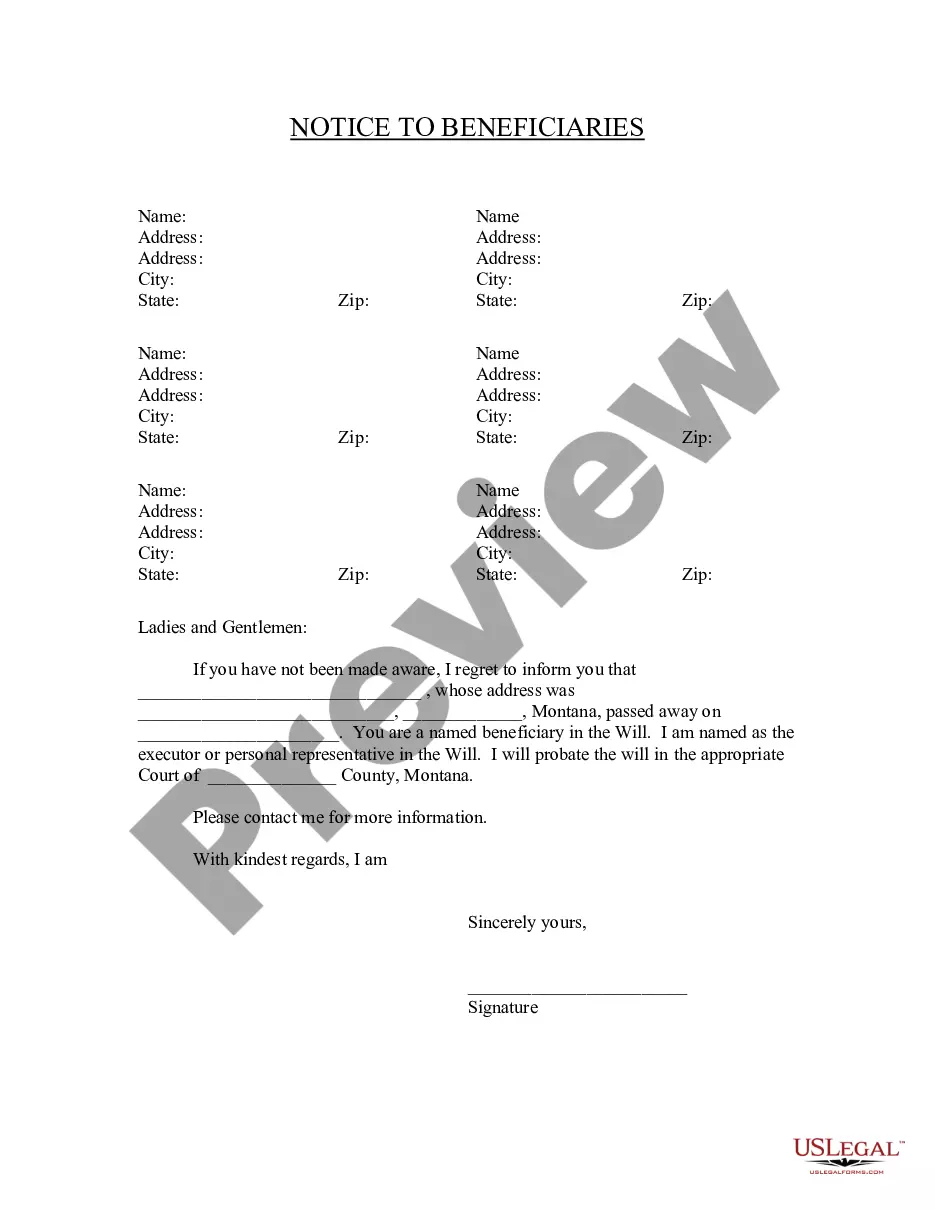

Montana Notice to Beneficiaries of being Named in Will

Description

How to fill out Montana Notice To Beneficiaries Of Being Named In Will?

Steer clear of expensive attorneys and locate the Montana Notice to Beneficiaries of being Named in Will at an economical rate on the US Legal Forms website.

Utilize our straightforward category functionality to search for and acquire legal and tax documents. Review their descriptions and view them prior to downloading.

Choose to receive the document in PDF or DOCX format. Click on Download and locate your form in the My documents tab. Feel free to save the template to your device or print it. After downloading, you can fill out the Montana Notice to Beneficiaries of being Named in Will by hand or using editing software. Print it and reuse the form as needed. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed guidance on how to obtain and fill out each form.

- US Legal Forms members simply need to Log In and access the specific document they require in their My documents section.

- Individuals who do not have a subscription yet should follow the instructions listed below.

- Ensure the Montana Notice to Beneficiaries of being Named in Will is suitable for use in your region.

- If applicable, review the description and utilize the Preview feature before downloading the templates.

- If you are confident the template fulfills your requirements, click on Buy Now.

- If the template is inaccurate, use the search bar to find the correct one.

- Next, register for an account and choose a subscription plan.

- Make payment using a credit card or PayPal.

Form popularity

FAQ

No, in Montana, you do not need to notarize your will to make it legal. However, Montana allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

Joint tenancy with right of survivorship. Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Tenancy by the entirety. Community property with right of survivorship.

Yes, a person can make his or her own will, but it must be in the testator's own handwriting. This type of will is called a holographic will. Such a will is valid if the signature and the material provisions are in the handwriting of the testator.

You can legally prepare your own will, it can even be handwritten. This type of will is known as a "holographic will." In Montana, your handwritten will must be signed by you. Your signature must also be located on any material provisions, and no witnesses will need to be present for the signing of your will.

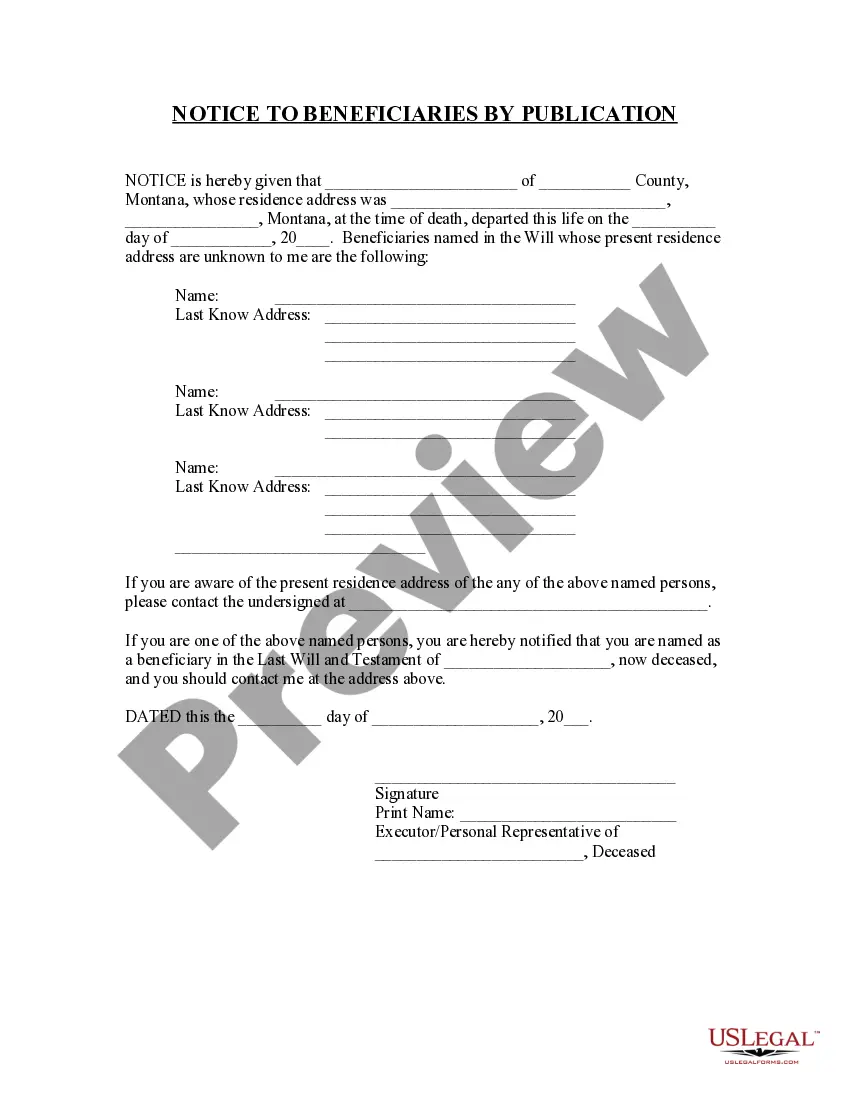

A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

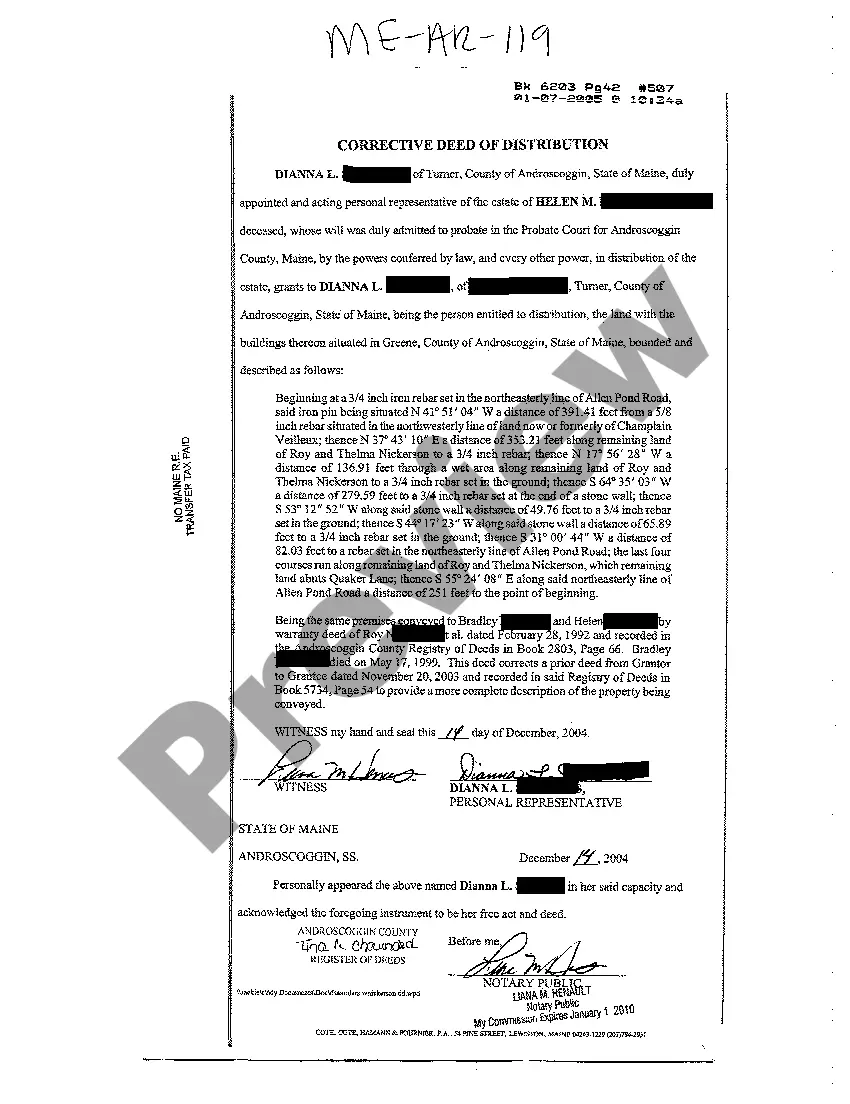

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).