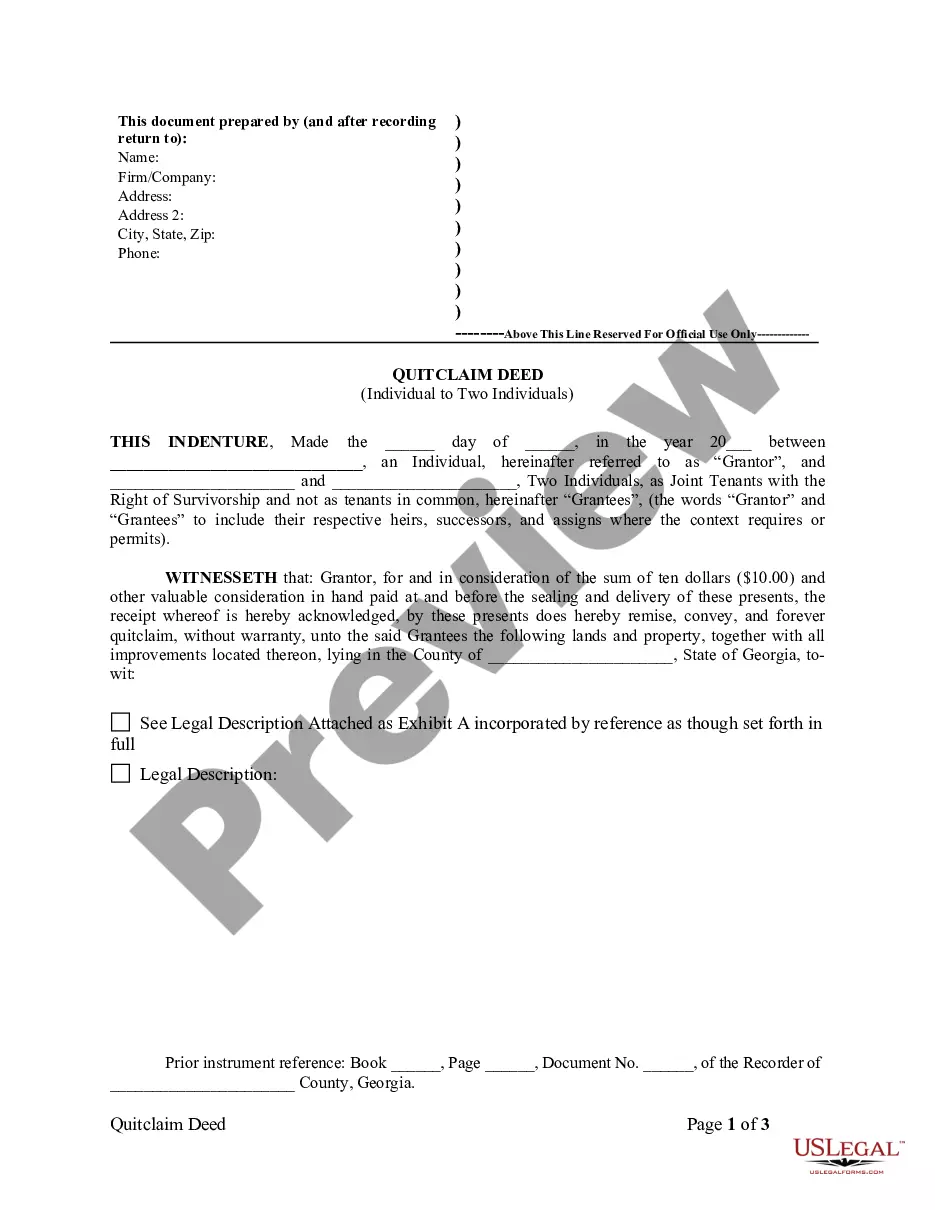

A North Carolina CD Order Form is a document used in the state of North Carolina to purchase a Certificate of Deposit (CD) from a financial institution. It requires the name of the customer, address, phone number, and social security number, as well as the type of CD desired, the length of its term, the rate of interest, and the amount of money to be deposited. There are two types of North Carolina CD Order Form: Individual CD Order Form and Joint CD Order Form. The Individual CD Order Form is used when a single person wants to purchase a CD, and the Joint CD Order Form is used when two people are purchasing the CD together. Both forms must be signed and dated by the purchaser(s) in order to be valid.

North Carolina CD Order Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina CD Order Form?

Completing official documents can be quite a hassle if you lack ready-to-use fillable templates. With the US Legal Forms online collection of formal paperwork, you can be confident in the blanks you find, as all of them adhere to federal and state regulations and are reviewed by our specialists.

Acquiring your North Carolina CD Order Form from our service is as straightforward as ABC. Previously authorized users with a valid subscription just need to Log In and click the Download button once they find the appropriate template. Subsequently, if necessary, users can retrieve the same document from the My documents section of their profile. However, even if you are new to our service, signing up with a valid subscription will only take a few moments. Here’s a quick guide for you.

Haven’t you experienced US Legal Forms yet? Register for our service today to obtain any formal document swiftly and effortlessly whenever you need to, and maintain your paperwork in order!

- Document compliance verification. You should meticulously examine the content of the form you wish to use and verify whether it meets your requirements and aligns with your state law obligations. Previewing your document and reviewing its overall description will assist you in doing so.

- Alternative search (optional). If you encounter any discrepancies, explore the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now when you identify the one you need.

- Account registration and form acquisition. Register for an account with US Legal Forms. After account confirmation, Log In and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and subsequent usage. Select the file format for your North Carolina CD Order Form and click Download to save it on your device. Print it to complete your paperwork manually, or utilize a multi-functional online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

NC form CD-401S is the North Carolina S Corporation Tax Return. S corporations must file this form to report income, deductions, and credits, ensuring compliance with state tax regulations. Understanding this form is important for maintaining your corporation's good standing. You can easily access the North Carolina CD Order Form on uslegalforms to obtain the CD-401S and other necessary tax documents.

Yes, North Carolina plans to gradually reduce income tax rates starting in 2026. This initiative aims to provide tax relief to residents and stimulate economic growth within the state. It is essential to stay informed about these changes to understand how they may affect your tax situation. For detailed guidance, refer to the North Carolina CD Order Form available on uslegalforms.

The NC CD-405 form is the North Carolina Corporate Income and Franchise Tax Return. Corporations operating in North Carolina must file this form to report their earnings and calculate tax obligations. Completing the CD-405 accurately is crucial for businesses to avoid penalties. For assistance, you can find the North Carolina CD Order Form on uslegalforms, ensuring you have the right documents.

NC form CD-419 is the North Carolina Application for Extension of Time to File. This form grants taxpayers an extension to file their income tax returns without incurring penalties. Utilizing the CD-419 can provide you with additional time to prepare your tax documents. To simplify this process, consider using the North Carolina CD Order Form available on uslegalforms.

Form D-400 is the North Carolina Individual Income Tax Return. This form allows residents to report their income and calculate their state tax liability. Completing the D-400 is essential for ensuring compliance with North Carolina tax laws. You can easily access the North Carolina CD Order Form to obtain this document and streamline your tax filing process.

Yes, North Carolina offers e-filing options for various tax forms, including corporate tax returns. E-filing simplifies the submission process, making it quicker and more efficient. By choosing to e-file, you can ensure timely compliance with tax deadlines. For e-filing instructions and related forms, including the North Carolina CD Order Form, check our platform.

The North Carolina form CD 405 serves as the official Corporate Tax Return for entities operating in the state. It captures critical data about a corporation's financial activities, ensuring compliance with state tax regulations. Filing this form correctly is vital to avoid any tax-related issues. For assistance with this and other forms, such as the North Carolina CD Order Form, visit our website.

The NC CD 405 form is utilized by corporations to report their corporate income tax liability in North Carolina. This form is essential for understanding your tax obligations and calculating the amount due. By filing this form, businesses can ensure they are meeting their tax requirements effectively. You can find related resources, including the North Carolina CD Order Form, on our platform.

NC form CD 401S is the tax return form specifically designed for S Corporations in North Carolina. This form helps S Corporations report their income, deductions, and credits to the state. Completing this form accurately is crucial for ensuring compliance with state tax laws. You may find it helpful to refer to the North Carolina CD Order Form for additional guidance.

In North Carolina, corporations that have gross receipts exceeding a certain threshold are subject to corporate minimum tax. This includes both domestic and foreign corporations doing business within the state. It’s essential for companies to comply with this requirement to avoid penalties. For more information on related forms, such as the North Carolina CD Order Form, you can visit our platform.