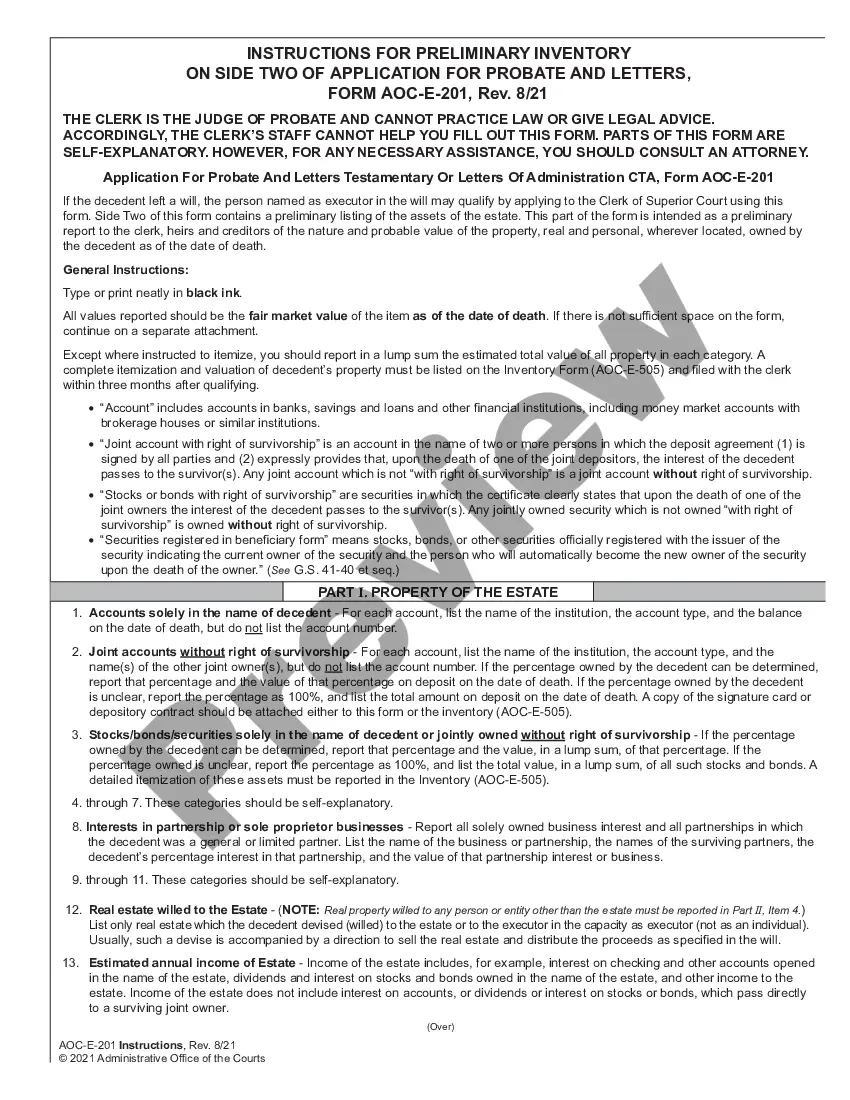

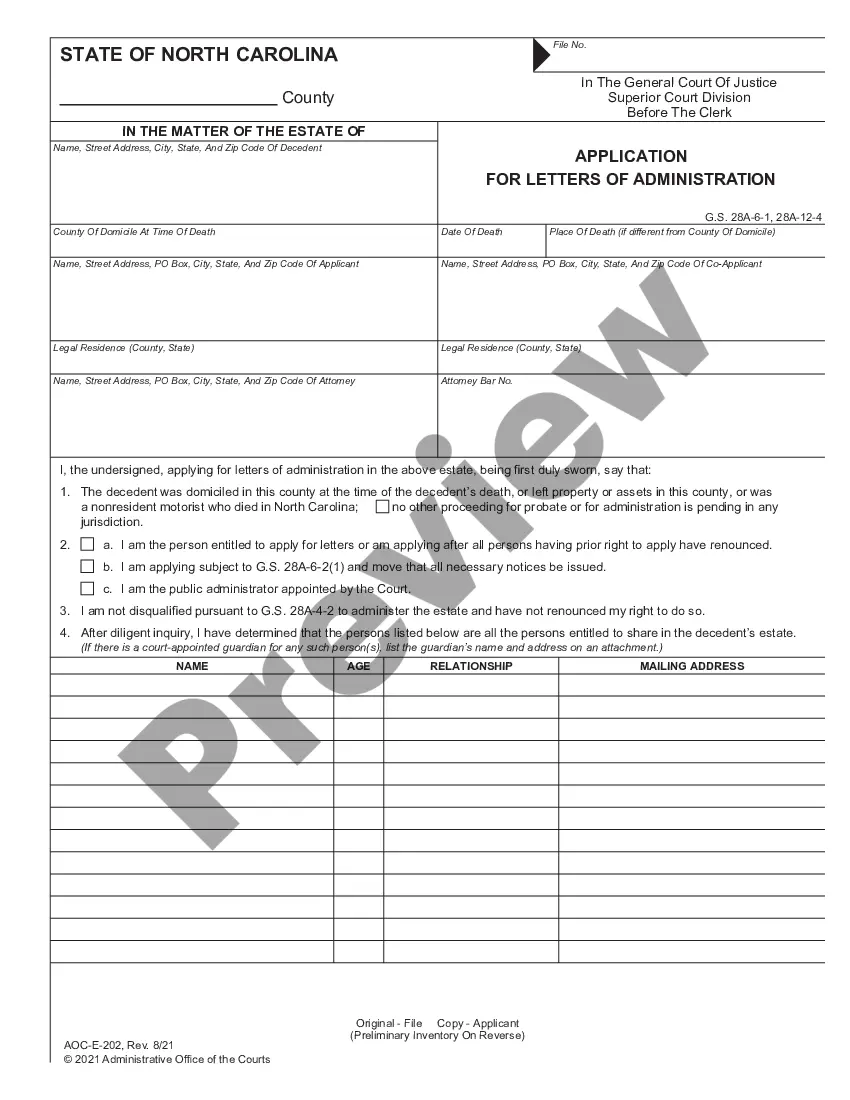

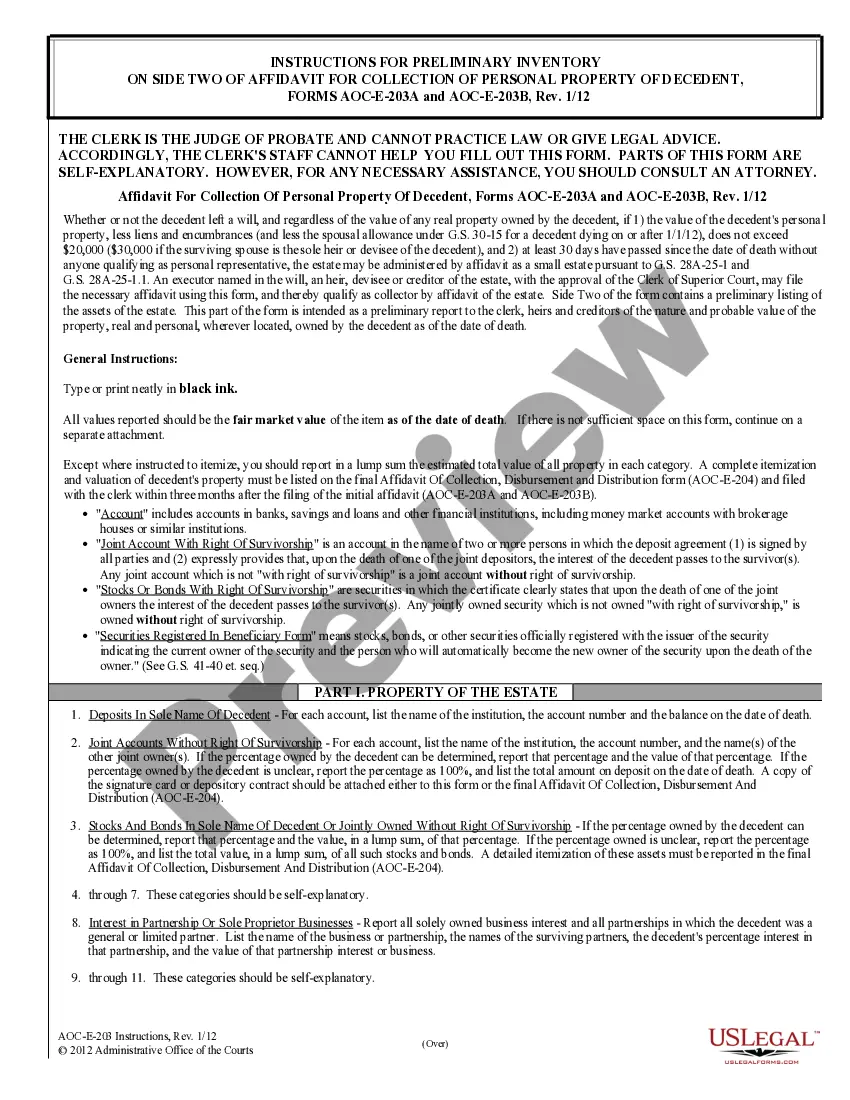

Instructions for Preliminary Inventory of Application for Letters of Administration: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Instructions for Preliminary Inventory of Application for Letters of Administration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Instructions For Preliminary Inventory Of Application For Letters Of Administration?

Steer clear of costly attorneys and locate the North Carolina Guidelines for Initial Inventory of Application for Letters of Administration you seek at an economical rate on the US Legal Forms website.

Utilize our straightforward categories feature to browse for and acquire legal and tax documents. Review their summaries and preview them prior to downloading.

After downloading, you can complete the North Carolina Guidelines for Initial Inventory of Application for Letters of Administration by hand or with editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed instructions on how to download and fill out each template.

- US Legal Forms members only need to Log In and retrieve the particular document they require from their My documents section.

- Individuals who have not yet subscribed must follow the steps outlined below.

- Confirm that the North Carolina Guidelines for Initial Inventory of Application for Letters of Administration is valid for use in your jurisdiction.

- If applicable, review the summary and utilize the Preview feature before downloading the template.

- If you believe the document suits your needs, click Buy Now.

- If the document is incorrect, use the search bar to find the appropriate one.

- Next, create your account and select a subscription option.

- Pay via credit card or PayPal.

- Opt to receive the document in PDF or DOCX format.

- Click Download and locate your file in the My documents section. You can save the document to your device or print it out.

Form popularity

FAQ

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

Collect and inventory the deceased person's assets, and keep them safe. have assets professionally appraised, if necessary. sell some assets, if necessary. pay valid debts and taxes, and. give out the remaining property as the will (or if there's no will, state law) directs.

Find the Will. Death Certificate. Locate and Identify Assets. Contact the Clerk of Court.

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

How Long Does It Take to Get through the Probate Process? The length of time that a probate proceeding may last is difficult to determine, but people should generally assume that it will take at least four months. Creditors must be given 90 days, which alone accounts for a three-month period.

You should expect it to take a minimum of six months to a year to settle an estate because of the legal notice requirements and time that creditors have to submit claims against the estate. Creditors have 90 days from the first publication date of the notice of probate.

Unless the Will provides otherwise, under North Carolina law, Executors or Administrators may claim a commission of up to 5% of the Estate assets and receipts, as approved by the Clerk of Court. Trusts should provide specific guidance regarding compensation.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.