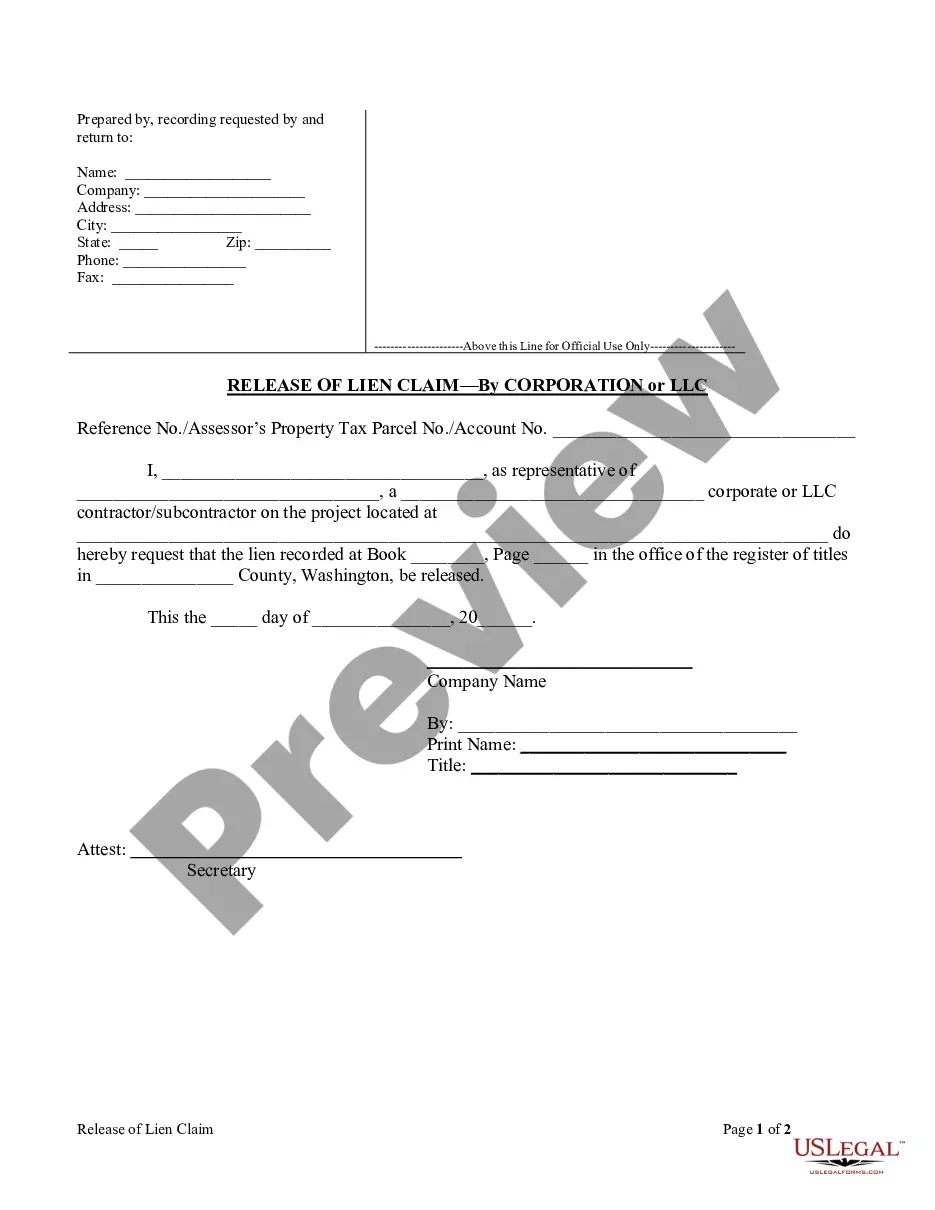

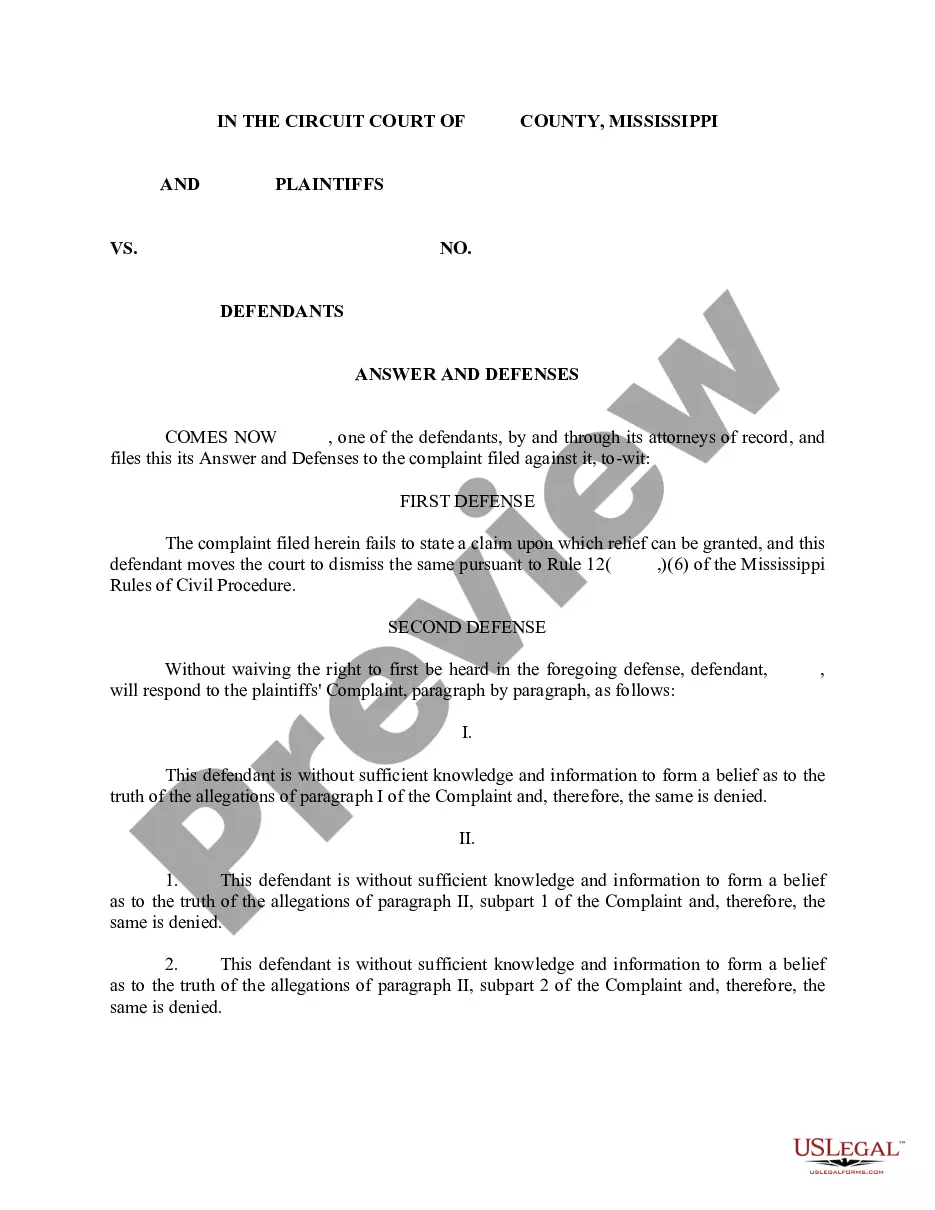

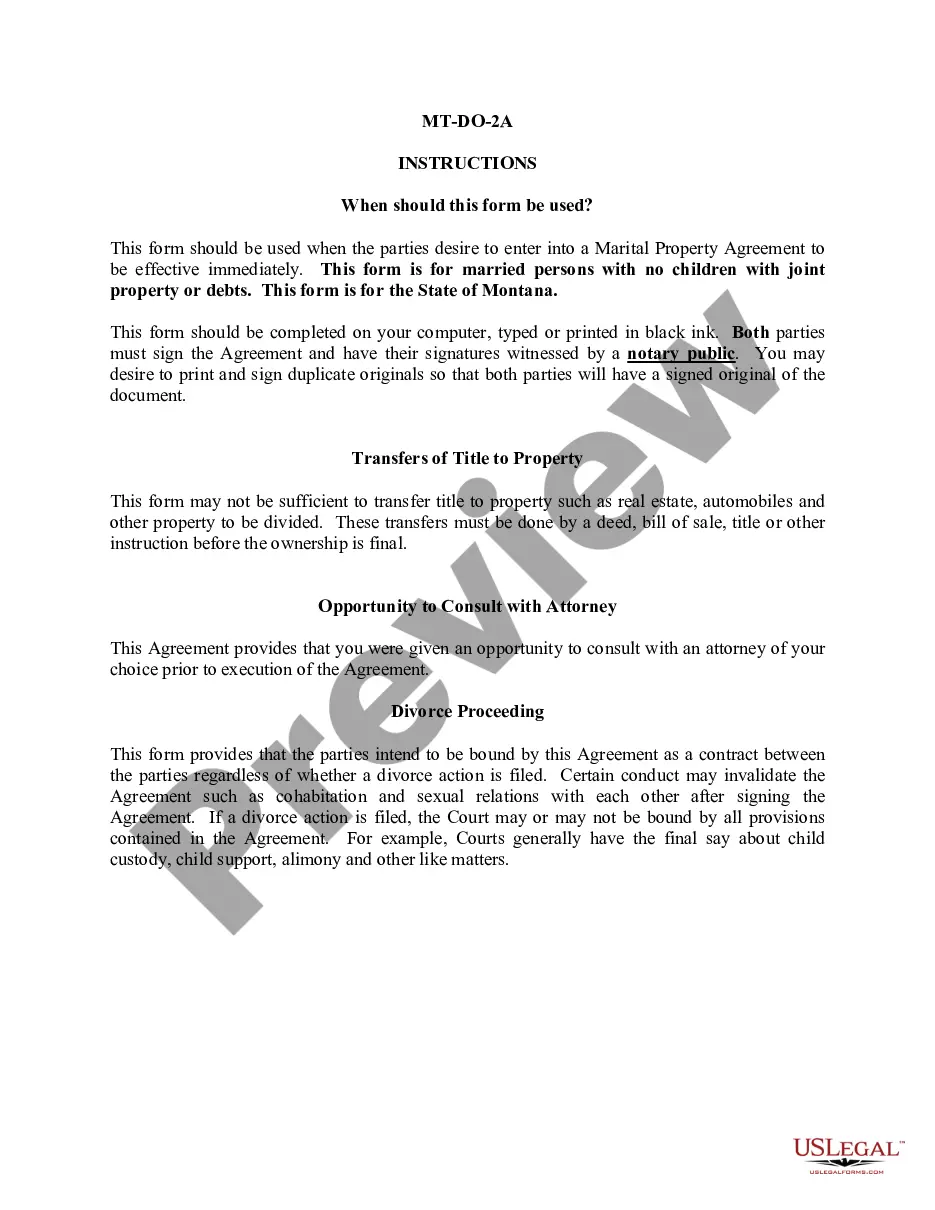

Montana Notices

Description

How to fill out Notices?

US Legal Forms - one of many greatest libraries of legitimate types in the USA - provides an array of legitimate record layouts you are able to obtain or print. Using the web site, you will get thousands of types for company and specific reasons, categorized by groups, says, or keywords.You will find the most recent types of types such as the Montana Notices within minutes.

If you currently have a registration, log in and obtain Montana Notices from the US Legal Forms local library. The Acquire option will appear on each kind you see. You gain access to all previously acquired types from the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, listed here are easy instructions to get you started:

- Make sure you have chosen the best kind for your personal metropolis/state. Go through the Review option to analyze the form`s information. Look at the kind description to ensure that you have selected the right kind.

- In case the kind does not satisfy your specifications, utilize the Lookup field towards the top of the screen to obtain the the one that does.

- Should you be content with the shape, confirm your option by visiting the Buy now option. Then, select the costs prepare you favor and provide your references to register for an bank account.

- Approach the transaction. Make use of your charge card or PayPal bank account to finish the transaction.

- Find the structure and obtain the shape in your system.

- Make modifications. Load, modify and print and indicator the acquired Montana Notices.

Each and every web template you added to your bank account lacks an expiration date and is your own property permanently. So, if you would like obtain or print yet another duplicate, just go to the My Forms portion and click in the kind you need.

Gain access to the Montana Notices with US Legal Forms, by far the most substantial local library of legitimate record layouts. Use thousands of skilled and express-certain layouts that fulfill your business or specific requirements and specifications.

Form popularity

FAQ

Visit TAP.DOR.MT.gov to quickly and easily pay for e-filed or paper-filed returns by e-check (for free) or by credit/debit card (for a small fee). See more payment options at MTRevenue.gov.

If you don't have access to a computer or Wi-Fi, call the following number to obtain help with your Montana refund status 406-444-6900.

The local attorney must file a notice of appearance in the case in which you seek to appear. This notice of appearance informs the court that you are making an application to the Montana Bar to appear pro hac vice. The Montana court rule requires local counsel to be at least minimally involved in the case.

Description:Choose one of these options: 1) Go to Montana TAP to submit your estimated payment or if you already have an account, log into your account. 2) Pay via credit or debit card through Montana TAP. Be aware that a service fee is added to each payment you submit with your card.

Montana has a graduated individual income tax, with rates ranging from 1.00 percent to 6.75 percent. Montana has a 6.75 percent corporate income tax rate. Montana does not have a state sales tax and does not levy local sales taxes. Montana's tax system ranks 5th overall on our 2023 State Business Tax Climate Index.

(a) A return may be filed by personal delivery to the Montana Department of Revenue, 3rd Floor, Sam W. Mitchell Building, 125 North Roberts, Helena, Montana.