Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

North Carolina Bill of Sale for Artwork or Work of Art or Painting

Description

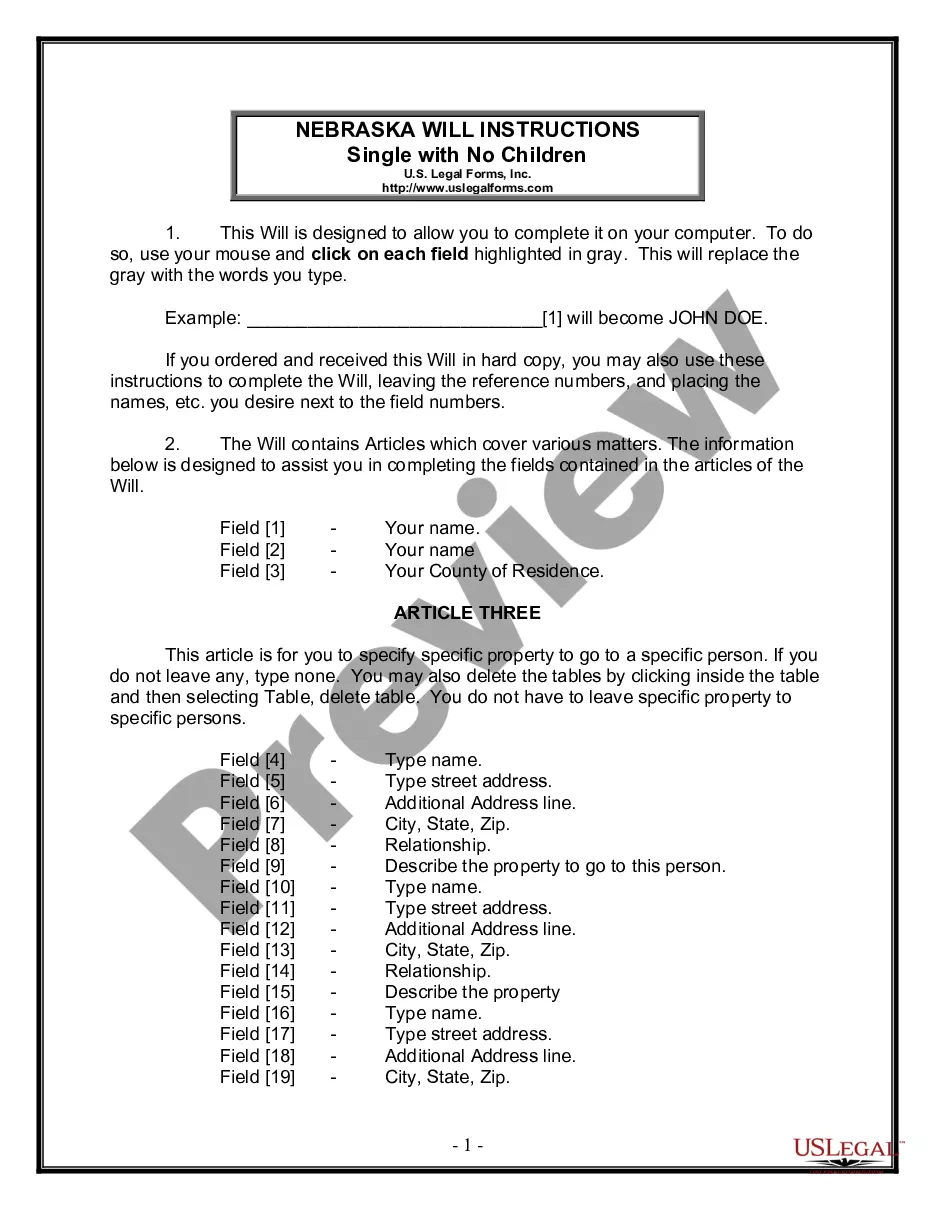

How to fill out Bill Of Sale For Artwork Or Work Of Art Or Painting?

US Legal Forms - one of the most notable collections of legal documents in the United States - offers a diverse selection of legal templates that you can download or print.

By utilizing the website, you will find thousands of forms for corporate and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the North Carolina Bill of Sale for Artwork or Work of Art or Painting in moments.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Download now button. Then, choose the pricing plan that suits you and provide your details to register for an account.

- If you already have a membership, Log In and download the North Carolina Bill of Sale for Artwork or Work of Art or Painting from the US Legal Forms catalog.

- The Download button will appear on each template you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to assist you in getting started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

In most cases, you don’t need a formal license to sell art, especially if it’s on a small scale. However, be sure to check local regulations to confirm. To further protect your interests during transactions, using a North Carolina Bill of Sale for Artwork or Work of Art or Painting ensures that all sales are properly documented, allowing you to focus on your creativity.

Absolutely, you can sell your art as a hobby. Many artists enjoy sharing their work with others while maintaining a casual approach to sales. If you want to keep your transactions organized, consider using a North Carolina Bill of Sale for Artwork or Work of Art or Painting, which provides clarity and structure, making it easier to handle sales when needed.

Yes, you can sell your art from home, and many artists do just that. Set up a dedicated workspace to create and display your pieces. When you sell, you should utilize a North Carolina Bill of Sale for Artwork or Work of Art or Painting to ensure proper documentation of the transaction and protect both yourself and your buyers.

To get your art printed for sale, start by choosing a reliable printing service that specializes in art prints. Ensure they use high-quality materials that showcase your artwork beautifully. Once you have your prints, consider using a North Carolina Bill of Sale for Artwork or Work of Art or Painting to smoothly transfer ownership when you make a sale.

Creating an invoice for artwork is straightforward. Start by including your name, contact information, and the buyer’s details, followed by an itemized list of the artwork sold with descriptions and prices. Don’t forget to mention the use of a North Carolina Bill of Sale for Artwork or Work of Art or Painting to formalize the transaction and provide legal validity to your sale.

Yes, you must report income from selling collectibles, including artwork. The Internal Revenue Service considers profits from these sales as taxable income. By documenting your transactions with a North Carolina Bill of Sale for Artwork or Work of Art or Painting, you can ensure accurate reporting and maintain clarity in your financial records.

Yes, you can claim artwork as a tax deduction under certain conditions. If you donate a piece of art to a qualified charity, you may deduct its fair market value. To clarify your intentions and protect your interests, using a North Carolina Bill of Sale for Artwork or Work of Art or Painting can provide essential documentation during tax filings.

Yes, you can sue someone for selling your art without permission, especially if you can prove ownership and that the sale harmed you. Documentation like a North Carolina Bill of Sale for Artwork or Work of Art or Painting can strengthen your case. It is advisable to consult with an attorney to understand the legal options available to you in this situation.

When selling art, ensure you own the rights to the work and are compliant with local laws, including copyright and tax regulations. Always provide a clear agreement, like a North Carolina Bill of Sale for Artwork or Work of Art or Painting, that outlines the sale terms. Familiarize yourself with any platform rules if selling online, and be honest about the artwork's history and condition.

If someone sells your art without permission, first gather evidence of your ownership and original work. You may need to send a formal cease and desist letter to the seller. If they refuse to comply, consider consulting a legal professional to explore your options for pursuing a claim against them for damages.