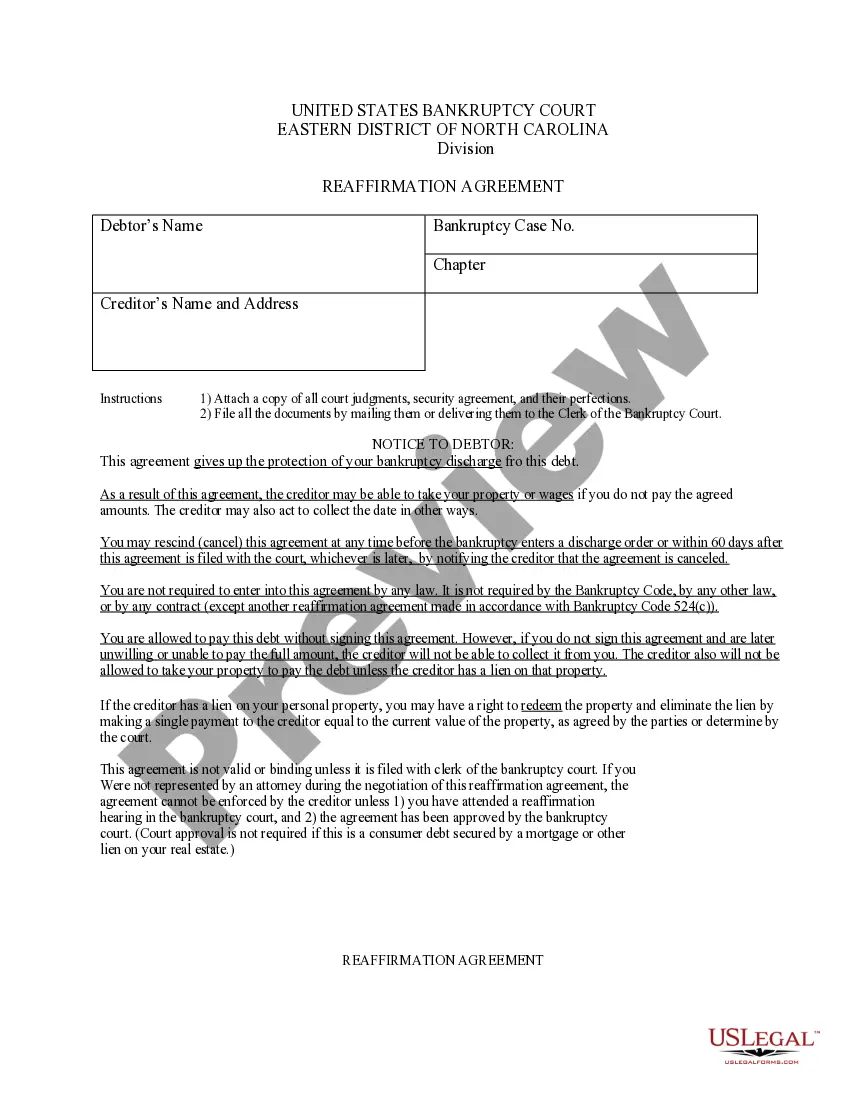

North Carolina Reaffirmation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Reaffirmation Agreement?

Steer clear of costly lawyers and locate the North Carolina Reaffirmation Agreement you require at an affordable cost on the US Legal Forms website.

Utilize our straightforward groups feature to search for and download legal and tax documents. Review their descriptions and preview them before downloading.

Choose to receive the document in PDF or DOCX format. Click Download and find your form in the My documents section. You can save the form to your device or print it out. After downloading, you can complete the North Carolina Reaffirmation Agreement by hand or using editing software. Print it and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms offers clients with step-by-step guidance on how to acquire and complete each template.

- US Legal Forms users only need to Log In and access the specific document they need in their My documents section.

- Those who have not yet subscribed should follow the instructions provided below.

- Verify that the North Carolina Reaffirmation Agreement is suitable for use in your state.

- If possible, browse the description and utilize the Preview option before downloading the sample.

- If you’re confident that the document fulfills your requirements, click on Buy Now.

- If the form is incorrect, use the search tool to find the appropriate one.

- Then, create your account and select a subscription plan.

- Make your payment via credit card or PayPal.

Form popularity

FAQ

By contrast, a reaffirmation agreement is a new contract. It's often on the same terms as the prior contract, but you can try to negotiate a new payment amount, interest rate, or some other provision.

If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.