North Carolina Promissory Note with Installment Payments

Description

How to fill out Promissory Note With Installment Payments?

Are you presently in a situation where you need documents for potentially business or personal purposes almost every workday.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the North Carolina Promissory Note with Installment Payments, which can be tailored to meet state and federal regulations.

Once you locate the correct form, click Purchase now.

Select the pricing plan you want, fill in the required details to create your account, and complete the transaction using your PayPal or Visa/Mastercard. Choose a preferred file format and download your copy. You can view all the document templates you have purchased under the My documents section. You can obtain another copy of the North Carolina Promissory Note with Installment Payments at any time if needed. Just click the relevant form to download or print the document template. Utilize US Legal Forms, which offers one of the broadest selections of legal forms, to save time and minimize errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Promissory Note with Installment Payments template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

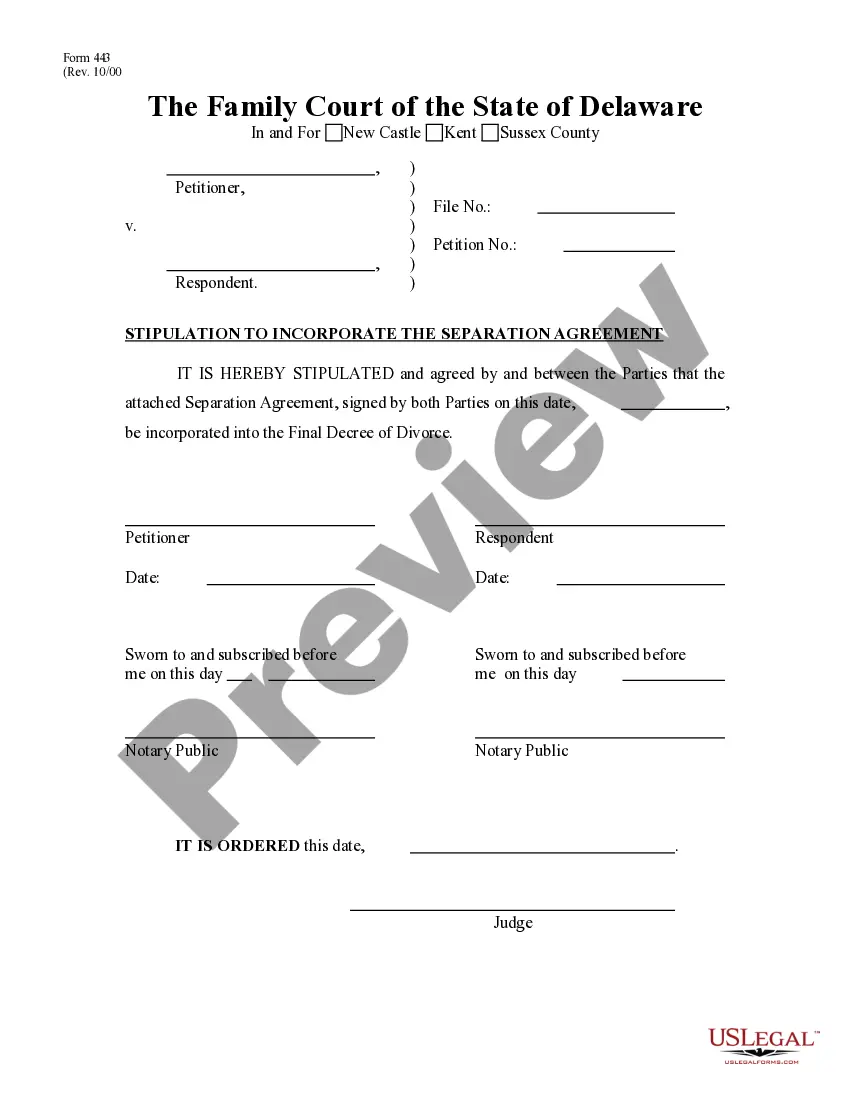

- Utilize the Review button to inspect the form.

- Read the information to confirm that you have selected the correct document.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

The validity of a promissory note in North Carolina is generally indefinite unless specified otherwise in the agreement. However, the enforceability can be affected by the statute of limitations. For anyone creating a North Carolina Promissory Note with Installment Payments, it’s essential to clearly outline the terms of payment to avoid any ambiguity regarding validity over time.

In North Carolina, the statute of limitations for a promissory note is typically three years. This means that if legal action is necessary due to non-payment, the lender must act within this time frame. Understanding this timeline is crucial for both parties in a North Carolina Promissory Note with Installment Payments, as it impacts the enforceability of the agreement.

Yes, a promissory note is a legally binding document in North Carolina when it meets certain criteria, such as clear terms regarding repayment. A North Carolina Promissory Note with Installment Payments creates obligations for both the borrower and the lender. It defines how and when payments will be made, ensuring all parties understand their commitments.

In North Carolina, documents that typically require notarization include deeds, mortgages, and powers of attorney. Additionally, if your North Carolina Promissory Note with Installment Payments involves significant amounts or particular stipulations, notarization can help ensure all parties involved recognize the agreement's seriousness. Always check specific legal requirements for your document type to avoid future complications.

In North Carolina, a contract does not generally have to be notarized to be legally binding. However, for certain contracts, such as those related to real estate, having a notarized signature can protect against disputes. When dealing with a North Carolina Promissory Note with Installment Payments, a notarization can add an extra layer of security, but it is not mandatory for the note’s validity.

A promissory note that requires a borrower to repay funds in installments is specifically designed to break the total debt into smaller, manageable payments. This structure supports borrowers in fulfilling their repayment obligations without facing financial strain. If you are interested in creating a North Carolina Promissory Note with Installment Payments, platforms like uslegalforms can provide templates and guidance, making the process straightforward.

A promissory note can also be referred to as a 'note payable' or simply a 'note.' Regardless of the terminology used, it serves as a legal document indicating the borrower's commitment to repay the lender. When utilizing a North Carolina Promissory Note with Installment Payments, understanding these terms helps in grasping your rights and responsibilities clearly.

In North Carolina, a promissory note does not legally require notarization to be enforceable. However, having the note notarized can add an extra layer of protection and credibility for both parties. It is often advisable to consider notarization, especially in situations involving larger sums or complex agreements such as a North Carolina Promissory Note with Installment Payments.

To write a promissory note for payment under a North Carolina Promissory Note with Installment Payments, start by including the date, names of the parties involved, and the principal amount. Clearly outline the repayment schedule, specifying the due dates and payment amounts. Make sure to include any interest rates, if applicable, and both parties should sign the document to make it legally binding.