North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust is a legal document that is filed with the North Carolina Secretary of State in order to form a nonprofit corporation. This document outlines the purpose of the organization, its members, and its directors. It also specifies how the organization is to be governed, how it will manage its affairs, and how it will raise funds. There are three types of North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust: 1) a single-member trust, 2) a multi-member trust, and 3) a pooled trust. A single-member trust is for a single individual, while a multi-member trust is for multiple individuals. A pooled trust is used to pool the resources of multiple individuals to help those individuals manage their medical expenses.

North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust

Description

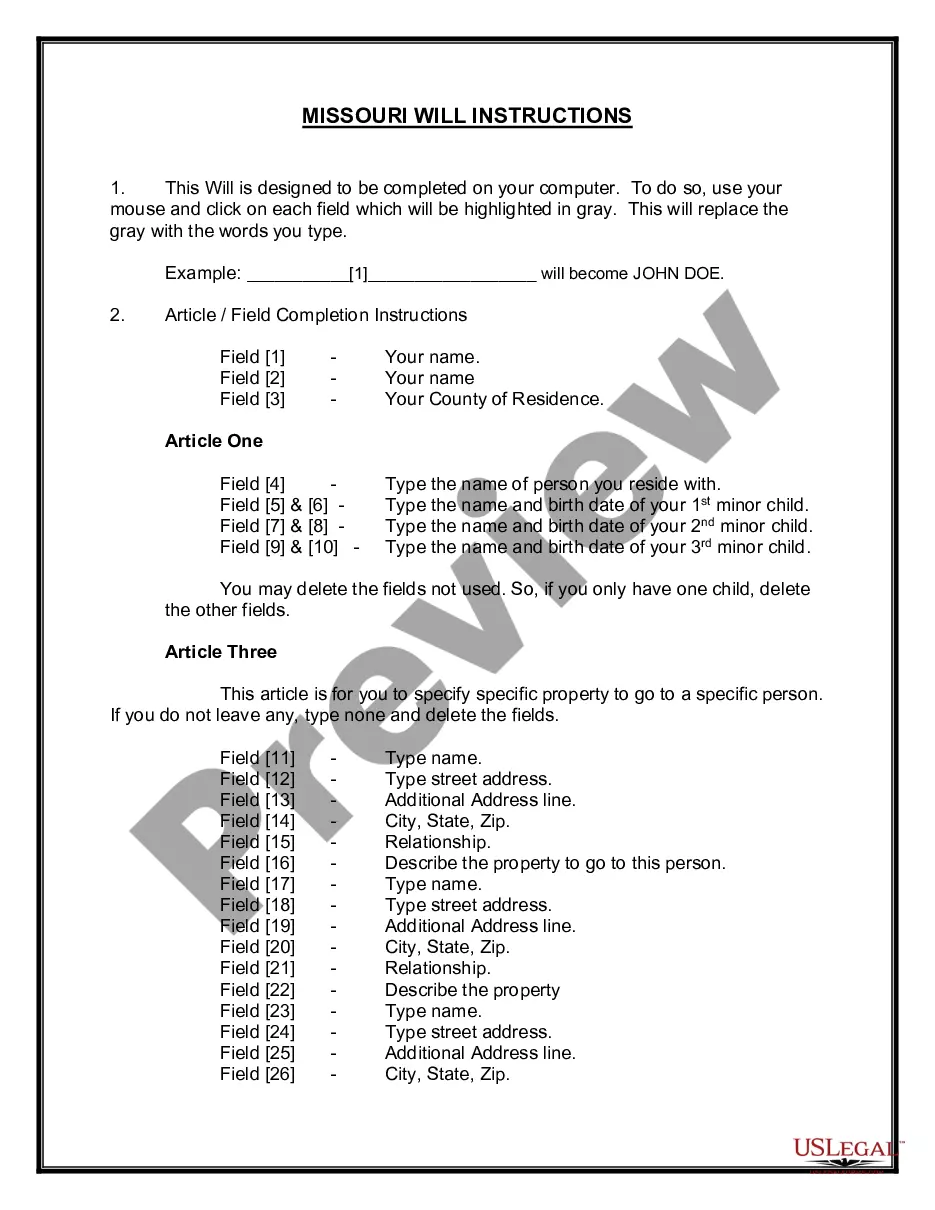

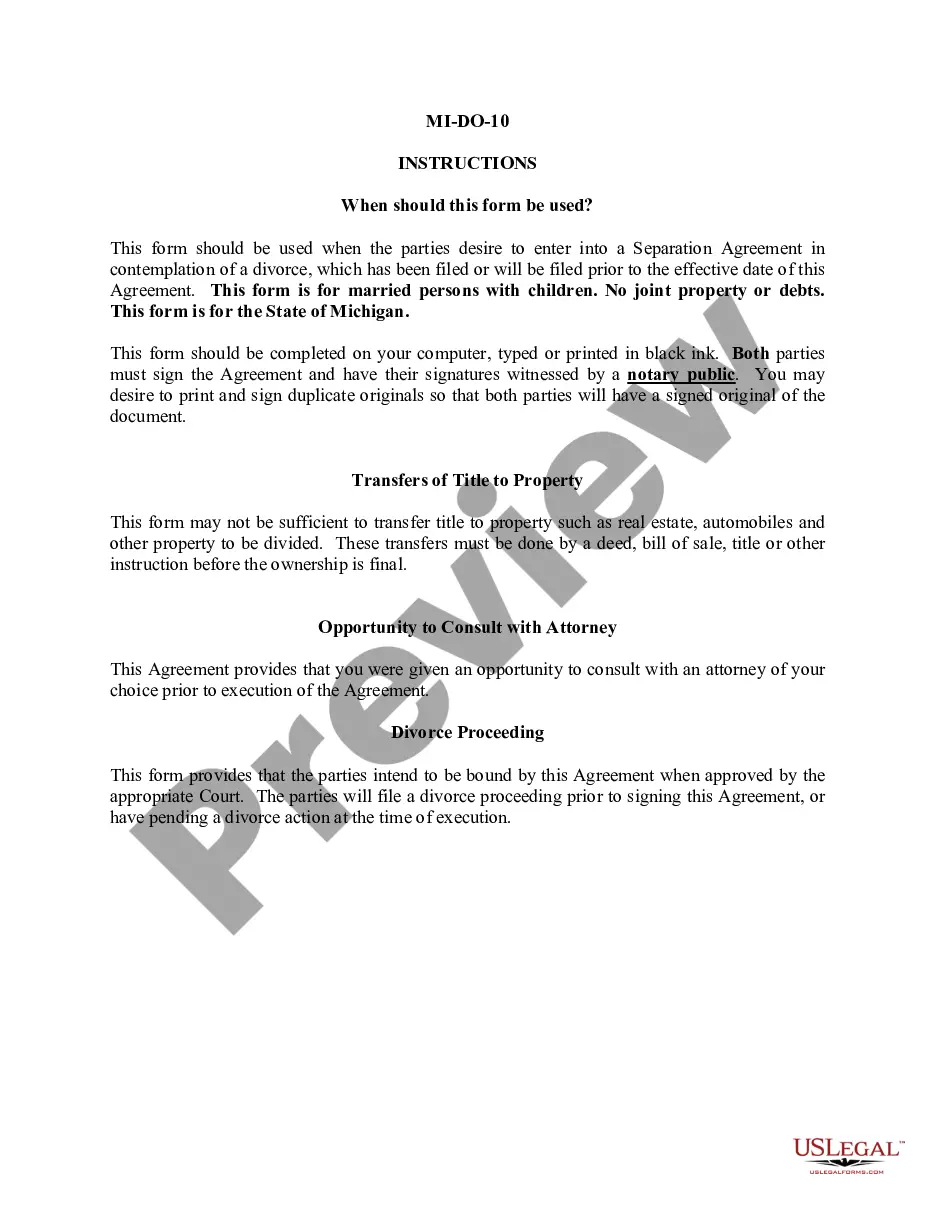

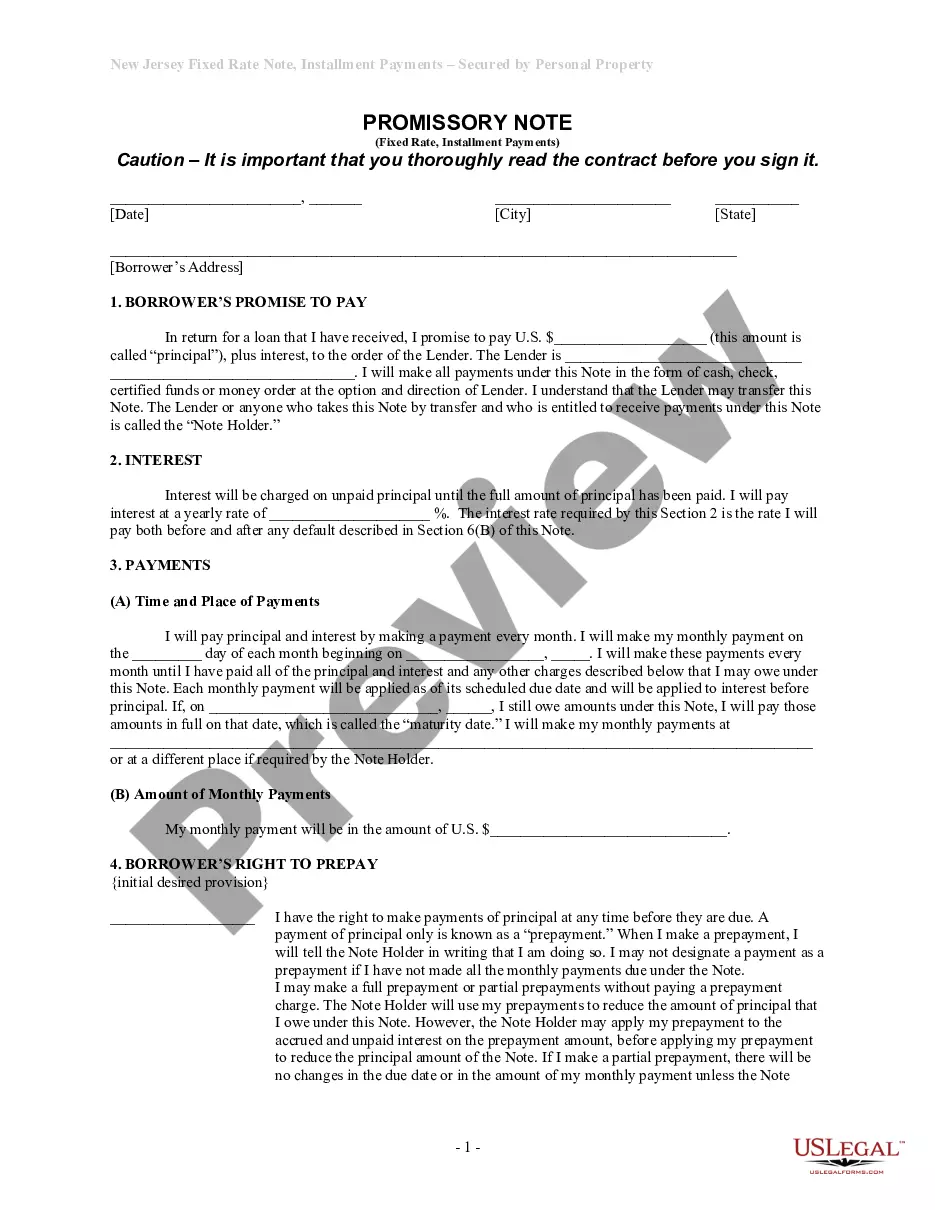

How to fill out North Carolina Articles Of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust?

How much time and resources do you typically spend on composing formal documentation? There’s a greater option to get such forms than hiring legal specialists or spending hours searching the web for a proper blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, including the North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust.

To acquire and complete an appropriate North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust blank, adhere to these simple instructions:

- Look through the form content to ensure it complies with your state regulations. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your North Carolina Articles of Incorporation Nonprofit Corporation Community Third Party Or Medicaid Pooled Trust on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

Every North Carolina nonprofit would be required to file an annual report with the N.C. Secretary of State that includes its name, address, and email address, as well as the names, addresses (which can be the nonprofit's address), and titles of its principal officers, and a brief description of its activities.

To dissolve your nonprofit, you will need a plan of dissolution. At a minimum, the plan must provide that all of your nonprofit's liabilities and obligations are to be paid and discharged, or otherwise adequately provided for, and also provide for the proper distribution of any remaining assets.

How to Start a Nonprofit in North Carolina Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.

How Much Does It Cost to Start a North Carolina Nonprofit? The fees to start a nonprofit in North Carolina include a $60 fee with your Articles of Incorporation and a $275 fee for 501c3s when filing for tax-exempt status with the IRS. You may also choose to incur additional costs along the way.

You must give at least five days' notice of the meeting and the notice must include a copy or summary of the plan of dissolution. If your bylaws require that dissolution also be approved by any other person, that person must provide approval in writing.

How to Start a Nonprofit in North Carolina Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.

NC Nonprofit Articles of Incorporation Requirements.Get a Federal Employer Identification Number (EIN)Hold Your Organizational Meeting & Adopt Bylaws.Apply for Federal and/or State Tax Exemptions.Register for Required State Licenses.Open a Bank Account for Your NC Nonprofit.