North Carolina Certificate of Assumed Name for a Corporation

Definition and meaning

The North Carolina Certificate of Assumed Name for a Corporation is a legal document that allows a corporation to conduct business under a name that is different from its registered corporate name. This certificate is typically filed with the county register of deeds where the corporation conducts business. The purpose of the certificate is to protect consumers by ensuring they know the true identity of the business they are dealing with.

Who should use this form

This form is essential for corporations that intend to operate under a different name than their official corporate name. It is particularly relevant for small businesses, partnerships, and corporations that wish to establish a brand that is more marketable or easier for customers to recognize. Failure to file this certificate can lead to legal issues, including the inability to enforce contracts made under the assumed name.

How to complete a form

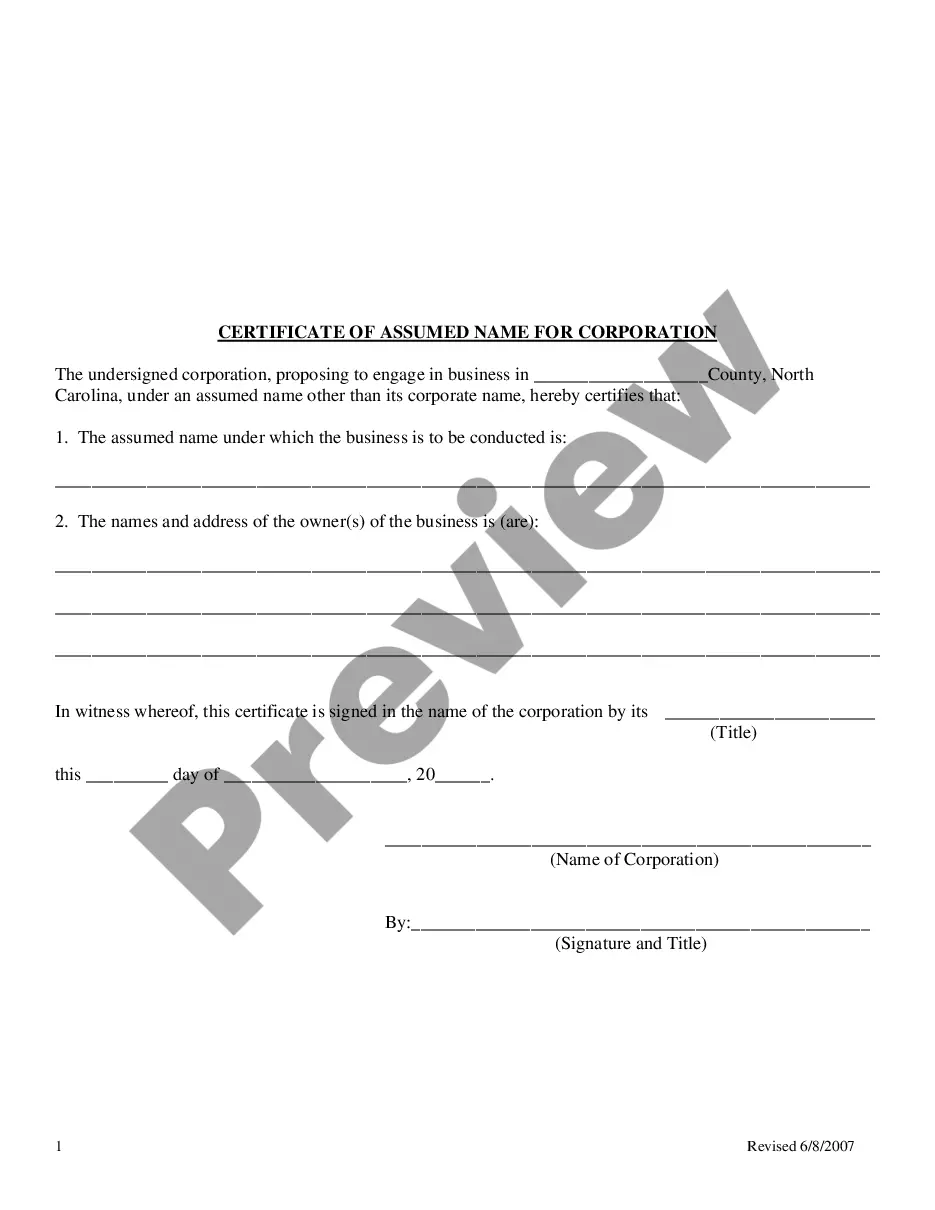

Completing the North Carolina Certificate of Assumed Name for a Corporation involves several steps:

- Identify the assumed name: Clearly state the name under which the business will operate.

- List the owners: Provide the names and addresses of all owners connected to the business.

- Acknowledge the filing: The document must be signed by an authorized representative of the corporation.

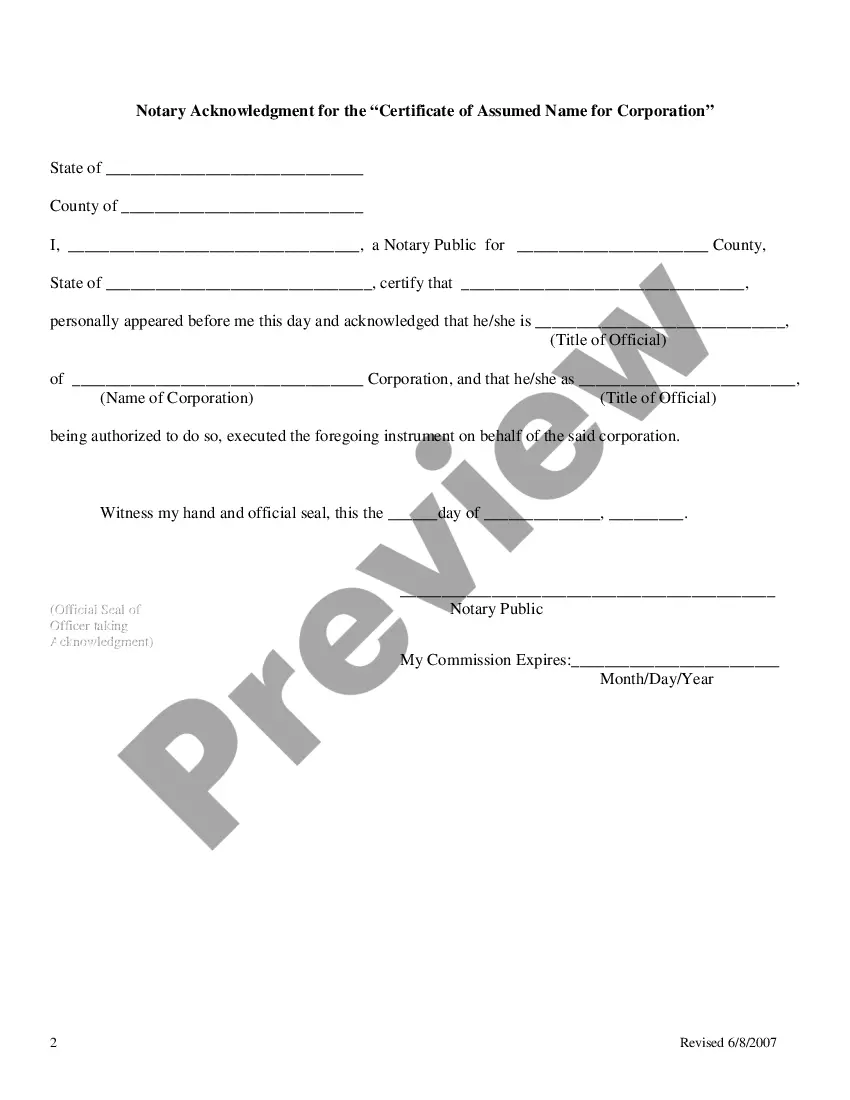

- Notarization: The completed form needs to be notarized to validate the signatures.

Common mistakes to avoid when using this form

When filing the North Carolina Certificate of Assumed Name for a Corporation, consider the following common pitfalls:

- Failing to list all owners associated with the business.

- Not providing a complete and accurate assumed name.

- Neglecting to have the form notarized.

- Using a name that is already registered by another entity.

Key components of the form

The North Carolina Certificate of Assumed Name for a Corporation includes several critical components:

- Assumed name: The name under which the business will operate.

- Business owner's names and addresses: Contact information for the individuals who own the business.

- Corporation information: The registered name and details of the corporation.

- Signature and title: The authorized representative must sign and include their title.

Form popularity

FAQ

For example, business owner John Smith might file the Doing Business As name "Smith Roofing." Corporations and limited liability companies (LLCs) may register DBA names for specific lines of business. For example, Helen's Food Service Inc. might register the DBA "Helen's Catering."

When to Renew Your DBA If registering in Texas, you can use the DBA for 10 years, and in New York, no renewal is necessary as there is no expiration date. As long as you stay on top of your DBA's expiration date, you can continue to renew it as long as you like.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

If you're a sole proprietor or a partner with the authority to sign contracts for the partnership, you sign using your own name. Then, UpCounsel says, you add the "doing business as" name. DBA examples are "Bert Smith, DBA Steel IT Security" or "Helen Marker, DBA The Best Vintage Jewelry."

The form is presented to a clerk for filing. The cost to file your DBA is $33 for an Individual DBA and $34 for a Partnership DBA (which includes the filing fee, a copy for the filers records and a certified copy for proof of filing).

A DBA can be filed in order for a company to transact business under the company's domain name. This is especially helpful when your company name is not available as a domain name. For example, you may want to operate another business or website in addition to your existing one.

1Obtain the appropriate forms. First, acquire the appropriate forms for registering a DBA in your jurisdiction.2Complete the forms. Provide all required information on the DBA forms.3Provide your business entity type.4Provide any other information.5Sign the forms.6Pay the fee and file the forms.

Obtain the appropriate forms. First, acquire the appropriate forms for registering a DBA in your jurisdiction. Complete the forms. Provide all required information on the DBA forms. Provide your business entity type. Provide any other information. Sign the forms. Pay the fee and file the forms.