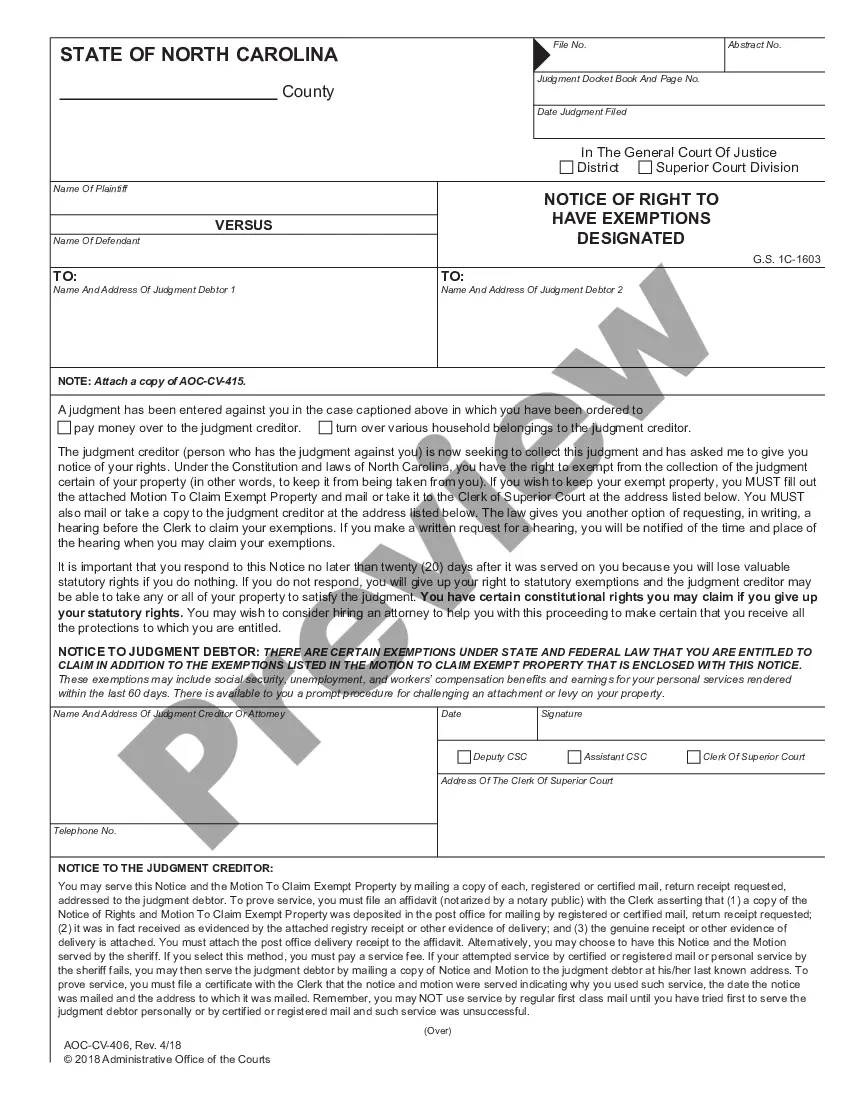

The North Carolina Notice of Right To Have Exemptions Designated is a legal document that is given to debtors when their assets are about to be seized by creditors. This document informs the debtor of their right to have certain assets exempted from seizure, such as furniture, tools, and necessary clothing. It also informs them that they have twenty days from service of the notice to designate which assets they wish to exempt. There are two types of North Carolina Notice of Right To Have Exemptions Designated: one for individuals, and one for married couples. The individual form is used when only one person's assets are being seized, while the married couple form is used when both spouses' assets are being seized. Both forms list the exemptions that are available, including items like household goods, tools, and clothing.

North Carolina Notice of Right To Have Exemptions Designated

Description

How to fill out North Carolina Notice Of Right To Have Exemptions Designated?

How much time and resources do you often spend on composing official paperwork? There’s a better option to get such forms than hiring legal experts or spending hours browsing the web for a suitable blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the North Carolina Notice of Right To Have Exemptions Designated.

To obtain and prepare a suitable North Carolina Notice of Right To Have Exemptions Designated blank, follow these easy steps:

- Look through the form content to make sure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the North Carolina Notice of Right To Have Exemptions Designated. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely secure for that.

- Download your North Carolina Notice of Right To Have Exemptions Designated on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us now!

Form popularity

FAQ

The creditor with a judgment must give you a Notice of Right to Have Exemptions Designated. This document allows you to protect some of your property from being used to pay the judgment. You must complete the Motion to Claim Exempt (Statutory Exemptions). You must file the Motion within 20 days from receiving it.

North Carolina's Homestead Exemption The homestead exemption protects equity in your home. In North Carolina, The homestead exemption protects up to $35,000 in equity of any real or personal property used as a residence. Both spouses must be on the title to double this exemption.

North Carolina General Statutes allow for certain types of property to be exempt from property taxes. Exempt property may include but is not limited to the following: Property used for religious purposes. Property set aside for burial purposes.

Stopping the Writ of Execution The most effective way to stop a writ of execution is to ask the Judgment Creditor to stop it. The sheriff will often back off if the parties are working to resolve the judgment.

"Notice of exemption" means a brief notice which may be filed by a public agency after it has decided to carry out or approve a project and has determined that the project is exempt from CEQA as being ministerial, categorically exempt, an emergency, or subject to another exemption from CEQA.

If a creditor has a judgment against an individual in North Carolina and is seeking to execute the judgment in North Carolina, that creditor will need to serve the judgment debtor with a Notice of Right to Claim Exemptions. Upon service, the judgment debtor has the right to file a MOTION TO CLAIM EXEMPT PROPERTY.

NORTH CAROLINA A judgment is a lien on real property for ten years from the entry date. N.C. Gen. Stat. § 1-234.