North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What is this form?

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property ownership under certain conditions. This deed allows the grantor to convey real estate to the grantee, typically in situations where the property is part of an estate or trust. Unlike a standard warranty deed, this form is specifically designed to reflect the authority of the fiduciary acting on behalf of another party, whether due to a will, trust, or legal obligation.

Key parts of this document

- Grantor and Grantee details: Names and addresses of the parties involved.

- Property description: A complete legal description of the real estate being conveyed.

- Consideration: The value or compensation for the property transfer.

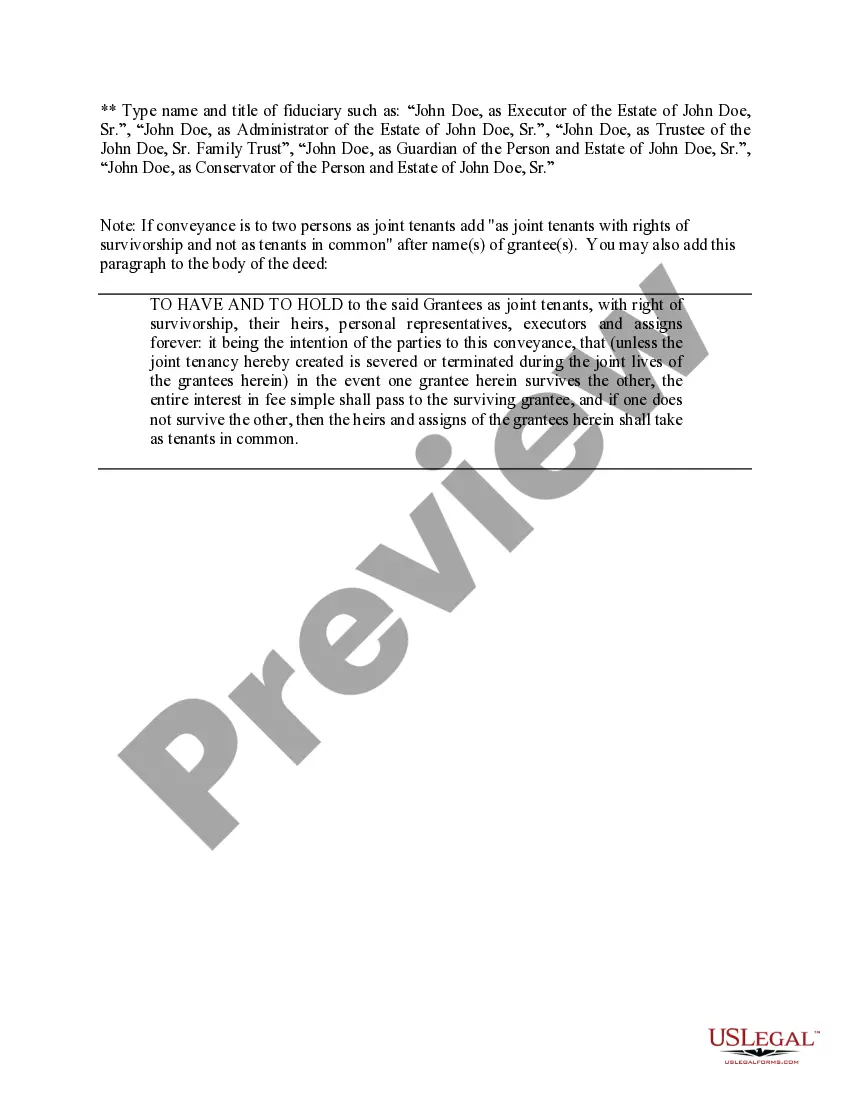

- Fiduciary title: Clear indication of the fiduciary's legal capacity when executing the deed.

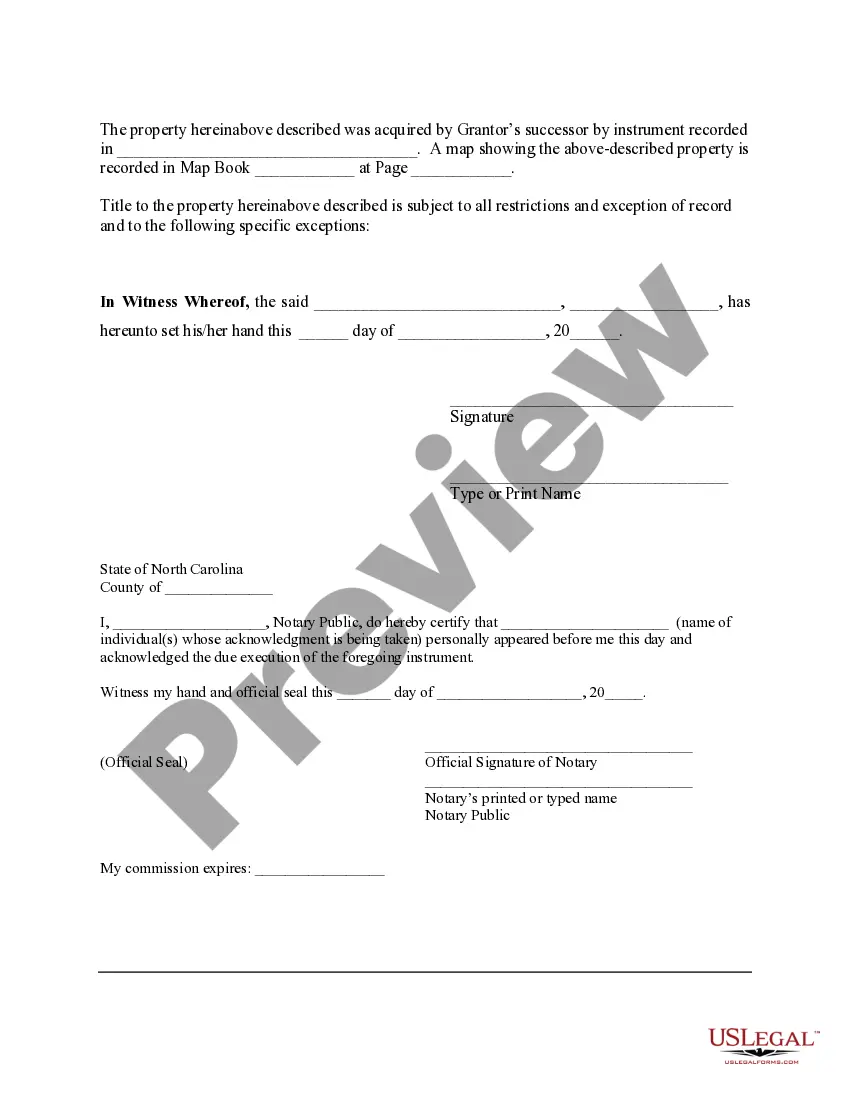

- Signature and notarization: Required signatures and certification from a notary public.

When to use this document

This Fiduciary Deed should be utilized when transferring ownership of property within the context of estate management or trust execution. Common scenarios include when an executor of a will is distributing assets, a trustee is managing property held in trust, or when a guardian is authorized to convey property on behalf of a ward.

Who can use this document

- Executors managing the estate of a deceased person.

- Trustees distributing assets from a trust.

- Guardians handling property for a minor or incapacitated individual.

- Administrators overseeing an estate without a will.

- Any fiduciaries acting under legal authority to transfer real estate.

How to complete this form

- Identify the parties: Clearly enter the names and addresses of the grantor (fiduciary) and grantee.

- Specify the property: Provide a complete legal description for the property being transferred.

- Enter consideration: Note the monetary or other value offered for the property transfer.

- Sign the deed: The grantor must sign the form in the presence of a notary public.

- Notarize the document: Have the notary complete the certification portion to validate the deed.

- File the deed: Record the completed and notarized Fiduciary Deed with the appropriate county office.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete legal description of the property.

- Not notarizing the deed or incorrectly filling out the notarization section.

- Leaving out the consideration amount or providing an unclear value.

- Using outdated forms or not adapting to the latest state requirements.

Why use this form online

- Convenience: Access and fill out the form from anywhere, without the need for in-person visits.

- Editability: Easily make necessary changes to the document before finalizing it.

- Reliability: Use a trusted resource that ensures compliance with North Carolina law for fiduciary deeds.

Looking for another form?

Form popularity

FAQ

To get an executor deed, you need to be appointed as the executor through the probate process. After obtaining letters testamentary from the court, you can create the executor deed that will allow you to transfer estate property. Properly utilizing the North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries is crucial in ensuring all legal requirements are met, making the process seamless.

An executor's deed is a legal document that allows the executor of an estate to transfer property from the estate to the beneficiaries or other parties. This deed must be executed after the probate court validates the will and grants letters testamentary. It serves as proof of the executor's authority to convey the property. Familiarizing yourself with the North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries will aid you in handling these transactions smoothly.

In North Carolina, to obtain a letter of administration, you must file a petition with the probate court when no will exists. The court will review your petition, and if approved, you will receive letters of administration, granting you authority to manage the deceased's estate. It is essential to understand the role of a fiduciary in this process, and using the North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can help clarify your responsibilities.

To obtain an executor deed, you must first be appointed as the executor by the probate court. After securing letters testamentary, you can prepare the executor deed, which transfers property from the estate to the beneficiaries, or to yourself if that is the case. The North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can be instrumental in crafting this document correctly and ensuring compliance with state laws.

Yes, executors of estate accounts in North Carolina are considered fiduciaries. This means they have a legal and ethical obligation to act in the best interests of the estate and its beneficiaries. Executors must manage estate assets prudently and transparently, adhering to applicable laws. Understanding the responsibilities tied to the North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can help executors fulfill their duties effectively.

North Carolina does not recognize beneficiary deeds, which are designed to transfer property at death without going through probate. Instead, property owners can use a North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries to facilitate asset transfer. This deed allows fiduciaries to manage property effectively, ensuring a smooth transition during estate administration.

To obtain proof of an executor of an estate in North Carolina, you need to provide the court with the will, if one exists, and file a petition for probate. Once the court validates the will, it will issue letters testamentary, which serve as proof of your authority. This document confirms your role and enables you to act on behalf of the estate. Utilizing the North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can streamline this process.