolution should state the exact nature of the decision and any relevant details surrounding it. This ensures all stakeholders are informed and that the action takes effect legally. Utilizing the North Carolina Declare None - Resolution Form - Corporate Resolutions can provide a structured format for such resolutions.